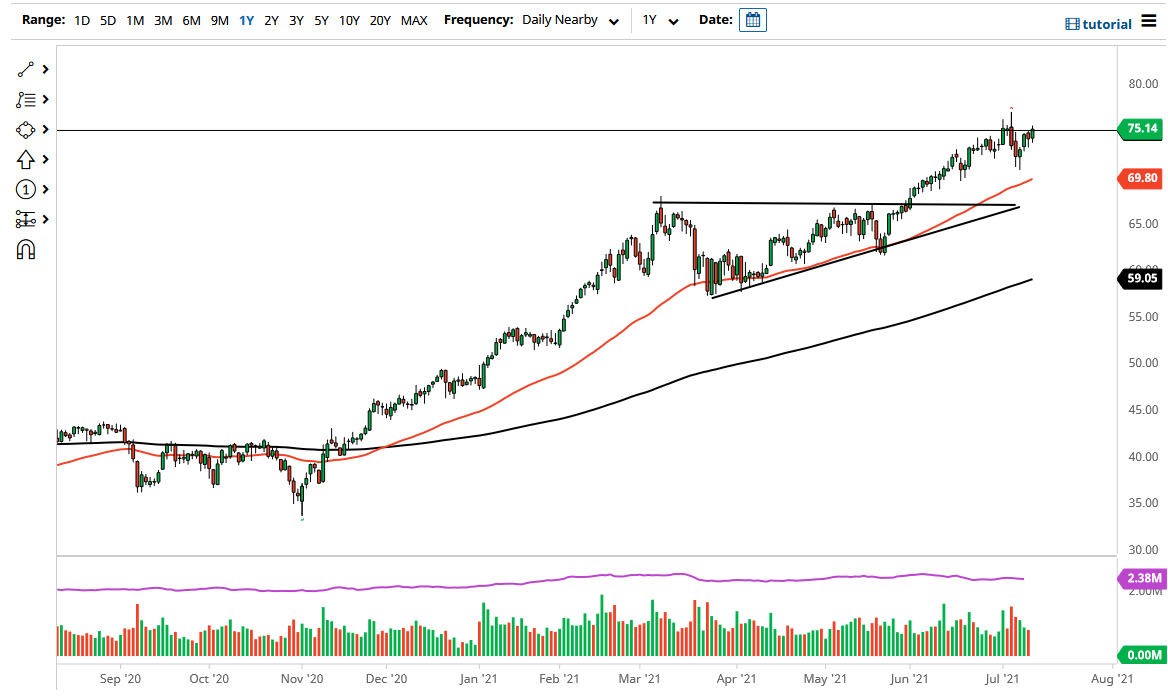

The West Texas Intermediate Crude Oil market rallied a bit during the trading session on Tuesday, but nothing overly dramatic. It is not until we can break above the highs of last week that I would be willing to throw a lot of money at this market, but it certainly looks as if buyers are trying to step in and support it. Furthermore, when you look at the longer-term trend, it is fairly obvious that there are plenty of buyers underneath.

I believe that the 50-day EMA reaching towards the $70 level only reinforces that area as potential support, especially as we have formed a massive amount of support just last week as the market bounced from there. To the upside, the market breaking above the highs of last week could open up the possibility of a move towards the $80 level. The $80 level is a large, round, psychologically significant level that people will pay close attention to, but I think at the end of the day it probably will not matter, because if we reach that area, we will probably continue to go higher.

If we were to see a turnaround in the oil market, it could be due to the Delta variant flaring up in the coronavirus situation, as we have seen places like Australia shut themselves back down. If that is going to be the case, it obviously has a negative look for crude oil demand, but longer-term, it is hard to believe that crude oil will see a lack of demand as everybody out there gets back to work.

Furthermore, if you look at the chart you will notice that we have been in a very strong uptrend for a while, so the biggest issue with the crude oil market now is how much leverage to use. I would suggest that perhaps smaller positions should continue to be what you look at, as we will have the occasional choppiness, and that could cause a bit of selling pressure. We will continue to see this market offer “buy on the dips” type of opportunities, as we have for several months. In fact, it is not until we break down below the $67.50 level that I would consider shorting.