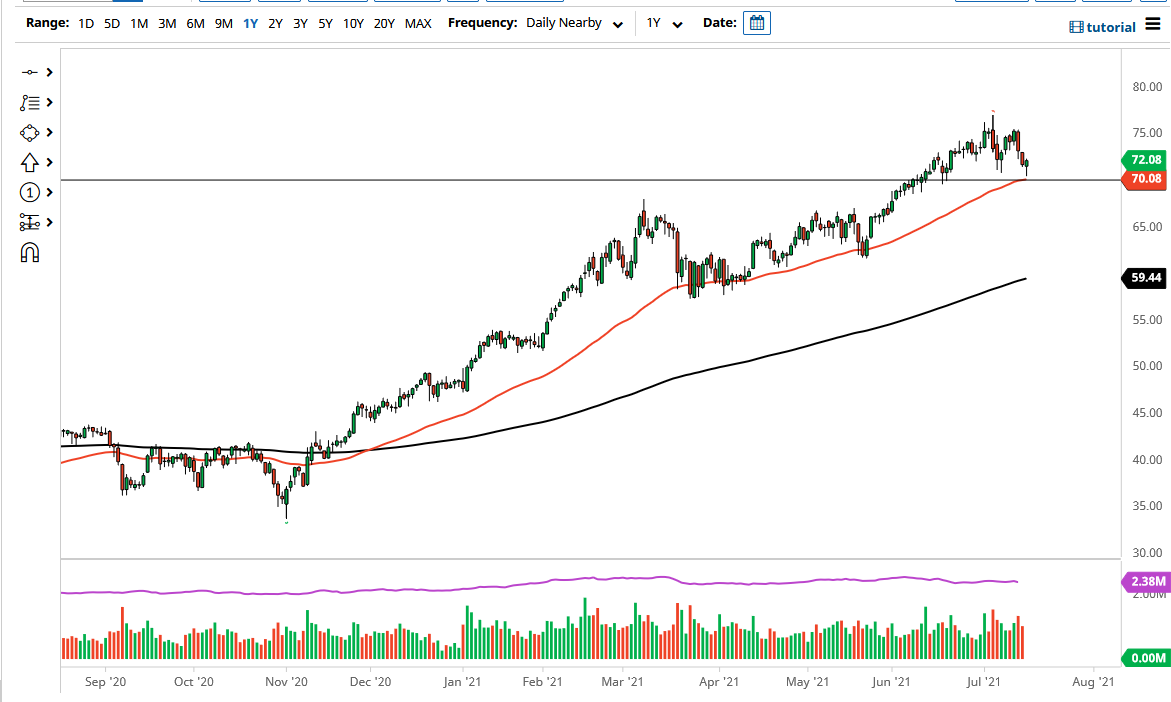

The West Texas Intermediate Crude Oil market fell during the trading session on Friday, reaching down towards the $70 level which is a large, round, psychologically significant level and will attract a lot of attention. Furthermore, we have already tested it for support previously, and the 50-day EMA is reaching towards that level as well. This is a market that should continue to see plenty of choppy behavior, but if we can break above the top of the hammer for the session, that is a very strong sign.

If we do get that breakout to the upside, that could very easily see this market go back and forth in the overall consolidation pattern, which extends to roughly $75 or so. Ultimately, this is a market that had recently been bullish but now has to start digesting gains. This is probably based upon the idea of the reopening trade and the increased demand for crude oil worldwide. That being said, OPEC+ cannot seem to get its act together when it comes to production numbers, and that could continue to cause issues. However, if we do get some type of announcement over the weekend, it is very likely that Monday will start out with a gap to the upside and a rally.

Alternately, if things take a turn for the worse, we could see this market break down below the $70 level. At that point, I would anticipate that the market will go looking towards the $67.50 level which was the previous high from the ascending triangle. That is an area that I think will be very interesting to say the least, but if that gets broken, it is likely that we will go even lower, perhaps looking towards the 200-day EMA.

I think at this point we are going to see an impulsive candlestick sooner or later, which could give us an idea as to which direction we will head in. If and when we can break out above the recent highs, then crude oil is more than likely going to go looking towards $80. In general, this is a market that looks as if it is trying to digest gains and figure out where we are going to go longer term with all of these various headlines.