The United Arab Emirates has brought a bit of a spanner in the works when it comes to the OPEC+ meeting and decision on production cuts or expansion going forward. As a general rule, most of the members of the cartel want to expand production, but only in a limited sense. However, the United Arab Emirates seems to be much more interested in opening the spigots in order to flood the market with supply and take advantage of massive demand while it is still around.

Because of this, there are a lot of concerns as to whether or not there is going to be an agreement at all. After all, we have seen OPEC do this before, where one or two members decide that they want to flood the market with supply, and eventually it becomes a “free-for-all” for producers to take advantage of market conditions. If that is going to be the case, we should suddenly see a massive amount of supply head into the marketplace. Furthermore, OPEC needs to be very cautious, because at these somewhat higher levels, shale oil in the United States becomes much more attractive as well.

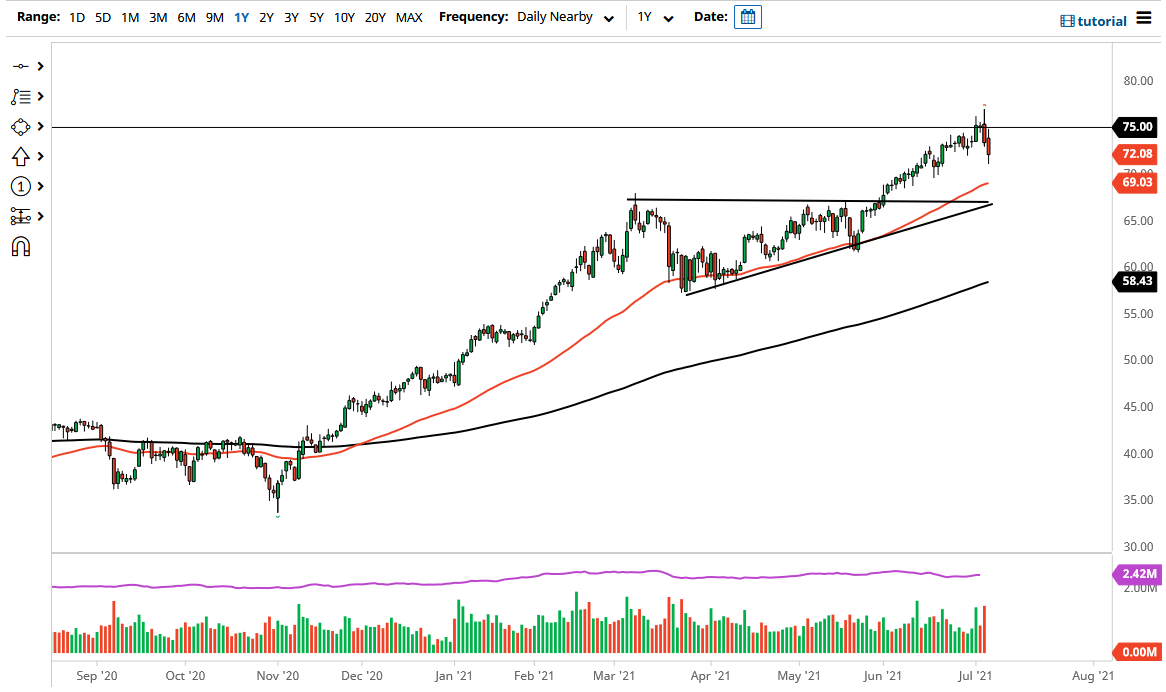

That being said, I do not necessarily think that the market is going to break apart forever, rather that we will probably pull back in order to find a significant amount of support in one of several different possible areas. The $70 level is an area that I think will attract a certain amount of attention, as it is not only a large, round, psychologically significant figure, but we also have the 50-day EMA reaching towards it. In other words, the 50-day EMA itself is reason enough to think that there could be a significant amount of buying.

Underneath the 50-day EMA, the market opens up the possibility of a move down to the previous ascending triangle, and what was the top of it. That would be the $67.50 region, where I think there will be even more support. The market needed to cool off a bit, so this pullback may be exactly what it needed. I will wait until we get a daily supportive candlestick in order to get long, but if we break down below the top of the ascending triangle, I would more than likely be thinking of shorting the market at that point.