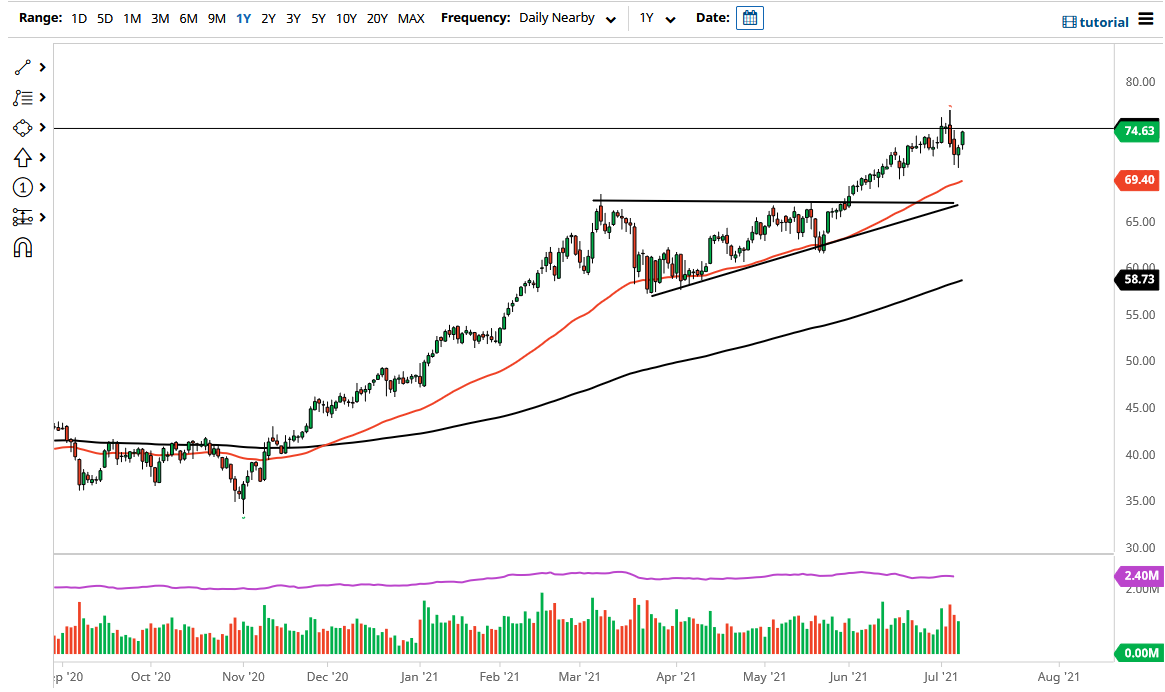

The West Texas Intermediate Crude Oil market gapped a little bit higher during the trading session on Friday, but then shot higher to reach towards the $75 level. The $75 level is an area that will attract a certain amount of attention due to the large, round, psychologically significant nature of the figure, and the fact that we have struggled to get above there recently. With that being the case, the market is probably going to continue to see a bit of selling pressure just above.

To the downside, the 50-day EMA is starting to reach towards the $70 level, which should also be supportive based upon the fact that it is a large, round, psychologically significant figure. With that, I think this is a market that continues to see plenty of buyers on dips, but we have to get through all of the noise that surrounds OPEC at the moment.

We have recently seen that the United Arab Emirates has dug in its heels when it comes to the idea of producing more crude oil, which could put quite a bit more out into the markets. If that is going to be the case, then it is likely that prices would fall as supply picks up. However, there is a lot out there that could happen when it comes to some type of an agreement, or perhaps even a lack of an agreement. In other words, we could be all over the place, and the entire situation may change today. In other words, you need to be cautious when trading this market.

With that, it we are still very much in an uptrend, and it is not until we break down below the $67.50 level that I am concerned about it, as the $67.50 level is the top of the ascending triangle that we had broken out of to get up to this area. If we can get a daily close above the $75 level, then it is likely that we will continue to go looking towards the $80 level given enough time. Based upon the measured move of the triangle, we should go to at least the $77.50 level. That being said, quite often we run past that projected move.