The West Texas Intermediate Crude Oil market initially rallied on news that the OPEC+ members could not come to some type of an agreement to extend production. In other words, it is very likely that the lack of supply could continue to be a problem as the United Arab Emirates has been a bit of an outlier. However, since then, we have seen that the members continue to negotiate behind the scenes, and it is very likely that supply will continue to be increased over the next several months. This led to a major whiplash of the market during the trading session.

Ultimately, this is a market that may have gotten a bit ahead of itself, but there is obviously going to be a significant amount of demand going forward for the rest the year. With that being the case, I think we will probably continue to bounce around in this area, and I do believe that short-term pullbacks will continue to be potential buying opportunities. To the downside, I believe there are multiple areas where buyers might jump in and try to take advantage of value as it occurs.

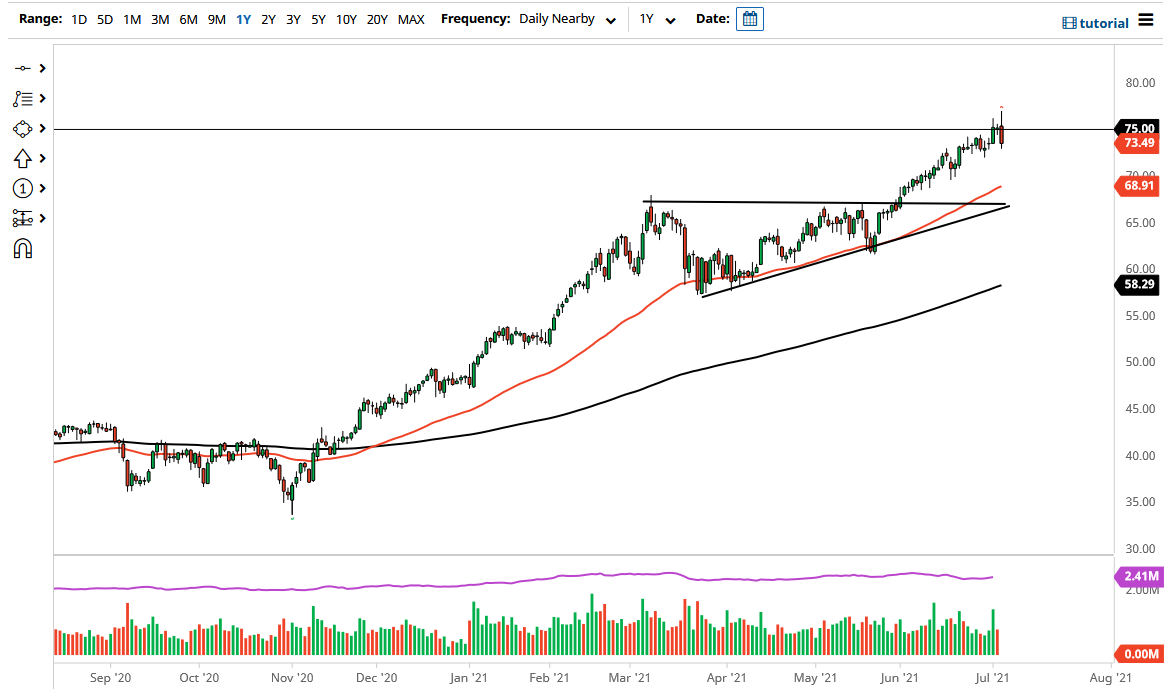

For example, I like the idea of the $70 level offering support, and then the 50-day EMA which sits just below there. Furthermore, I think that the top of the previous ascending triangle at $67.50 is essentially your “floor in the market”, and as long as we can stay above there it is very likely that the uptrend will continue going forward. However, if we were to break above the highs of the session at roughly $76.85, then markets would continue to go higher to look towards the $77.50 level, which is the “measured move” of the ascending triangle that we had previously broken out of. After that, it is likely that we will go looking towards the $40 level.

The US dollar will have its influence as well, but at the end of the day the demand for crude oil should continue to pick up quite significantly over the next several months, at least that is what most pundits believe. However, one has to wonder how long it takes for the supply to catch up to the demand. That seems to be a question for the Q3 timeframe, but as we get further into the summer, people will start to focus on that.