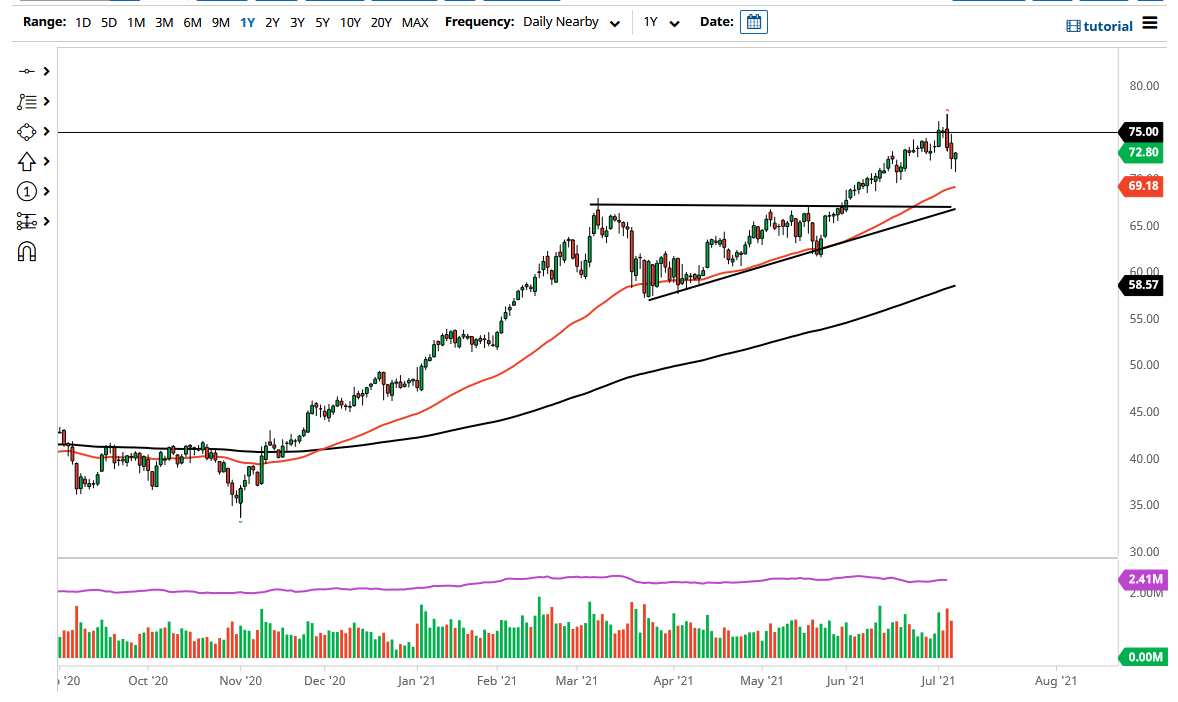

The West Texas Intermediate Crude Oil market initially fell during the course of the trading session to find support near the $71 level. We have bounced significantly from there to form a bit of a hammer, and that hammer of course is a very bullish sign. We had recently seen a lot of noise coming out of the OPEC+ meeting, and of course lots of conversations between the United Arab Emirates and the rest of the members. The UAE is talking about flooding the market with supply, but there is a significant amount of demand out there that people will be looking into.

To the downside, the 50 day EMA is sitting near the $69 level, and starting to rise again, signifying that perhaps the trend still has further to go. Beyond that, with economies reopening around the world it does make a certain amount of sense that crude oil demand will pick up. However, we have seen Tokyo and Australia both lock themselves down, so there is a certain amount of fear that perhaps the Delta variant will continue to be a major issue and perhaps shut things down as well. All things being equal, the market is likely to continue being noisy, but despite the fact that we had seen such a massive selloff as of late, we are still very much in an uptrend and that is one of the first things that you should think about.

I believe that the “floor the market” is near the $67.50 level, which was the top of the ascending triangle that we recently broken out of. The market continues to see a lot of interest in that area due to the “market memory” that would come into that play, so with that I think the trend comes into play. If we break down below there, the market is likely to continue seeing even more selling pressure, but I think that would take some type of major “risk off event” to make that happen. If we can break above the highs of the Tuesday session, then I think oil is free to go looking towards the $80 level above which is a large, round, psychologically significant figure. At that point, there is probably going to be a lot of headline noise, but I do think that we at least make an attempt to get there.