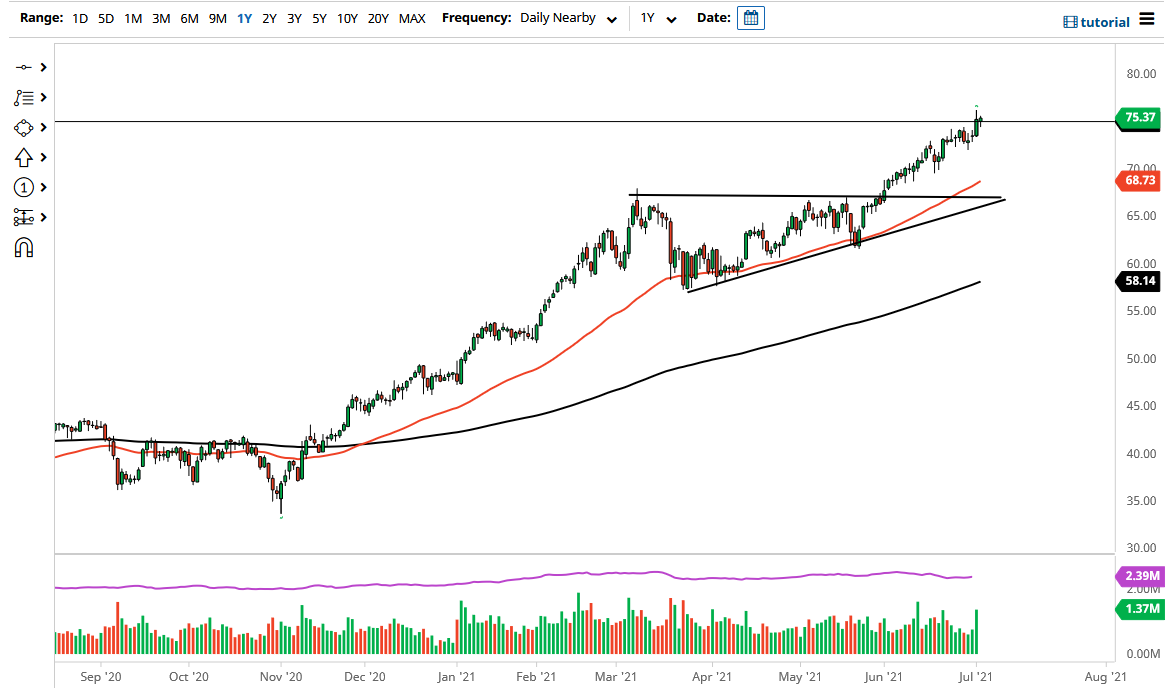

The West Texas Intermediate Crude Oil market fluctuated during the trading session on Friday, as we continue to hang around the $75 level. The market initially dipped during the trading session but rallied a bit during the session. If we can break above the candlestick from the Thursday session, that would be a very strong sign, perhaps opening up a move to the $77.50 level. This is an area that I am aiming for due to the fact that the ascending triangle underneath measures for a move to that level.

Longer term, I think that the market is probably going to go looking towards the $80 level. Short-term pullbacks at this point should continue to attract a lot of attention, especially due to the fact that the OPEC meeting over the next couple of days will decide what we do next with production. Ultimately, if the oil-producing countries cannot come to some type of agreement for an expansion of output, the market is likely to see a lot of noise as a result. Ultimately, this is a market that I think still is very much in an uptrend, so I have no interest in shorting it.

If we break down from here, then the 50-day EMA could be a target, as it races towards the $70 level which is a large, round, psychologically significant figure that a lot of people would pay attention to. I do not think this market is going to fall anytime soon, as demand for crude oil should continue to pick up. Ultimately, this choppy behavior should continue to be the mainstay of this market, but obviously in an upward drift overall as longer-term forces are at play.

Pay attention to the US dollar, because if it continues to get battered like it was on Friday, that could also propel this market higher. On the other hand, if the US dollar strengthens, it could essentially slow this market down, but I do not think that in and of itself will turn the market around as fundamentals are far too strong to change things for a bigger move. Buying on the dips continues to be the best way going forward and, with that, I will be trading in that manner.