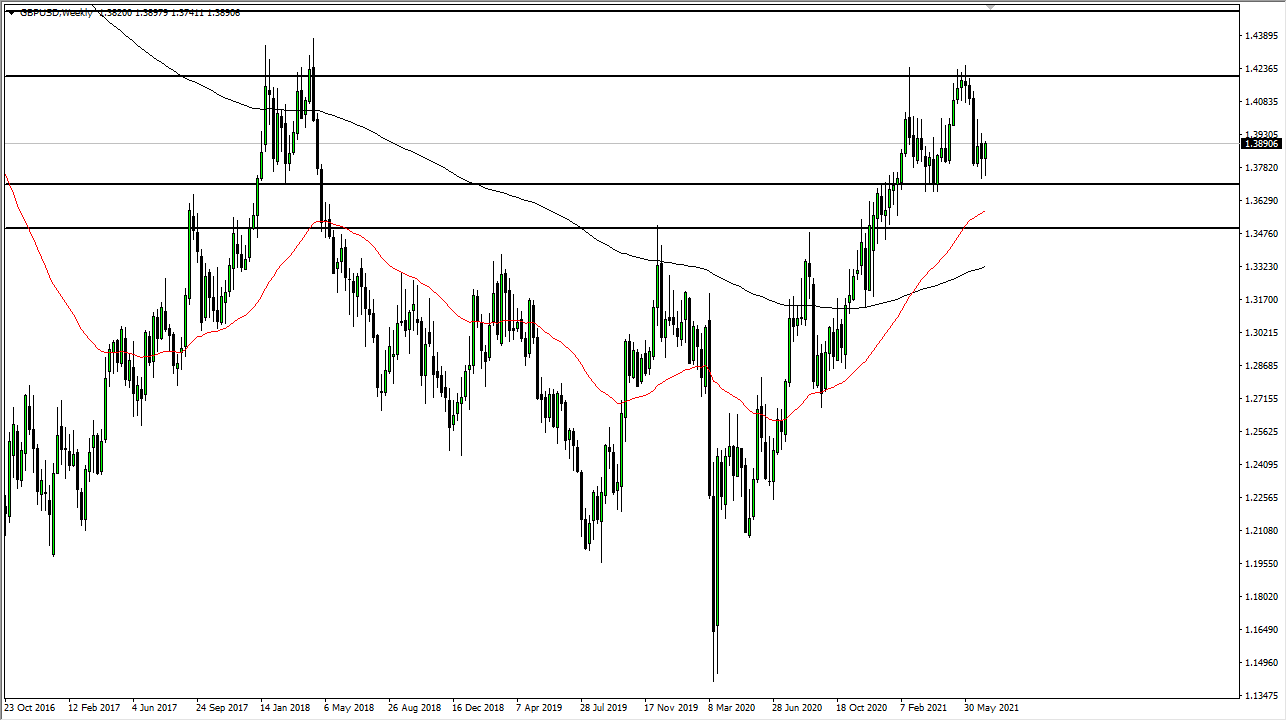

EUR/USD

The euro fell rather significantly during the trading week, breaking down below the 1.18 level before recovering quite nicely on Friday. The resulting candlestick is a hammer, so if we can break above the top of that hammer, then it is likely we could go looking towards the 1.20 level. If we can break above that 1.20 level, then the market is likely to go looking towards the 1.22 handle. On the other hand, if we break down below the lows of the week, then 1.17 comes into the picture, and then eventually 1.16.

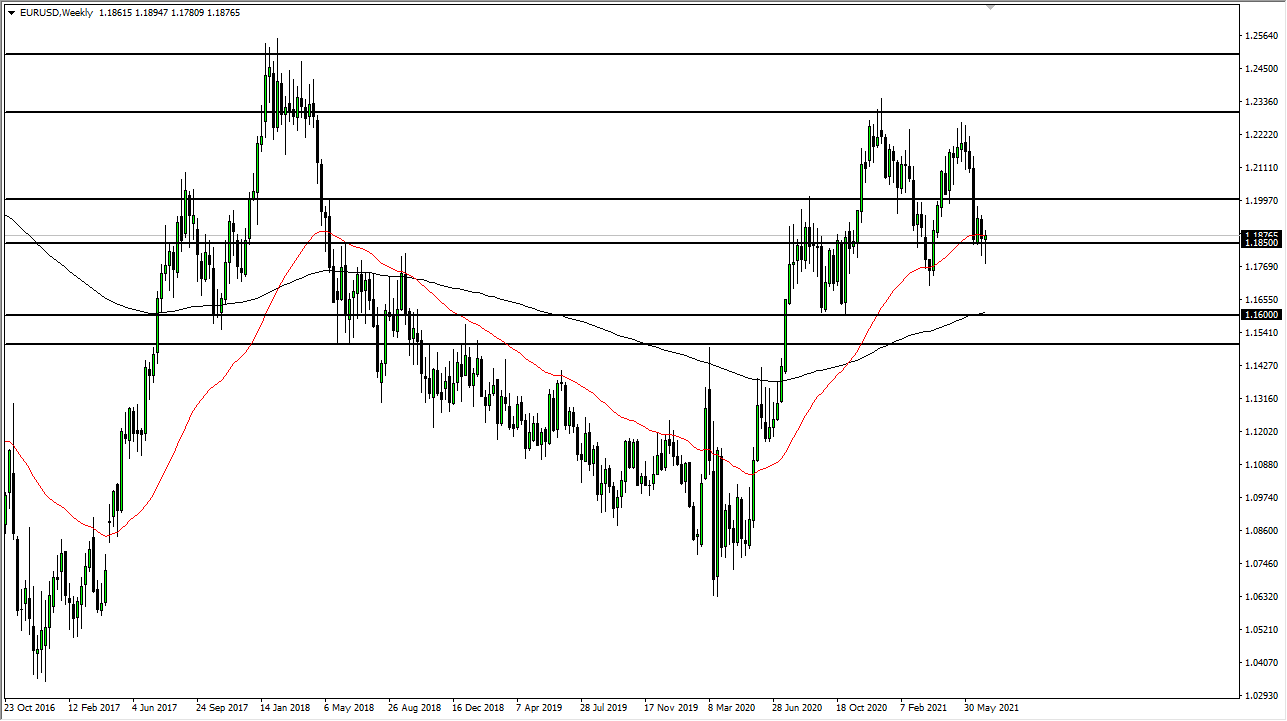

AUD/USD

The Australian dollar was very noisy during the week, dancing around the 0.75 handle. The 50-week EMA sits just below there and flattens out, so I think at this point in time we are trying to make a decision as to which direction to go. Simply put, I think the easiest way to trade this market is to either start selling again on a break of the weekly low, or perhaps breaking above the resistance on the last three candlesticks. If we do break out, it is very likely that we could go looking towards the 0.70 level, just as a breakout above the last three candlesticks could open up a move to the 0.7750 level.

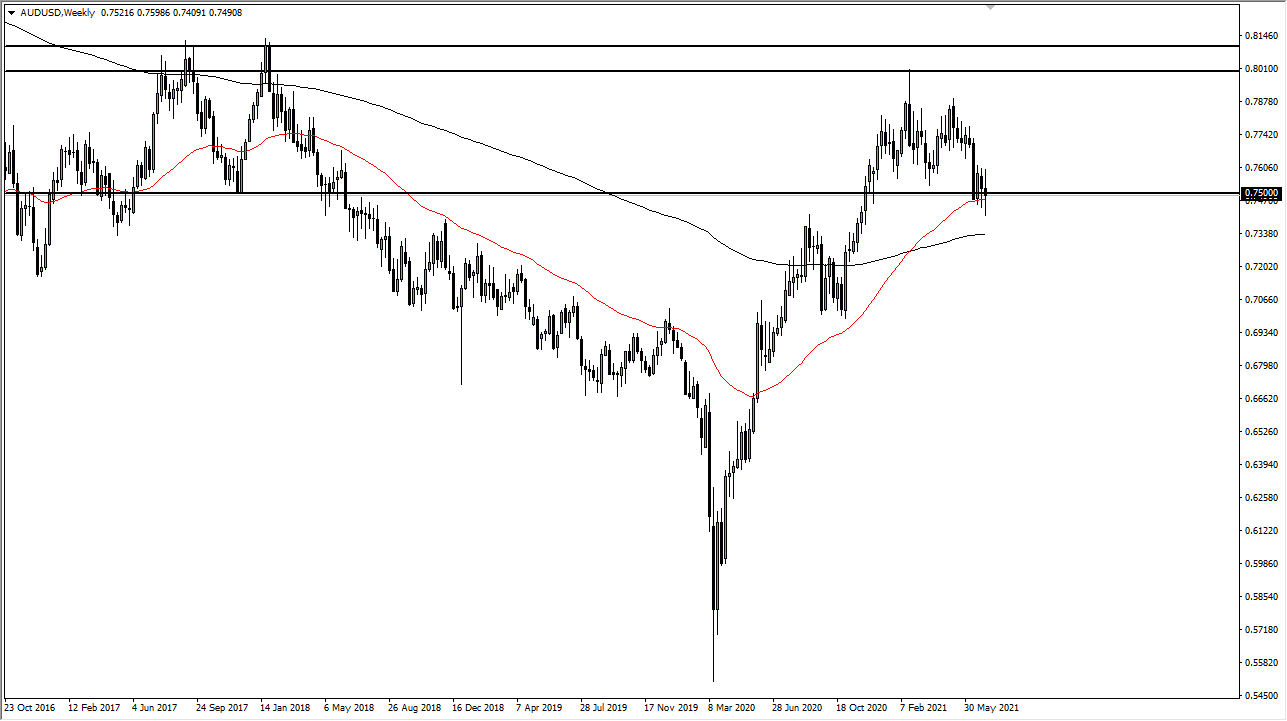

NZD/USD

The New Zealand dollar has been back and forth during the week, looking at the 0.69 level as support, and as you can see, it looks a bit confused at the moment. Ultimately, this is a market that has been bouncing around and I think is trying to carve out some type of range for the summer. If we break down below the lows of the last couple of candlesticks, then I think we will fall much further, perhaps reaching towards the 0.66 level. On the other hand, if we can break above the top of the weekly candlestick, then it is likely that we could go to the 0.73 handle after that.

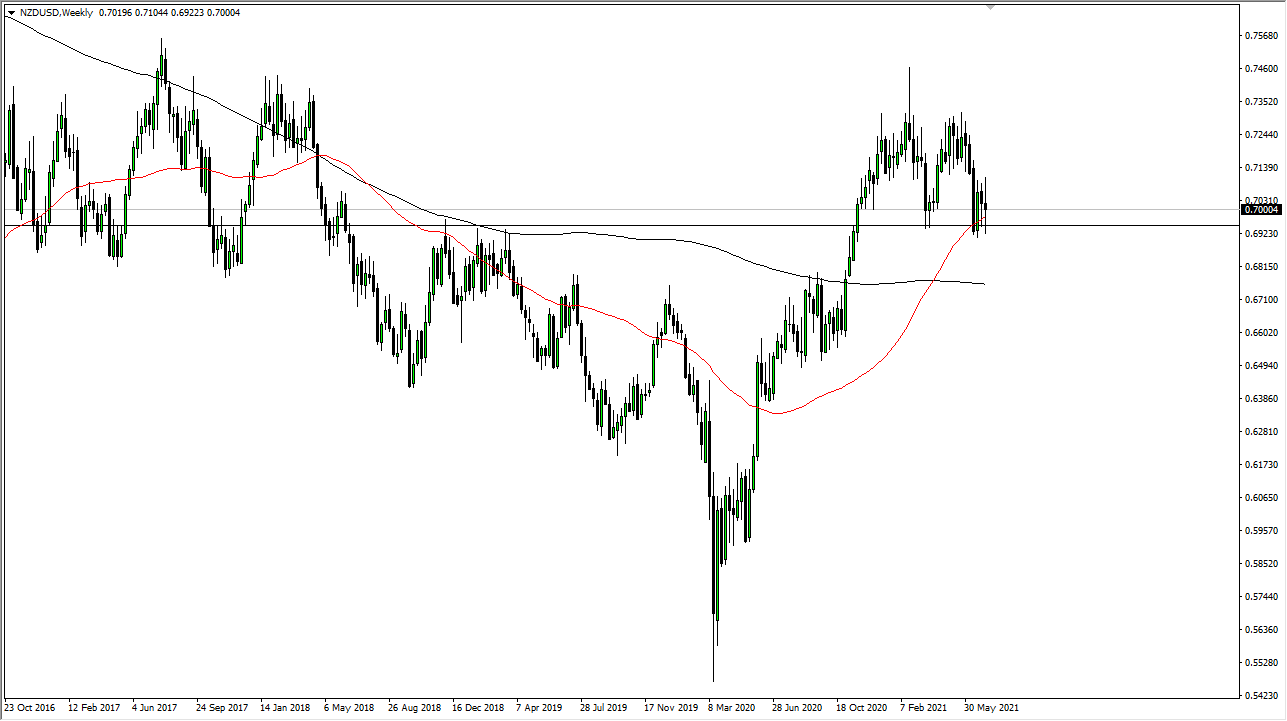

GBP/USD

The British pound initially fell during the week but bounced enough from the 1.37 level to show signs of support. Because of this, it looks as if we are going to continue to bounce around in this general vicinity, and I think we may be trying to carve out a range in this market just like we are in the New Zealand dollar. If that is going to be the case, then we could go back to the 1.42 handle. To the downside, if we break down below the 1.37 handle, we could very easily go to the 1.35 handle.