Five trading sessions in a row was enough to push the price of the US dollar against the Japanese yen to the 109.53 support level, the lowest in a month, and closed last week's trading around the 110.25 level.

The recent correction of the currency pair came after a stronger control of the bulls on the currency pair, amid expectations that the US interest rate hike will soon take its gains at the beginning of trading this month, reaching the level of 111.65, its highest since March 2020.

Currently investors continue to gauge the potential impact of COVID-19 variants, particularly the highly contagious delta variant, as governments in some countries re-impose lockdowns and travel restrictions.

The problem has been particularly bad in Asia and Europe, where countries that largely avoided outbreaks earlier are now dealing with increasing numbers of their own cases. The growing number of coronavirus cases has been one of the reasons why investors have been returning to bonds in recent days.

Investors have also been closely watching the Federal Reserve to see how it reacts to the US economic recovery and whether it will withdraw some of its support sooner than expected. In a report to Congress released on Friday, the US central bank said its low interest rate policies are providing "strong support" for the economy as it recovers from the coronavirus pandemic. It indicated that it plans to continue this support until further economic progress is achieved.

This week, the USD/JPY pair will eyed closely with the announcement of US inflation figures, then retail sales, and the expected testimony of US Federal Reserve Governor Jerome Powell. The Japanese yen may wait for the Bank of Japan to announce an update on its monetary policy decisions.

Tokyo recorded 950 cases of the new coronavirus, the highest daily number in two months, as the infection spread steadily less than two weeks before the city hosts the Summer Olympics. Saturday's tally compared to the 822 confirmed cases reported on Friday. Japanese Prime Minister Yoshihide Suga declared a state of emergency in Tokyo from Monday to prevent infection from becoming explosive during the Olympics, which will open on July 23.

The government initially planned less drastic measures, but came under pressure to issue the emergency order as the most contagious delta strain spread in the Tokyo area. Experts have warned that the number of cases could rise to the thousands within weeks as people travel on summer vacations and the Olympics attract foreign and domestic visitors to Tokyo. Despite the recent acceleration in Japan's vaccination program, only 16.8% of the population is fully vaccinated. Japan has reported about 812,000 cases and about 15,000 deaths from the epidemic.

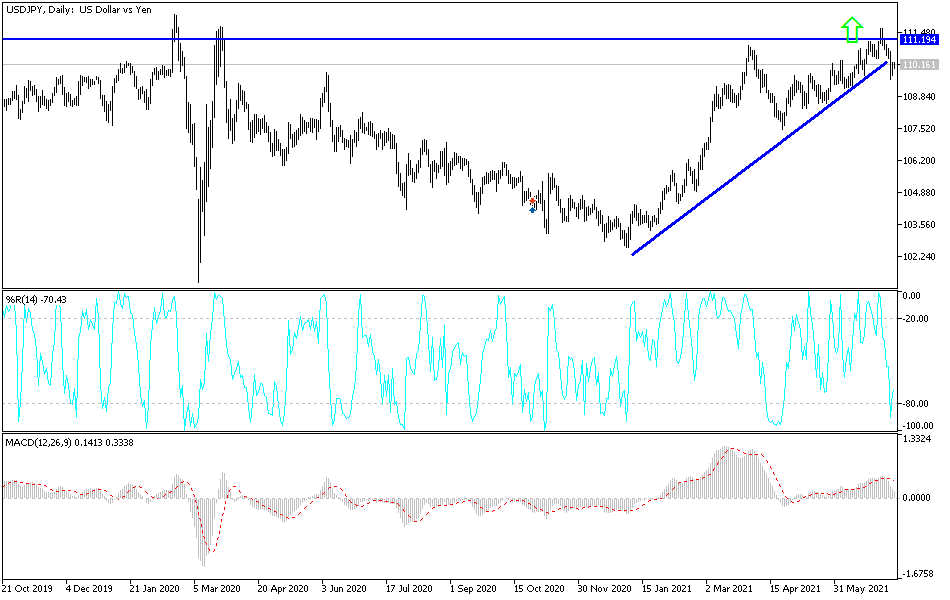

According to the technical analysis of the pair: On the daily time frame, the price of the USD/JPY currency pair is still at the beginning of forming a descending channel. The bears' control will strengthen if it moves towards the support levels 109.55 and 108.80. On the upside, holding onto the psychological resistance 110.00 gives some hope for the bulls to take control. In general, if global fears increase and restrictions return to closure to confront the Corona Delta variable, investors may rush to safe havens, and the Japanese yen will have the opportunity to launch strongly. This will increase the selling of the currency pair.