It was a strong catalyst for the US dollar to complete its sharp gains against the rest of the other major currencies. The Japanese yen is also one of the most important safe havens. The demand for the stronger dollar, which explains the sharp collapse of the US dollar against USD/JPY to the cusp of support 109.00 as it settles around the 109.50 level in the beginning of trading today, Tuesday.

Concerning the rapid spread of the Corona Delta variant, US Surgeon General Vivek Murthy warned that most deaths related to the Corona virus are among unvaccinated people. His comments came as infections in the United States rose 70 percent over the past week, and deaths rose 26 percent amid a resurgence of the virus in parts of the country with low vaccination rates.

Most recently, the UK reported 48,161 new cases on Sunday, with concerns about the continued spread of the delta variable offsetting optimism.

The Japanese government held its economic assessment for the second consecutive month in July, according to the monthly report released by the Cabinet Office. The Japanese economy showed further weakness in some components, although it continued to recover in a dangerous situation due to the emerging corona virus.

The Japanese government maintained its view on private consumption, business investment and exports. Meanwhile, the assessment was raised on business conditions this month, saying that conditions show recovery moves, although some severe aspects remain. Last month, the government said companies' judgments about current business conditions appeared to be on hold, while some harsh aspects remained. In the near term, the government expects the economy to show recovery movements, supported by the effects of policies and improvements in external economies.

Meanwhile, two opinion polls show support for the Japanese government continues to decline, and pre-Olympic crowds are marred by new cases of the virus among athletes. A Kyodo poll showed support for the government slipping by more than eight percentage points to 35.9%. The Mainichi Shimbun's support rating dropped four points to 30.

On the other hand, the US economic calendar is dominated by the housing market reports (starts and sales) and the preliminary PMI at the end of the week. Also, US Federal Reserve officials are entering a period of calm ahead of the FOMC meeting on July 27-28.

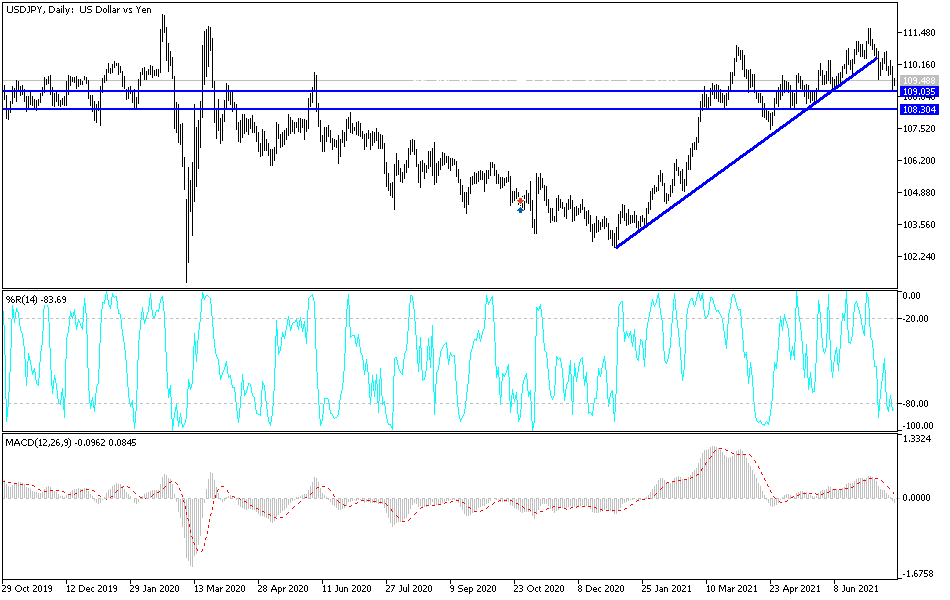

According to the technical analysis of the pair: USD/JPY moves to the expected support levels if the pair abandons the 110.00 psychological resistance level, the most important for bulls to control performance. The current important target for more control of the bears is 108.80, and from it and at least it is better to buy the currency pair, waiting for the moment of the rebound upwards. To the upside, the 110.00 resistance will remain the most important for the time being, to stimulate an opposite move to the current bearish outlook.

I still prefer buying the currency pair from every downside level, especially below the 108.80 support. The yen will be affected today by the announcement of the CPI reading in Japan, and the dollar will be affected by the announcement of building permits and housing starts.