It may remain in a narrow range around and above that resistance until investors and markets interact with the US Federal Reserve’s announcement tomorrow and then the US economic growth rate is announced . The data and events will be important for the future of the currency pair in the coming days. Its gains last week and until yesterday were on the threshold of the resistance 110.60 and it is settling around the 110.15 level at the time of writing the analysis. Ahead of the release of the US durable goods orders numbers and the US consumer confidence index reading.

From today, the divided US Federal Reserve will meet to discuss when and how it should undo ultra-low interest rate policies. Currently, the US economy is growing rapidly in the wake of the pandemic recession, and the pace of employment is healthy, which is why Fed policy makers are likely to come close to action soon. In particular, officials are expected to discuss the timing and mechanics of slowing their $120 billion per month bond purchases — pandemic-era policy aimed at keeping long-term loan rates low to stimulate borrowing and spending.

This week's meeting comes against the backdrop of a risky policy bet by Federal Reserve Chairman Jerome Powell. Powell is betting that the central bank can engineer a very subtle mission: keep the Fed's benchmark short-term rate fixed near zero, where it has been since March 2020, until the labor market fully recovers, without fueling a high bout of inflation.

US new home sales fell for the third consecutive month in June, falling 6.6% to reach their lowest level in more than a year. In this regard, the US Commerce Department reported that a drop in June sales left sales at a seasonally adjusted annual rate of 676,000. This followed a 7.7% drop in sales in May, and a 10.1% drop in April.

The pace last month was 19.4% down from a year ago and the slowest since April 2020. The housing sector has been an outstanding performer since the economy began emerging from a severe but short pandemic recession in April of last year. The median price of a new US home sold in June was $361,800, up 6.1% from a year ago. But it is down 5% from May, suggesting that the rise in prices may slow slightly as builders increase inventories. The number of new homes for sale at the end of June rose to 353,000, up 7% from May.

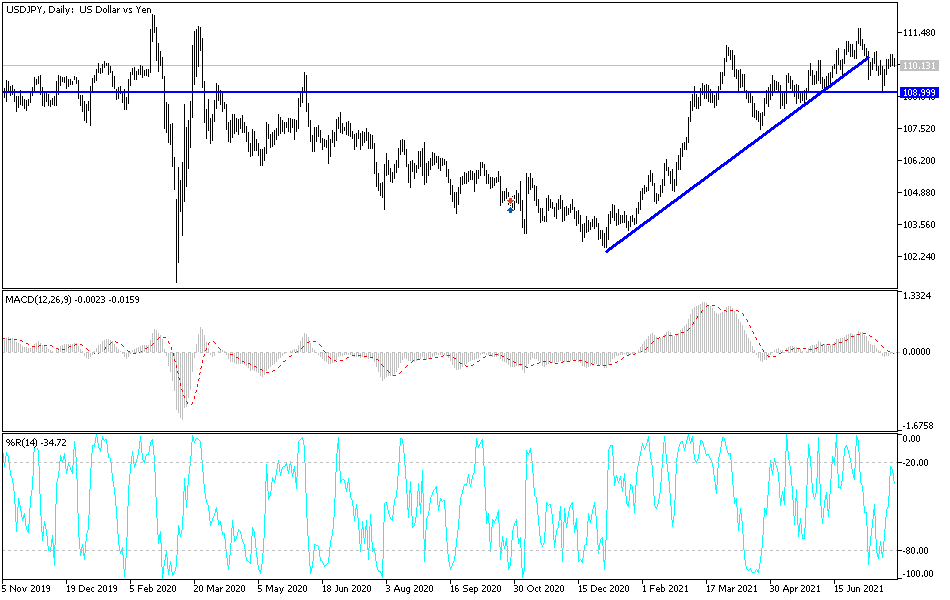

According to the technical analysis of the pair: With the price of the USD/JPY currency pair sticking to the move and above the psychological resistance 110.00, the bulls will still control the performance. They are the closest to the most important resistance for more control, the resistance level 111.20. On the other hand, the currency pair may come out of the correctional strength upwards if the bears in the currency pair return to the support levels 109.75 and 108.80, respectively.

I expect a movement in a limited range for the dollar-yen currency pair until the announcement of the US Central Bank, followed by the announcement of the growth rate of the US economy.