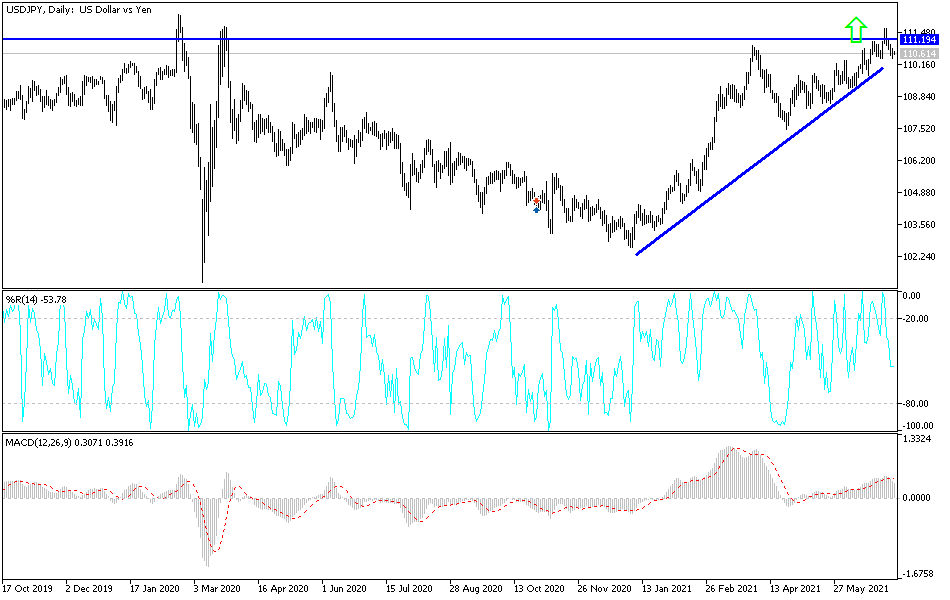

The conflict of safe havens (the dollar vs the Japanese yen) is back. The secret is the rapid spread of the Corona virus variables, which threatens global efforts to revive the global economy amid plans to ease the restrictions of the epidemic. Delta variable has become the talk of the world. The beginning of the change was in India, and the exposure of global economies to it may negatively affect investor sentiment and market performance in the coming period. The narrative confirms the reasons for the decline of the USD/JPY currency pair in recent trading sessions. It reached the 110.40 support level, before settling around the 110.62 level at the time of writing the analysis. Investors’ desire to buy the dollar is still the strongest and an ideal safe haven since the outbreak of the epidemic, in addition to the US Federal Reserve’s intention to tighten its monetary policy as soon as possible.

Overall, as officials continue to see risks to the economic outlook, the minutes of the Fed's latest monetary policy meeting indicate that the US central bank will not be in a hurry to begin reducing its asset purchase program. The US Federal Reserve has repeatedly said it plans to continue its asset purchases at a rate of at least $120 billion per month until "another significant progress" is made toward its goals of maximum employment and price stability.

The June meeting minutes echoed Fed Chair Jerome Powell's view that "additional substantive progress" had yet to be achieved, although participants expected continued progress. While many participants expect the conditions to begin reducing the pace of asset purchases will materialize sooner than they previously expected, others saw the incoming data as providing a less clear indication of the underlying economic momentum.

The minutes added that some participants decided that the US central bank would be able to make a better assessment in the coming months and stressed that the central bank should be “patient in assessing progress toward its goals and announcing changes in its asset purchase plans.”

On another level affecting the performance of the USD/JPY, Tokyo reported 920 new cases of coronavirus, the highest level since mid-May, two weeks before the Olympics. Japanese Prime Minister Yoshihide Suga held a meeting with key ministers to discuss coronavirus measures. Suga noted Tokyo's recovery and vowed to "do everything in our power to prevent the further spread of infection."

Suga says he will make a final decision on reinstating the state of emergency on Thursday after consulting with a panel of experts. A state of emergency in Tokyo ahead of the July 23 games will mean Olympic officials abandon plans to have local spectators or lower stadium capacities. Dr Shigeru Omi, the government's chief medical advisor, urged authorities to crack down quickly ahead of the Olympics and summer holidays when many people tend to be more active.

"The period from July to September is the most critical period for Japan's actions on COVID-19," he says. And only 15% of Japanese were fully vaccinated. Japan has reported about 810,000 cases and about 14,900 deaths.

According to the technical analysis of the pair: Despite the recent performance, the general trend of the USD/JPY currency pair is still bullish as long as it is stable above the psychological resistance 110.00. With the approach of tightening the US central bank policy, any descending levels for the currency pair may be an opportunity for investors to start thinking of buying again. The closest support levels for the pair are currently 109.90, 109.00 and 108.45. On the upside, a return to the resistance 111.20 will be important for the strong bulls to continue controlling the pair. The USD/JPY currency pair will be affected today by the risk appetite of investors and the US weekly jobless claims announcement.