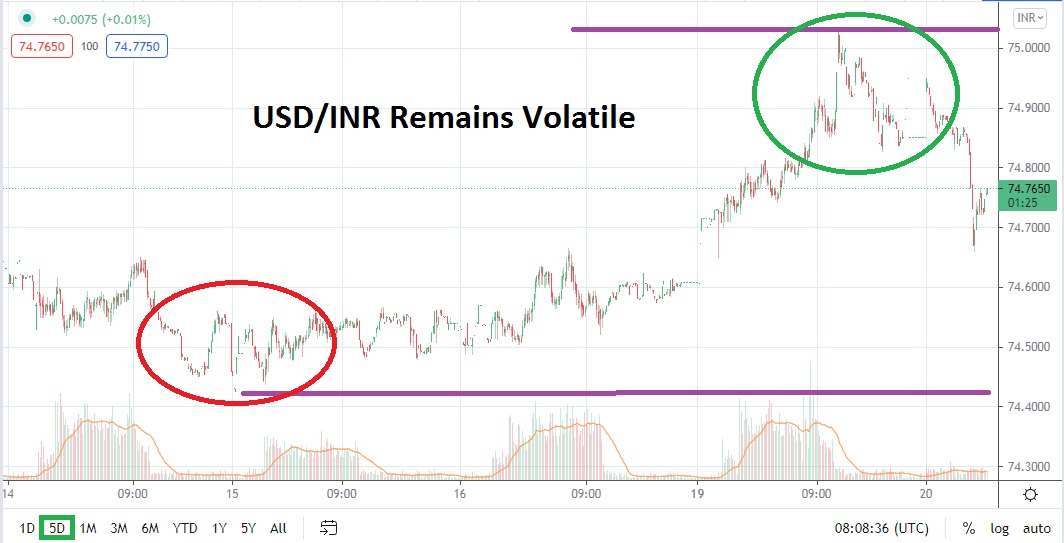

The USD/INR reached the 75.0200 level on Monday, while a turbulent bullish cycle traversed near the key psychological juncture of 75.0000 briefly. The USD/INR has certainly been within an upward trend the past month-and-a-half and yesterday’s price action tested highs not seen since April. Yes, the highs produced on Monday were met with a reversal lower which incrementally returned the USD/INR back to its ‘known’ range. An early low of 74.6100 was produced today and the current price is only slightly above this ratio.

After the whirlwind of volatile price action demonstrated, speculators are likely asking if this was the apex of bullish sentiment. Or, can the USD/INR continue to foster momentum higher and actually challenge highs seen in April? While it remains unlikely the higher values on the 21st of April will be touched, it is not out of the question. The USD/INR has been actively bullish and its perceived bearish sentiment feels as if it is losing its mid-term luster and is merely a memory.

Yes, the USD/INR does look overbought, but the trend has been solid the past month-and-a-half and it will take a brave trader to begin positioning themselves with selling positions. However, the current price of the USD/INR may attract technical traders. The values demonstrated yesterday were caused by a sudden wave of buyers who targeted highs near the 75.0000 mark, and now that they were achieved it raises the suspicion that values will reversal lower.

Traders need to be ready for the USD/INR to move fast as the Forex pair tries to establish price equilibrium after the volatility displayed. The USD/INR should be traded using strict limit orders to make sure price fills remain realistic. Using ordinary market orders to enter USD/INR positions under the present conditions could lead to emotional tests traders do not want.

Support near the 74.6000 to 74.5800 junctures should be watched, and if these ratios prove vulnerable, the USD/INR could test lower values seen late last week rather swiftly. On the other hand, if resistance near the 14.6800 to 14.7000 begins to come into sight again, traders could not be faulted for targeting higher ground for quick hitting trades. Stop losses, take profits and solid risk management are urged for traders within the USD/INR in the near term because volatility remains a likely prospect.

Indian Rupee Short-Term Outlook:

Current Resistance: 74.6800

Current Support: 74.5900

High Target: 74.9200

Low Target: 74.5100