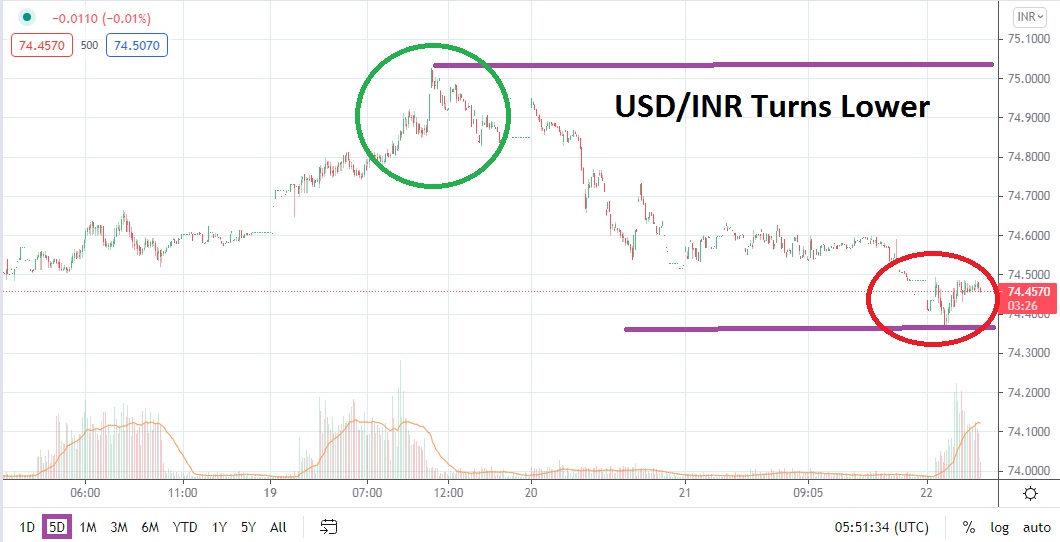

As of this writing, the USD/INR is near the 74.4500 mark and the Forex pair has demonstrated an ability to produce a short-term bearish move. The direction lower, however, comes after the USD/INR touched important highs only a few days ago near the 75.0000 juncture. The USD/INR has been within the grip of a rather strong bullish trend and the sudden move lower may simply be part of a natural cyclical round of reversals. The question that speculators need to consider is if the USD/INR can actually challenge important support levels and puncture them lower.

The steady progression higher within the USD/INR may feel like it happened too fast to speculators who have been pursuing selling positions. After perhaps paying an expensive bill for the USD/INR going against their notions, traders who have been wagering constantly on bearish potential may feel skeptical. They cannot be blamed for being cautious. However, trading is filled with sudden reversals and cycles of short- and mid-term developments that seem to go against longer speculative outlooks.

The USD/INR is also quite capable of exhibiting fast trading. The volume of transactions within the Indian rupee is not monster-sized like other major Forex pairs, meaning that large cash trades by financial institutions and corporations can sometimes shake the USD/INR violently and unexpectedly.

Having shown the capability to move lower yesterday and maintain this stance early today, support near the 74.4000 to 74.3700 junctures needs to be given attention. Cautious sellers should use nearby take-profit targets so they do not get hurt by the potential of reversals higher which suddenly resume bullish momentum. However, if the 74.4000 proves vulnerable and values are sustained beneath this ratio, traders with bearish sentiment may believe another leg downward could develop.

Until the USD/INR punctures support near the 74.37000 juncture and manages to sustain additional downward pressure, traders should remain cautious within the Forex pair. Speculators who have been testing the bullish side of the USD/INR and have been achieving solid results may actually want to buy the Forex pair on slightly lower moves towards the 74.4200 to 74.4000 marks, and anticipate a reversal higher. The USD/INR has been producing an incremental bullish climb for almost two months and, until proven otherwise, wagering on reversals higher after support has been tested could prove to be worthwhile.

Indian Rupee Short-Term Outlook:

Current Resistance: 74.5100

Current Support: 74.3700

High Target: 74.6200

Low Target: 74.2400