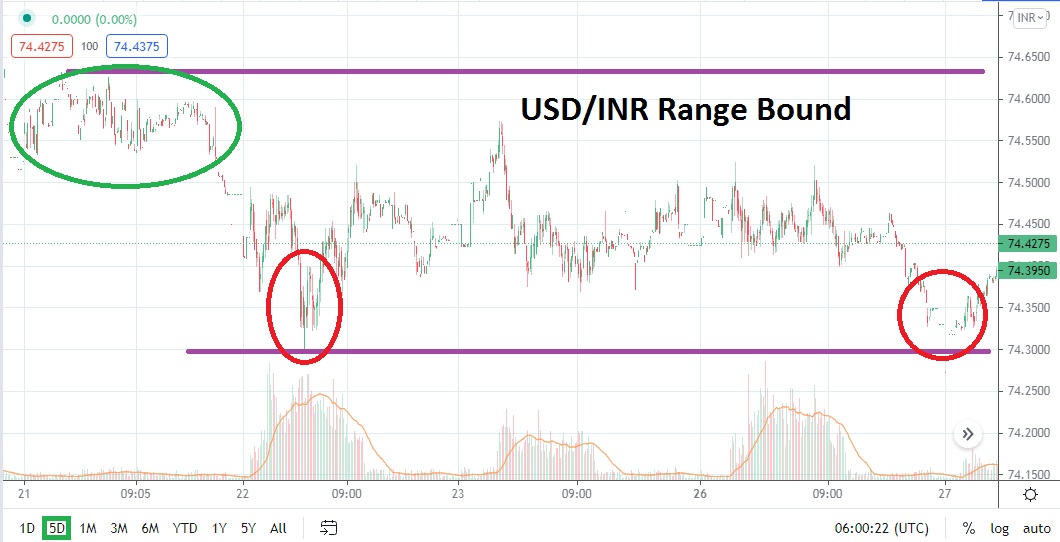

The USD/INR has not produced a sea of volatility the past handful of days and speculators of the Forex pair may be enjoying the calmer waters. Support near the 74.3100 juncture has been tested twice in the past week and both times produced reversals higher. On the 22nd of July, the USD/INR traded near the 74.3000 mark, and one day later put in a high of approximately 74.5700. In rather light trading conditions yesterday, the USD/INR traded near the 74.3100 mark and it has come within sight of the 74.4400 ratio early this morning.

What may prove to be intriguing for speculators is the notion that resistance levels have incrementally decreased since the 19th of July when the USD/INR was trading near the 75.000 juncture. Forex trends are never one-way avenues in the short term, and reversals are frequent. However, in the past week-and-a-half of trading, the USD/INR has clearly shown a downward trajectory. Traders need to remember that the USD/INR produced a substantial bullish run starting in late May, after the Forex pair was trading near a low of 73.3100.

The ability of the USD/INR to reverse higher off of this low has been demonstrated a few times in 2021. In March, the USD/INR traded near the 73.31 value also, and then on April the 20th, the Forex pair was trading near 75.5000. This rush higher was caused because of negative sentiment created by a massive wave of coronavirus which hit India and made international headlines from late March until April was finished.

The recent highs within the USD/INR have largely occurred because of nervous trading conditions caused by the U.S Federal Reserve as they discussed interest rates and inflation. Technically, the USD/INR did look over bought on the 19th of July and its incremental move lower is intriguing. The USD/INR is still trading above the 74.0000 level. The rather tight range it has created the past week could prove an opportunity for speculators who want to wage on more downside action.

Resistance junctures near 74.4600 and 74.5000 may prove to be attractive as spots where sellers may want to initiate short positions. If these nearby higher levels prove sustainable in the short term, it may signal that additional bearish momentum will be generated and that targeting lows near the 74.3800 level could be a worthwhile speculative position. Aggressive traders may want to sell at lower marks near the 74.4200 to 74.4500 ratios.

Indian Rupee Short Term Outlook:

Current Resistance: 74.4640

Current Support: 74.3600

High Target: 74.5100

Low Target: 74.2900