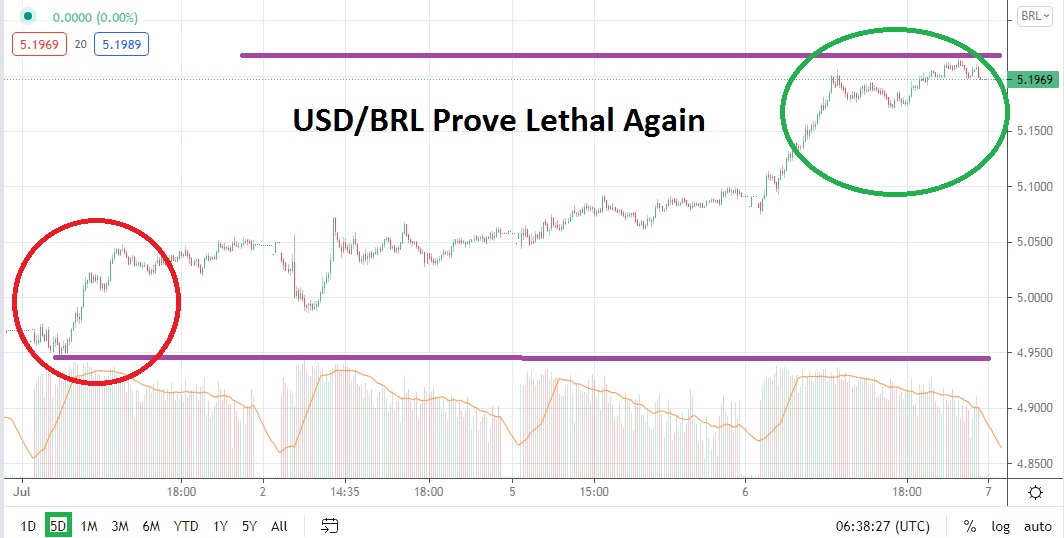

The USD/BRL was trading around the 5.0800 juncture yesterday when began to move and suddenly produced a strong swift rise and touched a high of nearly 5.2180 as the day ended. The USD/BRL has a habit of providing head-scratching results and Tuesday’s price action was no different. After trading within a very polite bearish range over the mid-term, the USD/BRL has essentially tracked higher since the 25th of June when it was trading at approximately 4.8700.

The USD/BRL will begin today’s trading near the 5.1900 to 5.2000 junctures and it is trading at highs not experienced since 1st of June. It was after breaking the 5.1000 mark yesterday with bullish momentum that the floodgates opened and the USD/BRL screamed to higher values. The question speculators now need to consider is if the Brazilian real will take a breather and begin to traverse within these higher values in a calm manner, or if yesterday’s spike upwards will be met by a reversal downwards.

The USD/BRL seldom provides comfortable trading conditions and its results are frequently a contradiction compared to many other pairs in Forex. While the USD/BRL is considered a major Forex pair it still has rather thin trading volumes and because of this it has the ability to produce rather surprising results when imbalances in the market occurs. Perhaps a reason for the imbalance yesterday was the return of U.S financial institutions which transacted large amounts of the USD/BRL upon their return from a long holiday weekend.

After technically enjoying the sunshine of a rather steady bearish trajectory over the past few months, the USD/BRL has abruptly reminded speculators it can be lethal. Bearish traders who were not using appropriate stop-loss orders yesterday have likely experienced an expensive lesson. Going into today’s trading speculators should certainly be braced for the potential of a volatile reaction.

Selling the USD/BRL may feel very dangerous at these levels, but it might prove to be rather intriguing and worthwhile for traders who can use appropriate tactics. Conservative traders may want to consider looking for slight movements higher above the 5.2000 juncture in order to short the USD/BRL. However, it is advised that nervous traders wait for the USD/BRL to trade for a couple of hours today to gauge short-term technical and behavioral sentiment before dipping their toes into the market.

Brazilian Real Short-Term Outlook:

Current Resistance: 5.2100

Current Support: 5.1700

High Target: 5.2600

Low Target: 5.1300