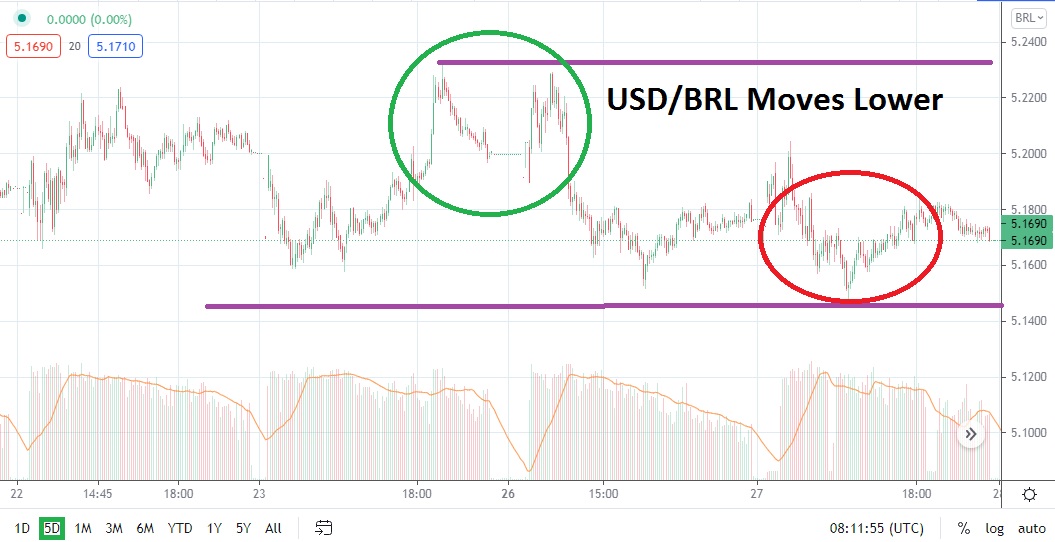

After coming within sight of the 5.3000 mark on the 20th of July, the USD/BRL has demonstrated an incremental decrease in resistance. A high of 5.2770 was touched on the 21st of July. This was followed by a high of 5.2330 on the 23rd 5.2275 was seen on the 26th following the weekend and yesterday a high of about 5.2040 was achieved. The steps down via resistance levels may be an important consideration for traders today as they prepare for the USD/BRL to open.

When the USD/BRL begins today’s session it will be near the 5.1690 mark. Yes, there may be a curious gap that is demonstrated, but if the value holds its ground this will foster the notion that the USD/BRL is potentially within a cycle which is attempting to recapture bearish values which are within eyesight of important technical support. The 5.1550 juncture appears to be important and if this level comes under attack and is proven weak, traders should then expect potential volatility to break out.

Lows on the 26th and 27th tested the 15.1550 junctures, but failed to penetrate beneath. Speculators who continue to have bearish sentiment should watch the 5.17000 to 5.1800 marks carefully. If these nearby resistance junctures exhibit durability, it may be an indication additional bearish momentum could be getting ready to create further downward momentum. Traders who want to sell the USD/BRL on slight moves higher may find an opportunity to take advantage.

If the 5.1800 juncture is punctured higher, traders will then have to turn their attention to resistance near the 5.1900 and 5.2000 junctures. Even if these higher values are tested, the short-term bearish trend within the USD/BRL could remain intact as long as highs from the 26th of July are not punctured.

The importance of the 5.1500 level does appear to be important and a potential inflection point for the USD/BRL. If bearish momentum continues in the broad Forex market against the USD, the Brazilian real may continue to find that the USD/BRL pursues price action downwards. Selling the USD/BRL on slight rises in value and seeking current support levels as take profit targets appears to be a logical speculative choice today.

Brazilian Real Short-Term Outlook:

Current Resistance: 5.1875

Current Support: 5.1575

High Target: 5.20600

Low Target: 5.1390