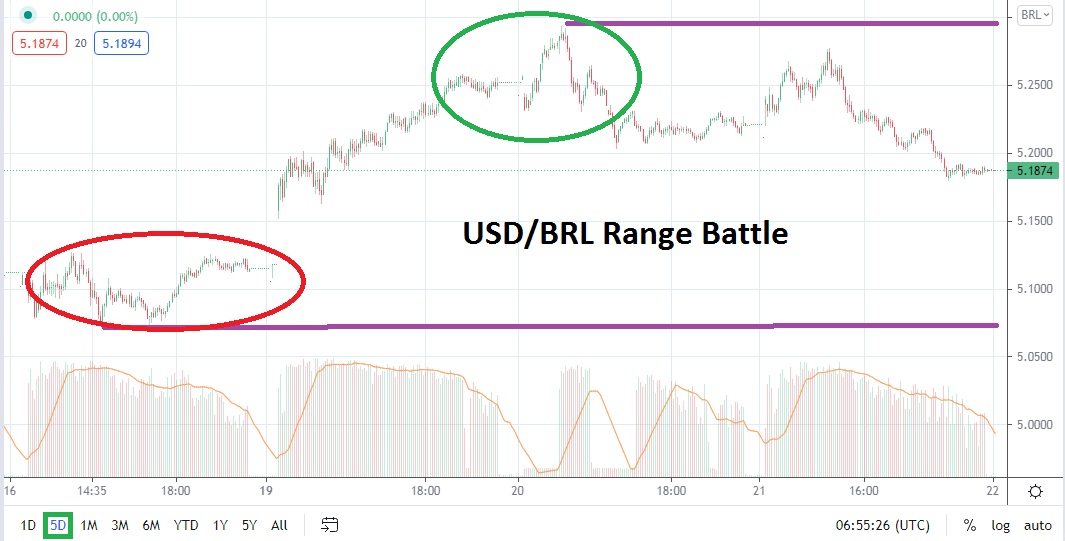

Since the last week in June, the USD/BRL has produced a rather steady bullish trend higher. The Forex pair moved towards the 5.2900 mark on Tuesday which briefly challenged highs seen on the 8th of July when the USD/BRL traded above the 5.3000 level. Yesterday produced a choppy day of trading, but finished near a low of 5.1875. When the USD/BRL opens today, technically the Forex pair is near important short-term lows.

The USD/BRL often proves to be a rather difficult Forex pair to correlate to the broad markets. However, since late June, the bullish trend demonstrated has actually followed other major currencies which essentially have lost value to the USD. Coronavirus concerns in Brazil continue to be heard and inflation data from the U.S needs to be acknowledged, and technically the USD/BRL is producing a trend which has seemingly moved in step with other Forex pairs.

Choppy conditions have dominated and the USD/BRL which has intriguing short-term support near the 5.1500 juncture which could prove a rather interesting opportunity if reversals are expected. Traders should keep in mind the USD/BRL tends to open with slight gaps because of its rather light trading volumes compared to other major currencies. Speculators are advised to wait for the market to open and then use limit orders. If the USD/BRL opens with a sustained price near the 5.1875 ratio, aggressive traders may want to pursue buying positions.

Range trading should be expected in the USD/BRL and the 5.2100 to 5.2300 resistance junctures should be watched; if they are punctured higher, traders may expect to see loftier values targeted again. After achieving a very solid bearish trajectory from March until late June, traders may suspect the emergence of a bullish trend is a natural reaction. The question traders should ask themselves is if resistance levels will begin to prove durable and where.

Speculators who believe that technically the bearish momentum within the USD/BRL will begin to re-emerge are encouraged to use solid risk management. Yes, the U.S dollar has been strong against many major currencies in the short term and may be overbought, but wagering against its trend may prove costly. If a trader wants to sell the USD/BRL, they may want to wait for an additional move higher today and to short the Forex pair near current resistance levels.

Brazilian Real Short-Term Outlook:

Current Resistance: 5.2150

Current Support: 5.1500

High Target: 5.2700

Low Target: 5.1100