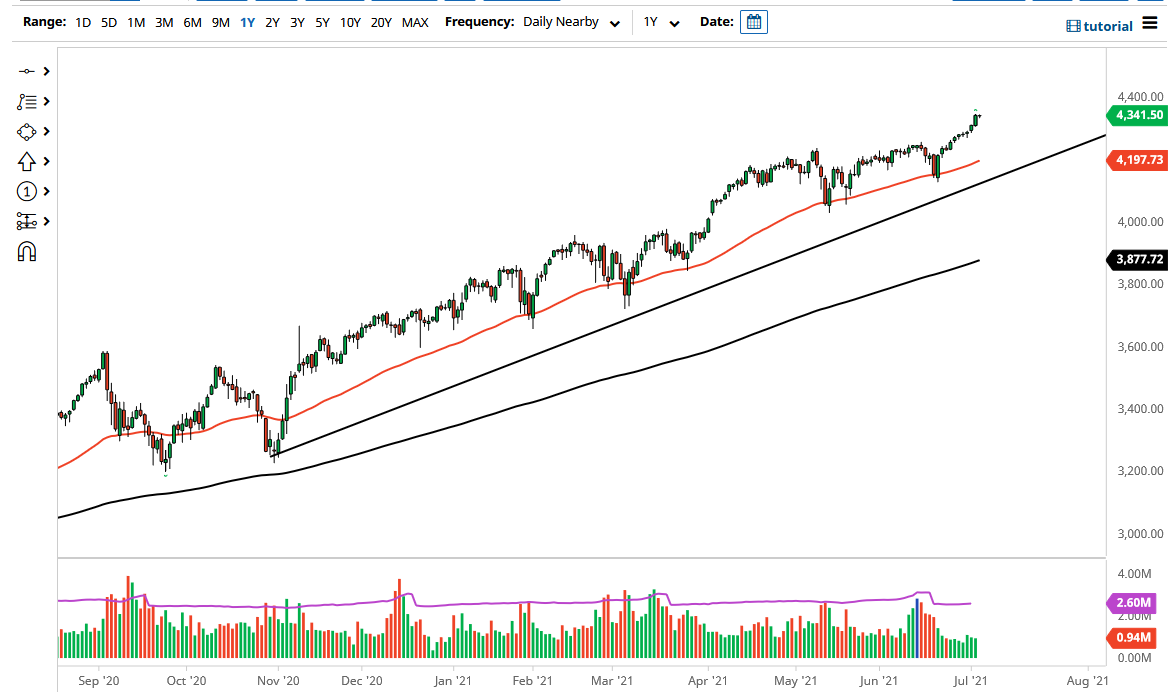

The S&P 500 did almost nothing during the trading session on Monday, as you would expect, due to the fact that the underlying index was closed. With the Americans celebrating the extended Independence Day holiday weekend, there is not any real movement until Tuesday in New York trading. That being said, you can take a look at the chart and quickly recognize that we are in an uptrend, so you should be looking for buying opportunities.

I like the idea of looking at this market through the prism of “buying the dips”, because it gives you an opportunity to pick up value going forward. The Federal Reserve continues to flood the markets with liquidity, and there is no real sense that they are going to end that anytime soon, despite the fact that there have been slightly hawkish statements coming out. The United States cannot afford higher interest rates, so this is essentially Wall Street playing against the bluff that the Federal Reserve seems to be trying to put out there.

Take a look at the Friday candlestick and you can see just how bullish it was, as it was the biggest candlestick in the last couple of weeks. At this point in time, you should take a look at the overall market structure, which seems to figure on 200-point moves every time we get some type of impulsive directionality, which is what we are currently in right now. With that in mind, I believe that the market will probably continue to see the 4400 level as a potential target. If we can break above there, then it is likely that we will continue to go looking towards the 4600 level, although I would assume that the 4500 level would cause a little bit of psychological and structural noise.

To the downside, the 50-day EMA is curling higher and sits just below the 4200 level, so at this point it would essentially be a “floor in the market.” Underneath there, then we have the uptrend line that comes into play, so I think it is very difficult to imagine a scenario where I would be a seller of this market. Looking for dips as potential buying opportunities is the way am going to be trading going forward, adding to positions to make them bigger along the way.