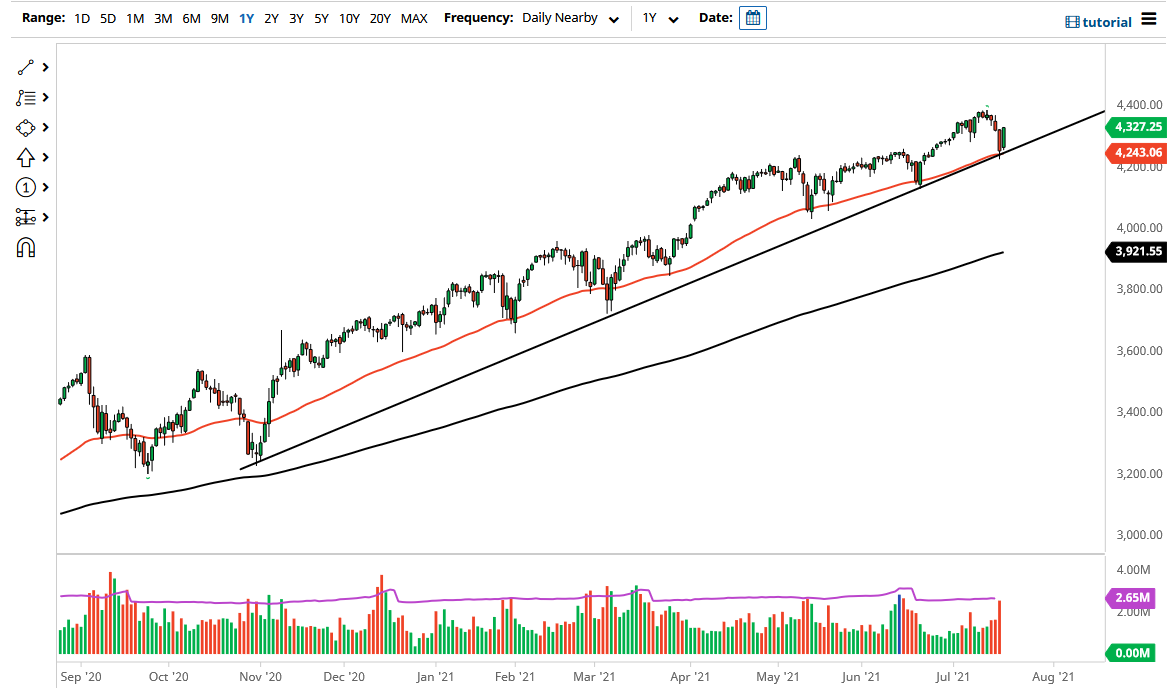

The S&P 500 bounced significantly during the trading session on Tuesday to wipe out the losses from the Monday session. Because of this, we have completely turned around the nasty behavior that we had seen as of late, and it is also worth noting that the uptrend line and the 50-day EMA both are coming into the picture. In other words, it looks like we are going to continue to see buying pressure in this market, as the Federal Reserve is almost certainly going to come into the picture and save everybody if there is a significant selloff.

To the upside, the 4400 level is a target that the market tried to get above previously, and I think we will almost certainly have to retest that area. If we were to break above the 4400 level, then it is likely that we would continue to go towards the 4500 level. This market does tend to move in 200-point increments, meaning that we are probably looking at the 4600 level.

If we do turn around and start selling off, it is possible that we could drop rather rapidly, and the Monday session certainly looked as if it we are going to have that happen. In the meantime, I think we probably can anticipate a significant amount of volatility, as the market tries to decide whether or not it can continue. Nonetheless, we are entering earnings season, so it is not a huge surprise to think that perhaps traders are looking to get long heading into those announcements. That being said, keep in mind that there are a lot of concerns when it comes to global growth, so a breakdown is not necessarily impossible. If we do get that breakdown, I believe the “floor in the market” is down at the 4000 level as I have stated multiple times over the last couple of weeks, due to the fact that it is a major options barrier and there is a gap that should hold as far as support is concerned. Furthermore, the 200-day EMA is starting to reach towards the 4000 level, offering even more support if we do get down to that area. You should keep in mind that a drop to the 4000 level would be a 10% correction, which is well within the tolerances of a simple pullback.