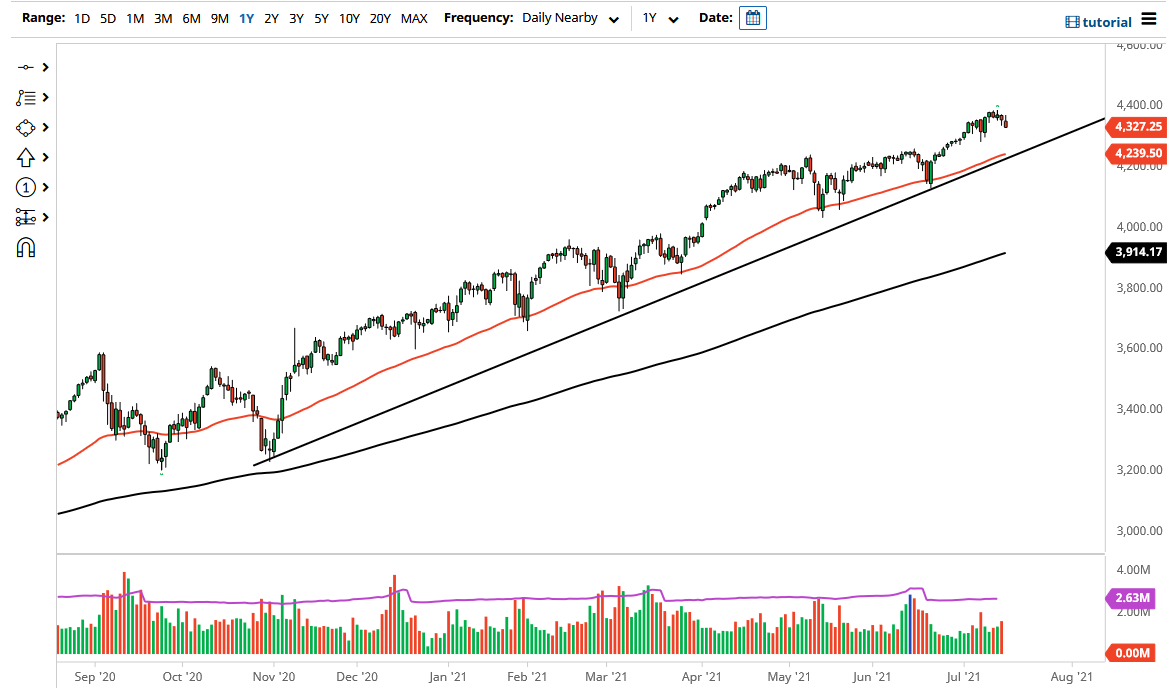

The S&P 500 initially gapped lower to show signs of negativity on Friday but then turned around to fill that gap before falling again. Ultimately, this is a market that has gotten a bit overdone, and it is starting to form a little bit of a “rounding top”, which is a negative sign. The index has plenty of support underneath that should continue to attract buying, but at this point it is likely that we will see a little bit of short-term negativity.

Furthermore, when you look at the S&P 500, you can see that the 50-day EMA is walking right along the uptrend line, and that means that the market is going to continue to find quite a bit of interest in that general vicinity from a technical standpoint. Even if we were to break down below there, it is likely that the market will probably see the 4200 level as a support level, and then possibly even reach down towards the 4000 handle where there is a small gap. The 4000 level is also a large, round, psychologically significant figure that a lot of people would pay attention to as well.

If we were to break down below the 4000 handle, it is likely that I would be a buyer of puts, as it would show quite a bit of negativity, but at the end of the day I believe that the Federal Reserve will jump into this market one way or another through verbal intervention or bond purchases to save everybody on Wall Street. To the upside, if we were to break above the 4400 level, then I think we would go looking towards the 4500 level, followed by the 4600 level.

This is a market that goes higher over the longer term due to the way it is constructed, as it is not equally weighted. With that being the case, as larger companies get bought into yet again, we should reach towards much higher levels. Pay close attention to the US dollar, as a strengthening US dollar also tends to work against the stock market as well. Ultimately, this is a market in which we will continue to look for value on dips, and eventually will hold. Regardless, I would not be a seller anytime soon.