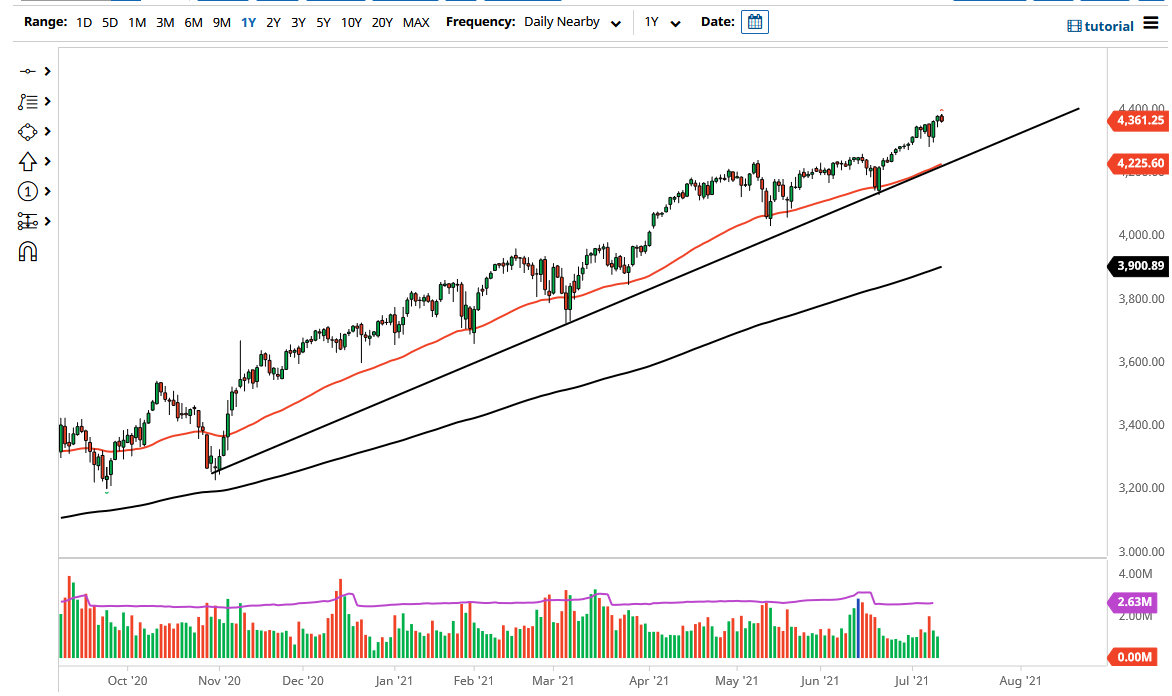

The S&P 500 pulled back just a bit during the trading session on Tuesday as the 4400 level has offered a bit of resistance. If you have been following my analysis over the last week or so, I have been talking about the fact that the S&P 500 has a habit of moving in 200-point increments. Because of this, I think that what we are looking at here is a simple pullback from a significant overall target. Even if we did break above the 4400 level, then it is likely that the market will try to get to 4600, but we would also have the 4500 level between here and there and it could offer a bit of psychological pressure.

Underneath, the 4200 level should continue to offer plenty of support, especially as the 50-day EMA is sitting right in that area, and the uptrend line is right there with the 50-day EMA. Breaking down below that could open up a move down to the 4000 handle, where we have a small gap, and if we break down below there I would likely be a buyer of puts, but I would not short the market, as the Federal Reserve will certainly sit up and take notice if the stock markets suddenly roll over.

In the meantime, this is a market that continues to offer buying opportunities on dips, and I think a day or two of negative price action might do a lot of good for this market. That being said, we also have to pay attention to the fact that the US dollar has shown itself to be relatively strong during the trading session on Tuesday, and that could have a bit of a negative headwind in this market as well. In general, this is a market that I think will eventually find plenty of buyers, because Wall Street will find some type of narrative to get involved to the upside. That being said, that does not necessarily mean that you need to buy at the all-time highs, so I believe at this point in time you are more than likely going to be better off looking for value and bounces in order to take advantage of it.