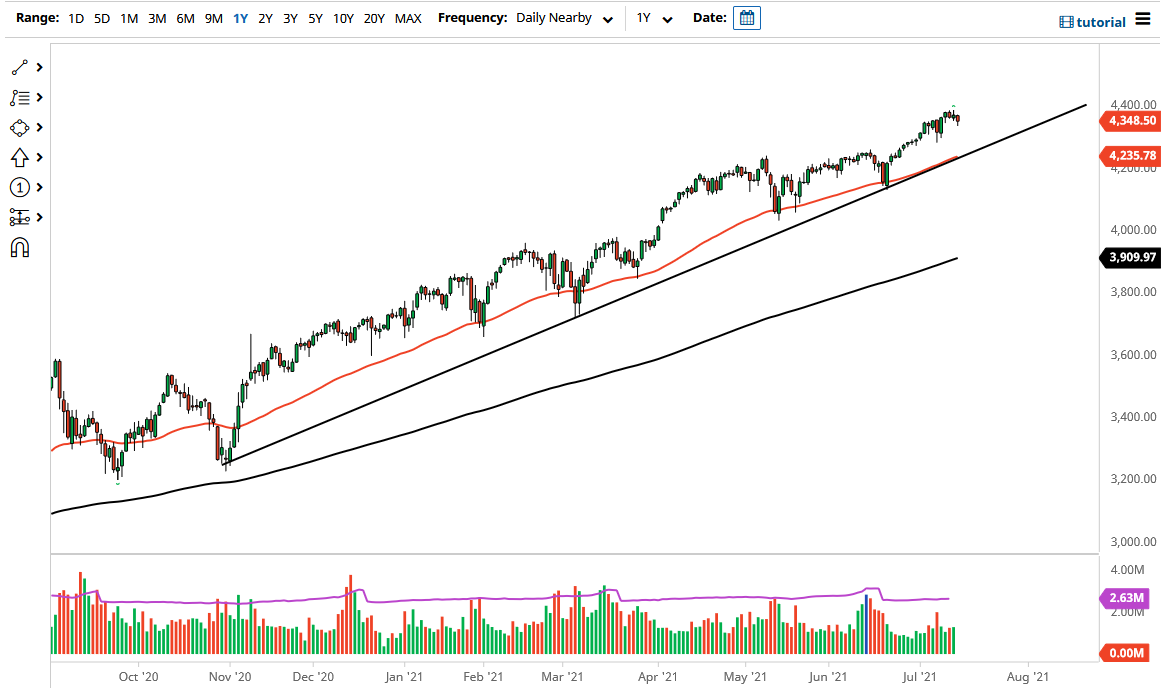

The S&P 500 has pulled back a bit during the trading session on Thursday, perhaps in reaction to the yields falling in the 10 year note, as they dropped below the 1.3% level. At this point, the market looks a little heavy or at the very least lackluster, so I think at this point the market is simply taken a bit of a breather. It probably needs to, due to the fact that it had been so strong for so long.

To the downside, the 50 day EMA sits right at the uptrend line, and therefore I think the combination of the two of them will probably continue to keep this market afloat. The S&P 500 does tend to move in 200 point increments, and now that we have essentially touched the 4400 level, it is possible that we could go looking towards the uptrend line which is closer to the 4200 level. Breaking down below there could open up the possibility of a move down to the 4000 handle, which has a bit of a gap attached to it and of course it is a large, round, psychologically significant figure. Beyond that, the 200 day EMA is starting to reach above the 3900 level and sloping quite nicely to reach towards 4000 given enough time.

I think the one thing you can probably count on is a lot of noise in this market, as there are a lot of conflicting narratives out there when it comes to the idea of inflation or deflation. In general, this is a market that has plenty of support underneath that though, so I think that any time we pull back it is likely that there will be value hunters out there. On the other hand, if we break above the 4400 level, that then allows the market to go much higher based upon the fact that it would be a simple continuation of the overall trend. On a break above there, then I think we are looking at a move towards the 4500 level. That has a certain amount of psychology attached to it, but I think ultimately, we will just simply continue to go much higher. At this juncture, the market still continues to be a “buy on the dips” scenario, just as it has been for 13 years.