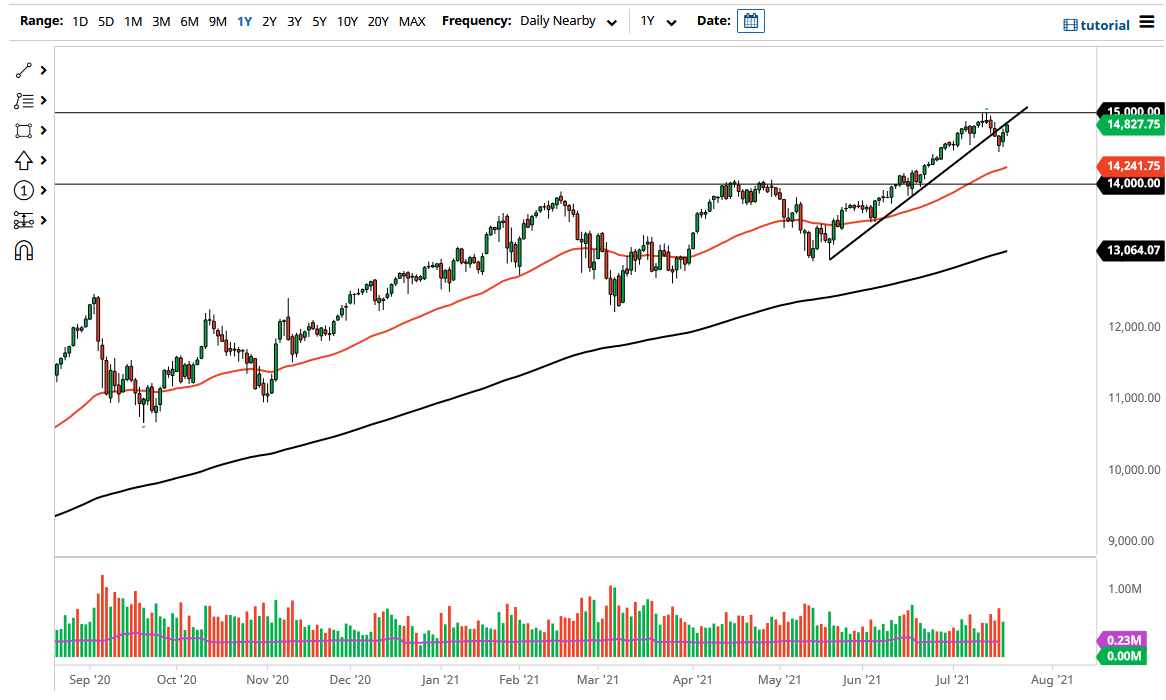

The NASDAQ 100 rallied during the trading session on Wednesday as we continue to see a lot of bullish pressure overall. That being said, we are testing the bottom of the previous uptrend line, so in theory we could see a little bit of resistance here. If that is going to be the case, then it is very likely that the market will continue to see the market pull back just a bit. It is possible that we could go into a bit of consolidation initially before trying to make the breakout, but the market is likely to continue hearing a lot of questions about almost everything when it comes to technology. The interest rate situation has seen rising interest rates over the last 24 hours, so that does tend to slow down the NASDAQ 100 overall.

If we break down below the lows of the candlestick for the trading session on Wednesday, then it is probably more likely than not that we may have to test the lows again. If we break down below the lows of the Monday candlestick, then we will probably go looking towards the 50-day EMA, if not the 14,000 level. Nonetheless, it is still not a market that you can sell, and if we break below the 14,000 level, I might be tempted to buy puts, but I would not be short of this market because, as you know, I do not short US indices as they are too heavily manipulated. It is only a handful of stocks that drive this market, and those are all the Wall Street darlings as per usual, so it is just easier to buy this market on dips or buy puts instead of risking getting your head handed to yourself.

If we can break above the 15,000 level, then it is likely that the NASDAQ 100 will go much higher, perhaps extending the overall gains towards the 15,250 level, but that is going to take some time to get to. Therefore, it is probably going to be more choppy behavior than anything else, with perhaps the occasional pullback coming into play and having its say as well. Keep your position size small and recognize that we are still very much in an uptrend regardless.