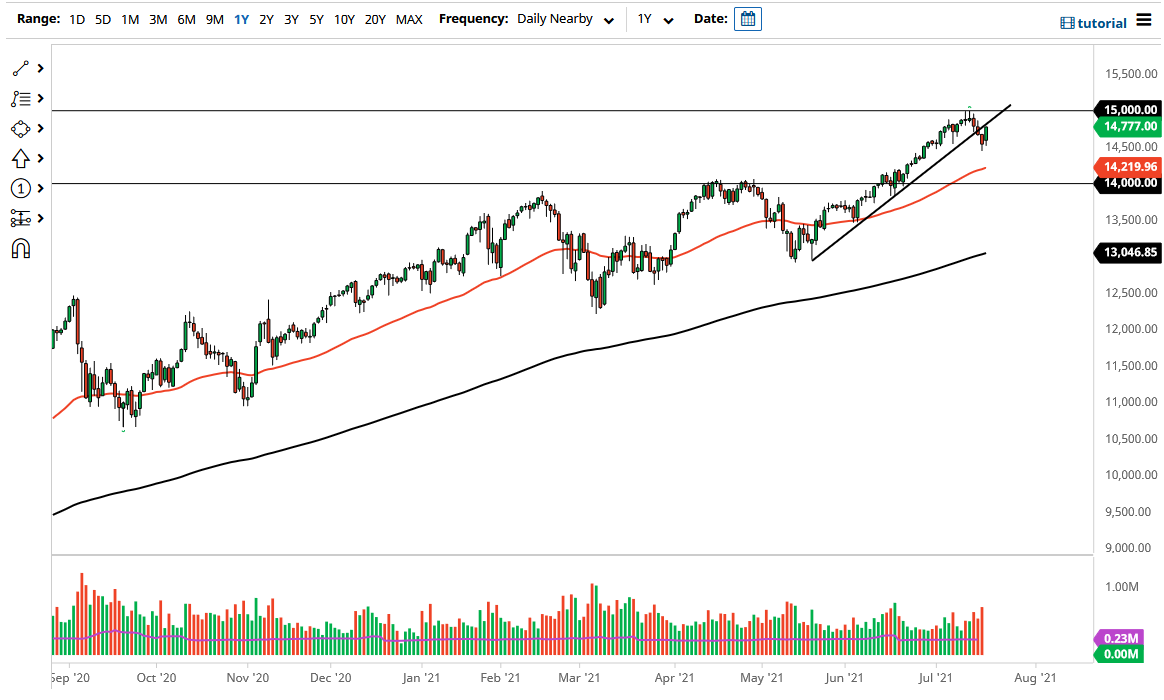

The NASDAQ 100 initially sold off after a gap higher on Tuesday, but then turned around to show signs of life again as we reached towards the 14,750 level. What is even more interesting is that it was where we had seen a previous uptrend line that was broken, so the question now is whether or not that resistance will hold. If it does, the market will more than likely will have to go lower to retest the 14,500 level. That is an area where I would anticipate seeing a bit of support, especially as the 50-day EMA is reaching towards that general vicinity. After that, we have a massive amount of support at the 14,000 handle, which was the scene of the original breakout.

Nonetheless, I think you can also start to look at the possibility of a bullish flag, so I do think that eventually the buyers will come back into the picture and pick this up, but the question is whether or not they can do it right away or if they need to get a little bit of value created before they get involved. A breakout above the 15,000 level would be an extraordinarily bullish sign as well, perhaps opening up the possibility of a longer-term rally. Regardless, I think this is a market that is almost impossible to short, but if we were to break down below the 14,000 level, then I might start considering buying puts, because this is a market that will almost certainly find one reason or another to go higher, even if the money flows into the bond markets to drive the rates down. This is mainly because when rates are low, people will use the technology sector as a way to buy growth when there are no rates to be found.

Regardless, these indices are not made to fall, because if they were, they would be equal weighted. They are not, and that means that you only need to pay attention to a handful of stocks that continue to move the market in general, such as Facebook, Tesla, Alphabet, and the other “Wall Street darlings.” With that being the case, it makes sense that we will simply grind higher over time and now it is only a matter of finding enough value to start picking up.