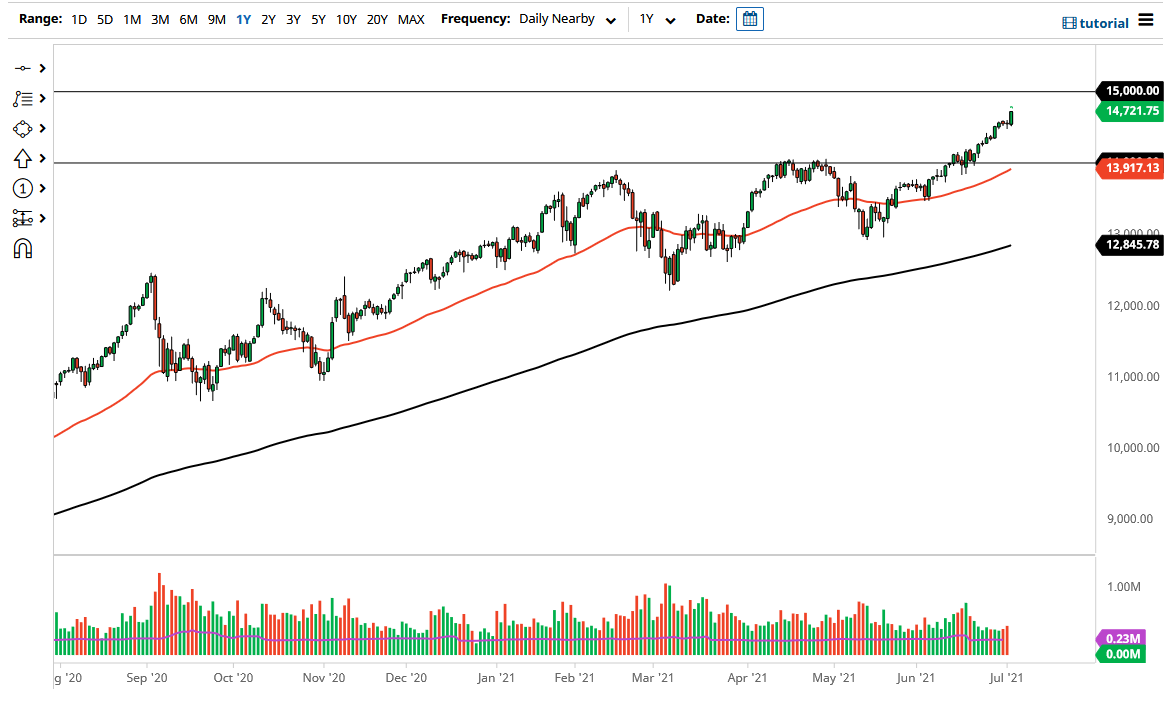

The NASDAQ 100 rallied rather significantly during the trading session on Friday to reach above the 14,700 level. Ultimately, this is a market that is in a major uptrend and is breaking out to the upside. When you look at the chart, it is obvious that we are in a very strong uptrend and that is not going to change any time soon. With that being the case, the market is likely to continue seeing buyers on dips, and I think that the “floor in the market” is closer to the 14,000 level. The 14,000 level is an area that was previous resistance, and it should now be support. Furthermore, the 50-day EMA is starting to cross that level, so I think it is only a matter of time before buyers would be interested, assuming that we even broke down to that area.

To the upside, the market looks as if it is going to go looking towards the 15,000 level, which is psychologically important, and a target based upon the measured move of the ascending triangle underneath that we had broken out of. I believe that the market will continue to see upward momentum, and if Friday is any sign, it is likely that we will continue to see plenty of buyers regardless of what happens next.

If we did somehow break down below the 14,000 level, it is very unlikely that the market would change for a bigger move, but if we do break down below there, I might be a buyer of puts, but I would not short this market due to the fact that the central banks around the world continue to flood the markets with liquidity, and the Federal Reserve is not going to be any different. With that, I believe that we are also paying close attention to the growth trade coming back into vogue, as the usual suspects continue to push the markets higher, such as Facebook, Alphabet, Microsoft and a few more. Remember, it is not an equally weighted index, but at the end of the day I think those stocks by themselves will continue to drive this market much higher. I think you need to look at pullbacks through the prism of value more than anything else.