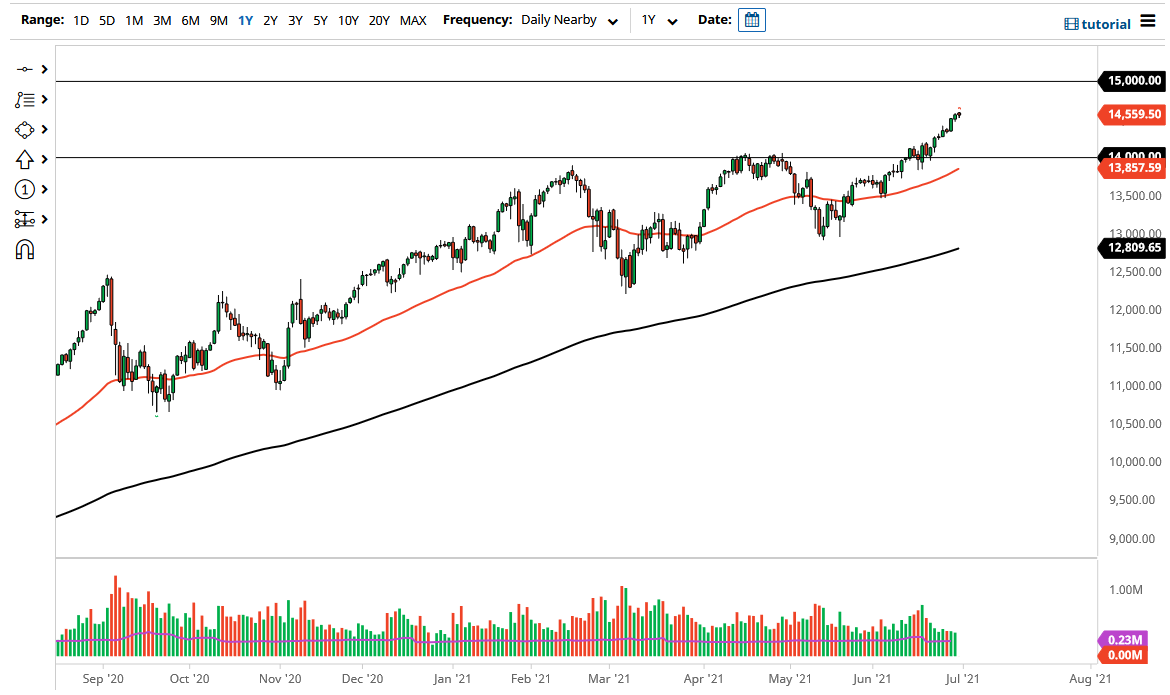

The NASDAQ 100 rallied ever so slightly during the session on Wednesday as we continue to reach ever so higher heading towards the jobs number. The jobs number comes out on Friday, and the Thursday session could be somewhat quiet heading into it, and perhaps we could even see a little bit of a pullback between now and then. The 14,500 level is an area of importance as well, as it is the “midway point” between the crucial 14,000 level and 15,000 level.

The market is most certainly favoring the handful of stocks that have been pushing it higher for quite some time, as the technology giants such as Facebook, Alphabet, Tesla, and the like continue to attract a massive amount of inflow. I do not think this will change, as it seems like the people are looking to get into growth stocks instead of value, as the Federal Reserve is seen as being stable and continuing to loosen monetary policy over the longer term. The market does not believe that the Federal Reserve can tighten anytime soon, and that is more likely than not going to show itself in the NASDAQ 100.

To the downside, I think that the 14,000 level should be a significant support level as it was previous resistance. Because of this, the market is likely to continue seeing a lot of upward pressure regardless, and any time there is a pullback I think there will be plenty of buyers involved to lift this market over the longer term. Whether or not we can break above the 15,000 level is a completely different question, but it is still possible that we will break above there. When you look at the chart, you can make an argument for an ascending triangle, that measures roughly 1000 points, so it all ties in quite nicely for a move to the 15,000 level.

If we get any type of pullback between now and the jobs number, and I think that is very possible, it is likely to find plenty of people that have missed the boat to get involved before that jobs report. After that jobs report, I fully anticipate that there will be a recovery in this market.