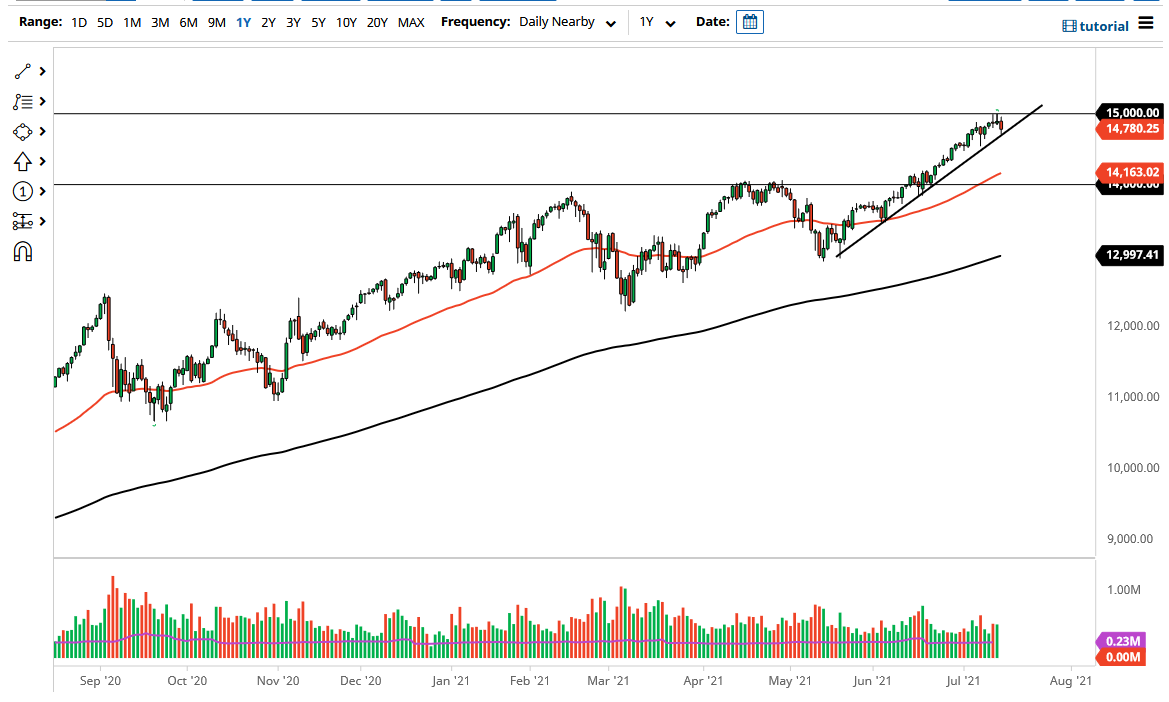

The NASDAQ 100 initially tried to rally again during the day on Thursday, but then pulled back significantly to break towards the uptrend line that I have drawn on the chart. The 15,000 level looks to be extraordinarily resistive, and the fact that we formed a couple of shooting stars on both Tuesday and Wednesday should tell you that this was very possible. At this point, if we break down below the trendline and then things could get a bit more interesting.

A breakdown below the uptrend line, it is very likely that the NASDAQ 100 would go looking towards the 14,500 level which has a little bit of previous support attached to it, and then very likely the 14,000 level underneath. The 14,000 level was where we broke out above previously, and therefore it is likely that we could probably see a little bit of built in support based upon the fact that it had been so resistive. Furthermore, you look at the ascending triangle that had formed underneath there, it measured for a 1000 point move, meaning that the market should go looking towards the 15,000 handle. We have fulfilled that, so now the next move is somewhat up in the air.

All things being equal, the market is very clearly bullish, and it should remain so unless something drastic changes. We started to see that a little bit during the trading session as a lot of money went flying into the bond markets. While low yields do help some of the large tech companies, the reality is it could also signal that people are starting to become more concerned about the economy in general. Nonetheless, this is a market that continues to be driven by a handful of stocks as per usual, so pay attention to all of the “Wall Street darlings” such as Facebook, Tesla, Microsoft, etc.

I have no interest in shorting this market, but if we did break down below the 14,000 level, I might be willing to start buying puts to take advantage of the negativity in the market. At this point, that does not look very likely to happen though, even though I do think we are about to get a bit of a pullback, which is probably good for the longer-term trend anyway.