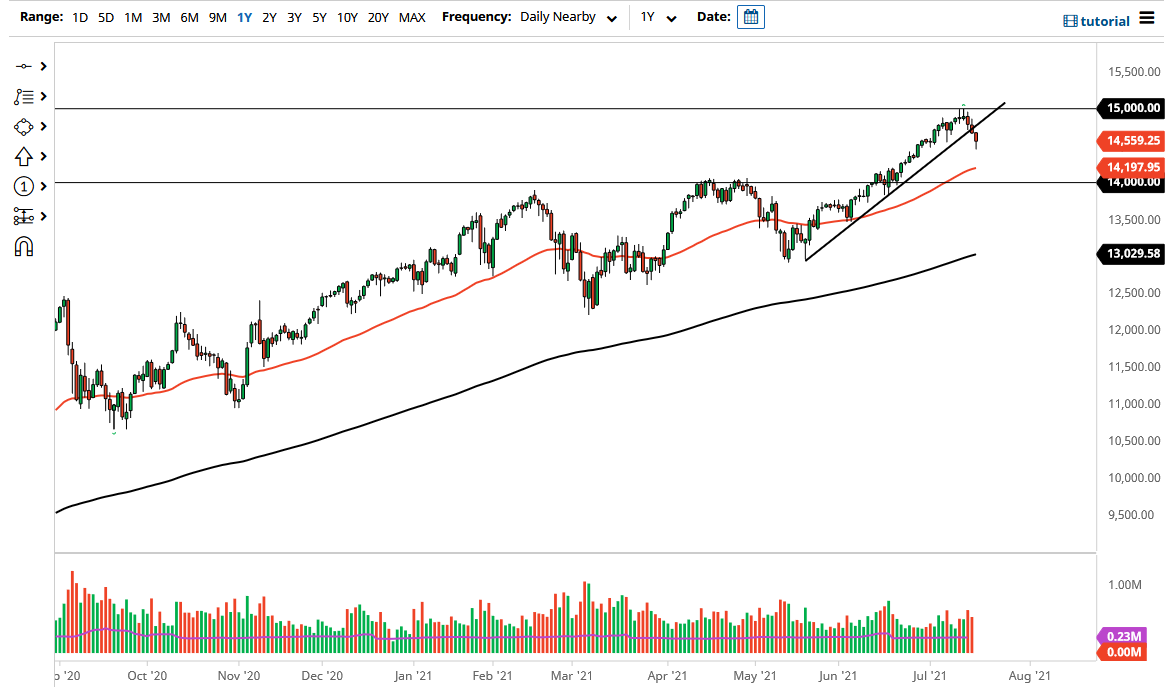

NASDAQ 100 traders woke up to a very negative move during the trading session on Monday, as the electronics session had seen selling almost immediately. As a result, the market has broken through a significant uptrend line, continuing the negativity that we had seen from last Friday. At this point, the market has broken below the 14,500 level, but also found a little bit of support underneath there to recapture it by the end of the day.

Looking at this chart, it looks as if the NASDAQ 100 is probably ready to continue drifting lower, perhaps reaching down towards the 50-day EMA. That would be a nice pullback to reach towards the recent breakout, which was closer to the 14,000 level. At this juncture, I think it is only a matter of time before the buyers return, but it might be something that we will see in a few days, not necessarily right away. There is nothing wrong with that, and in fact I think it is likely to be a scenario where we simply drift a little lower, and then eventually find our footing later on this week. This would not be a huge surprise, because we are starting to see the earnings season kick off as well.

The NASDAQ 100 will probably benefit more than anything else from the lower rates in the United States, as those high-growth technology stocks continue to be attractive for traders in general. Remember, the NASDAQ 100 is highly skewed towards a handful of companies, so there is no point in trying to think about it too much. It is going to depend on what Facebook, Microsoft, Tesla, and the like are all doing.

Given enough time, I do think that we will try to break above the 15,000 level, especially as the Federal Reserve is likely to continue to do everything they can to keep the market afloat, and one would think that it is only a matter of time before somebody says something to get involved. In general, this is a market that has been in an uptrend for ages, and I do not see that changing anytime soon. With this, I think that this pullback could continue, but in the end, I think it will end up being a bit of a buying opportunity.