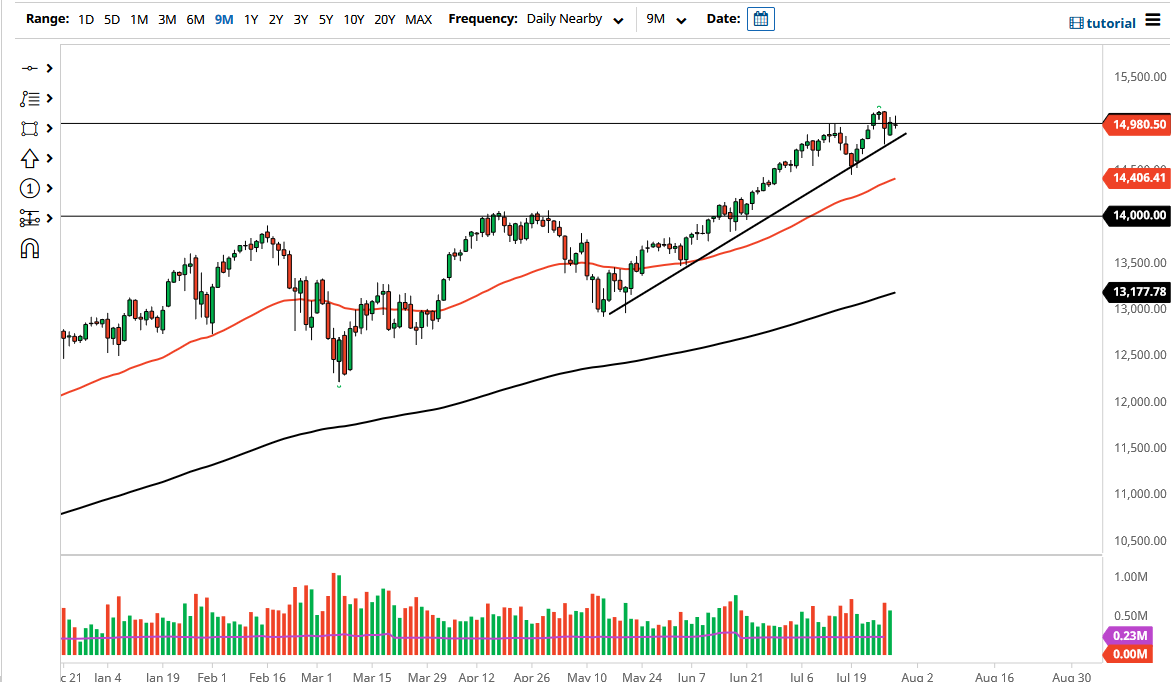

The NASDAQ 100 initially tried to rally during the trading session on Thursday, and was very strong almost immediately as soon as the Americans got on board trading the underlying index. However, we gave back those gains towards the end of the day, and the fact that Amazon missed its revenue expectations sent this thing much lower in a very short amount of time.

The resulting candlestick is a bit of a shooting star, and that does of course suggests that the market could continue to drop a bit. I do not necessarily think we break apart, but a retest of the previous uptrend line is most certainly possible. You should also keep in mind that we have been in an uptrend for a while, but that nasty candlestick from Tuesday is still something worth paying attention to. Was it the beginning of something bigger? I do not necessarily think this is a market that is going to melt down, but we may need to pullback in order to find a bit of value. Ultimately, this is a market that I think will continue to go higher over the longer term, but we probably need to get a certain amount of froth out of the market.

It is interesting that a lot of the “Wall Street darlings” have gotten hammered over the last couple of days, due to the fact that even though they have beat expectations, I think a lot of people are starting to take profit because now that we are reopening, a lot of the stay-at-home type of situation trade is getting hammered as well, so I think we may have to rebalance a little bit during the course of the next couple of days.

On the other, if we were to break out to fresh, new high then it is obvious that the market would go much higher, kicking off a continuation of the uptrend. At that point, I would anticipate that we would see the market go looking towards the 15,500 level, as the market does tend to move in 500 point increments, as it attracts a lot of options barrier. Ultimately, this is a market that I think sees a lot of volatility, but I think the buyers come back, if not for any other reason than value hunting.