The price of gold returned to the correction path upwards and settled around the resistance level of 1815 dollars an ounce at the time of writing. Investors reacted strongly to data showing an acceleration in consumer price inflation in the United States, and comments from a Federal Reserve official. Investors are also watching news regarding the spread of the delta type of coronavirus, and the possible return of new lockdown measures in many countries.

The strong rise in the dollar has limited the rally in gold. Where the dollar index advanced to the level of 92.77, and silver futures ended trading as low as 26.140 dollars an ounce, while copper futures settled at 4.3070 dollars per pound.

A report from the US Labor Department showed that consumer prices in the US experienced the largest monthly increase in thirteen years in June. The report stated that the Consumer Price Index jumped 0.9% in June after rising 0.6% in May. Economists had expected consumer prices to rise 0.5%. Core consumer prices rose 4.5% year-on-year in June, reflecting an acceleration from the 3.8% jump in May. Core prices experienced the largest annual increase since November 1991.

On the monetary policy front, New York Federal Reserve Chairman John Williams said the US economy has not made substantial further progress for the Fed to start reducing asset purchases. For his part, St. Louis Fed President James Bullard said in an interview with the Wall Street Journal that the US central bank should start cutting stimulus, but added that it should start immediately.

Investors also reacted to comments by San Francisco Fed President Mary Daly that strong gains in the US CPI are just temporary “pop” inflation that will not last, and the Fed must remain “steady in the boat” with its easy stance on monetary policy.

Federal Reserve Chairman Jerome Powell is scheduled to testify on the semi-annual monetary policy report before the House Financial Services Committee on Wednesday and before the Senate Banking Committee on Thursday. Confirmation indications of imminent tightening of the bank's policy will support the strength of the US dollar, which will be negative for the price of gold.

Los Angeles County is reporting the fifth consecutive day of more than 1,000 cases of the novel coronavirus. Health officials warned that the delta type of virus is the most contagious and continues to spread rapidly among unvaccinated people in the state. Los Angeles County is home to a quarter of California's 40 million residents. County officials reported 1,103 new cases in the past 24 hours. County officials said the five-day average for cases is 1,095 — a jump of more than 500% in just one month.

Meanwhile, the state has reported 3,256 confirmed cases of the novel coronavirus — the highest single-day total since early March.

Sydney officials have said that Australia's largest city will remain closed for at least five weeks due to the continuing spread of the Corona virus. New South Wales Premier Gladys Berejiklian said Wednesday that Sydney's 5 million residents will remain in confinement until at least July 30, two weeks longer than planned.

The extension comes after 97 new infections were reported on Wednesday in the last 24 hours, including 24 infected in the community. Berejiklian says the daily number of people infected while in the community should be close to zero before the lockdown ends.

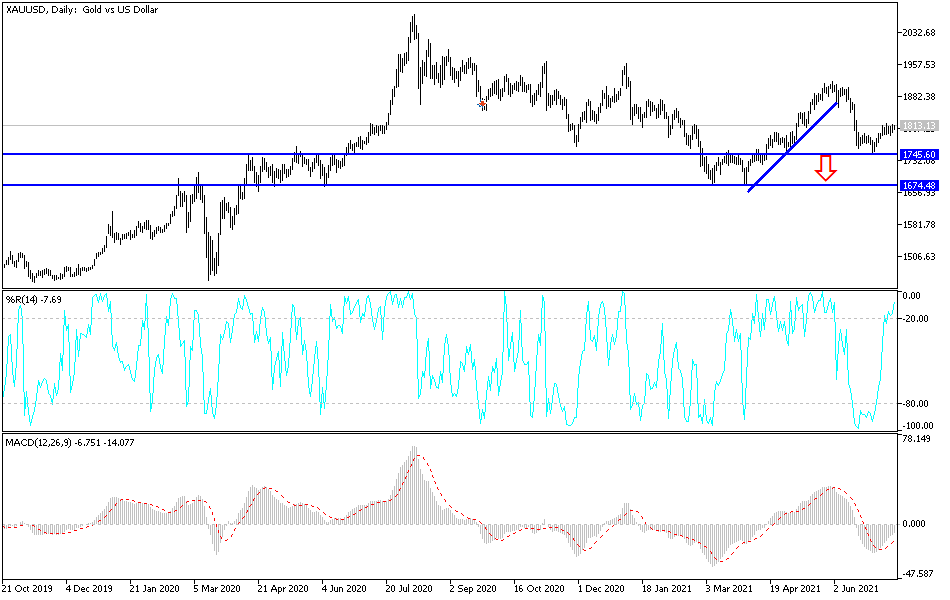

According to the technical analysis of gold: On the chart of the daily time frame, the stability of the price of an ounce of gold is still above the psychological resistance of 1800 dollars. This is motivating the bulls of the yellow metal to activate more buying deals, and thus the rush towards higher resistance levels and the closest to them are currently 1821, 1837 and 1855 dollars. These are important levels for the next strong move, the psychological top of 1900 dollars an ounce. On the other hand, the hopes of rising will evaporate if the price of gold moves below the support level of 1770 dollars an ounce. So far I still prefer buying gold from every bearish level. Global fears of the rapid spread of the Corona Delta variable, in addition to renewed skirmishes between the United States of America and China, will support gold as a safe haven.