Besides the dollar's level, US Treasury yields fell to 1.36%, while the dollar index fell to 92.37.

In his prepared remarks to the House Finance Committee, Federal Reserve Chairman Jerome Powell reiterated his belief that "more significant progress" toward the Fed's goals of maximum employment and price stability "remains a long way off," indicating that the US central bank is not likely to tighten monetary policy anytime soon.

The Fed chief reiterated that the US central bank will provide "advance notice" before announcing any changes to the asset purchase program. Powell acknowledged that inflation has risen significantly and is likely to remain high in the coming months, but he expected inflation to ease as the effects of production bottlenecks wear off.

Gold held steady around its gains after the central bank's beige book stated that the US economy "consolidated further". On the economic side, the US Labor Department said its producer price index for final demand rose 1% in June after jumping 0.8% in May. Economists had expected producer prices to rise 0.6%. The report also showed the annual rate of producer price growth accelerating to 7.3% in June from 6.6% in May, reaching the highest level since 12-month data was first calculated in November of 2010.

On the other hand, it affects the sentiment of investors and markets. Corona virus deaths and infections are again increasing globally in a frustrating setback that leads to another round of restrictions and undermines hopes for a return to normal life. In this regard, the World Health Organization said yesterday that deaths rose last week after nine consecutive weeks of decline. It recorded more than 55,000 people lost their lives, an increase of 3% from the previous week.

The World Health Organization also said cases rose 10% last week to nearly three million, with the highest numbers recorded in Brazil, India, Indonesia and Britain. The reversal is attributed to low vaccination rates, the relaxation of mask rules and other precautions, and the rapid spread of the most contagious delta variant, which the World Health Organization said has now been identified in 111 countries and is expected to become globally dominant in the coming months.

According to global figures, and amid an increase in the death toll in Argentina, the death toll has exceeded 100,000. Daily deaths from the Corona virus in Russia reached record levels this week. In Belgium, COVID-19 infections, driven by the delta type among young people, have nearly doubled over the past week. Britain recorded a total of more than 40,000 new cases in one day for the first time in six months. In the United States, with one of the highest vaccination rates in the world, newly confirmed infections have doubled daily over the past two weeks to an average of about 24,000, although deaths are still on a declining trajectory at about 260 per day.

Tokyo is under a fourth emergency before the Summer Games this month, with infections rising rapidly and hospital beds filling up. Experts said the number of cases could rise to more than 1,000 before the Olympics and double to thousands during the games. The surge in height has led to additional restrictions in places like Sydney, Australia, where 5 million residents will remain in lockdown until at least the end of July, two weeks longer than planned. South Korea has put the Seoul region under the toughest distance rules so far due to record levels of cases.

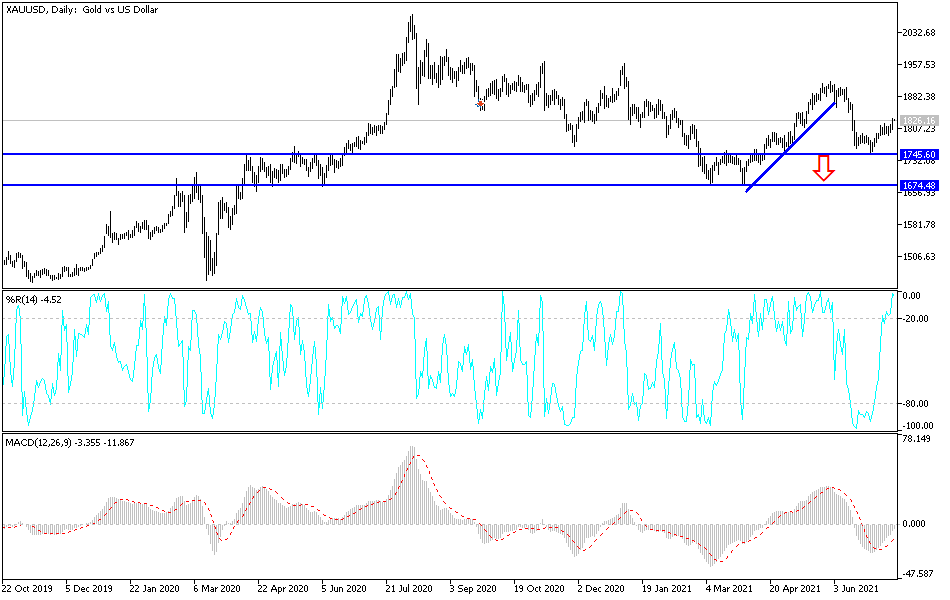

According to the technical analysis of gold: Gold is set to achieve strong gains in the event that things get out of control regarding the increase in injuries and deaths with the Corona Delta variable. This will increase investors’ flight from risk, and it is a good environment for the yellow metal to achieve more powerful gains. The nearest ones are currently 1838 and 1855 dollars, respectively. Most of the resistance levels identified in the recent technical analysis have been reached by gold. The stability of the metal above the psychological resistance 1800 dollars will continue to support the bulls. On the other hand, the bears will not control again without moving towards the support levels of 1798 and 1775 dollars, respectively. I still prefer buying gold from every bearish level.