For the sixth consecutive day, the price of an ounce of gold is recovering. This is despite the strength of the US dollar with gains to the level of 1815 dollars, and before the announcement of US Federal Reserve minutes. The price of gold fell to the support level of 1794 dollars per ounce before settling around the level of 1804 dollars per ounce in the beginning of trading today, Thursday. The price of the yellow metal rose as US bond yields continued to decline, reaching their lowest level in more than four months. The somewhat calm US dollar also contributed to the continued appreciation of the gold price. The price of gold surged to a nearly three-week high amid the longest winning streak since six consecutive sessions that ended on May 20. The price of gold has not finished at or above the psychologically important $1800 since June 16.

The price of gold has had a volatile year, with the sharp decline in June driven by rising Treasury yields, a strong dollar and bets that governments will begin to rein in pandemic stimulus. The economic risks lingering in weaker-than-expected numbers were highlighted for the US service sector.

Silver futures ended trading at $26.129 an ounce, while copper futures settled at $4.3225 a pound, and the benchmark 10-year US Treasury yield fell to a new low in more than two and a half months. Investors assessed the risks to growth caused by the COVID delta variable. The new virus is highly contagious in Asia, Latin America, and parts of Europe.

The minutes of the Fed's latest monetary policy meeting also indicated that the US central bank would not be in a hurry to start scaling back its asset purchase program. The Fed has repeatedly said that it plans to continue its asset purchases at a rate of at least $120 billion per month until "other significant progress" is made toward its goals of maximum employment and price stability.

The June meeting minutes echoed Fed Chair Jerome Powell's view that "additional substantive progress" had yet to be achieved, although participants expected continued progress.

The dollar, which usually goes inversely with gold, fell, but remained near a three-month high hit during the previous week. The benchmark 10-year US Treasury yields also fell to their lowest level in more than four months.

The head of the World Health Organization's emergency department called on governments to be "extremely vigilant" in fully lifting restrictions aimed at curbing the spread of COVID-19, warning that transmission will increase as countries open up.

Accordingly, Dr. Michael Ryan said, during a press conference of the World Health Organization to respond to Britain’s decision this week to ease restrictions despite the high number of cases, “every country at the moment is lifting restrictions in one way or another” in the hope of striking a balance between a return to normal life and the need to control the virus with increased vaccinations.

“Transmission will increase when it opens,” Ryan added, because not everyone is vaccinated and there is still doubt about how much vaccination reduces transmission. For her part, Maria Van Kerkhove, technical chief of the World Health Organization on COVID-19, says that several factors have driven the transmission of COVID-19: the behavior of the coronavirus and its variables; social mixing; reduced social measures; and the uneven and unequal distribution of coronavirus vaccines.

She also said: "The virus is now showing us that it is thriving." "This is not theoretical." Globally, there have been nearly 4 million confirmed deaths from the coronavirus.

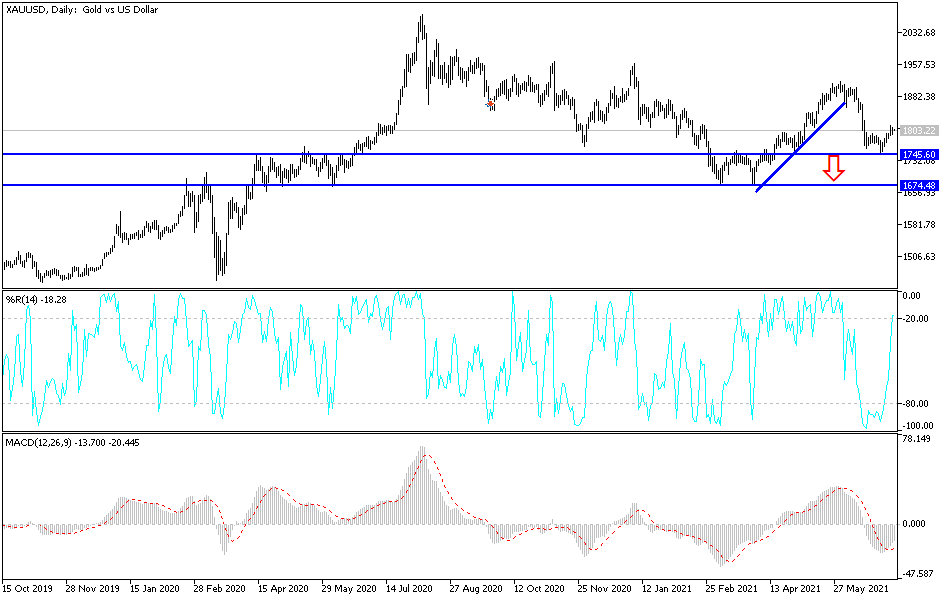

According to the technical analysis of gold: As I mentioned before, the stability of the gold price above the psychological resistance of 1800 dollars an ounce will support the upward movement and so far it needs more momentum to move towards higher resistance levels. The factors of its gains are increasing, especially the global fears of the outbreak of the Corona Delta variable and its threat to global plans to reopen the economy. Any decline in the price of gold may be an opportunity to buy again. The closest support levels for gold are currently 1786, 1772 and 1755, respectively. Increasing the expected momentum may push the price of gold to the levels of 1819, 1827 and 1845. I still prefer buying gold from every bearish level.

The gold price will be affected today by the level of the US dollar and the extent to which investors take risks or not, in addition to the announcement of the number of US weekly jobless claims.