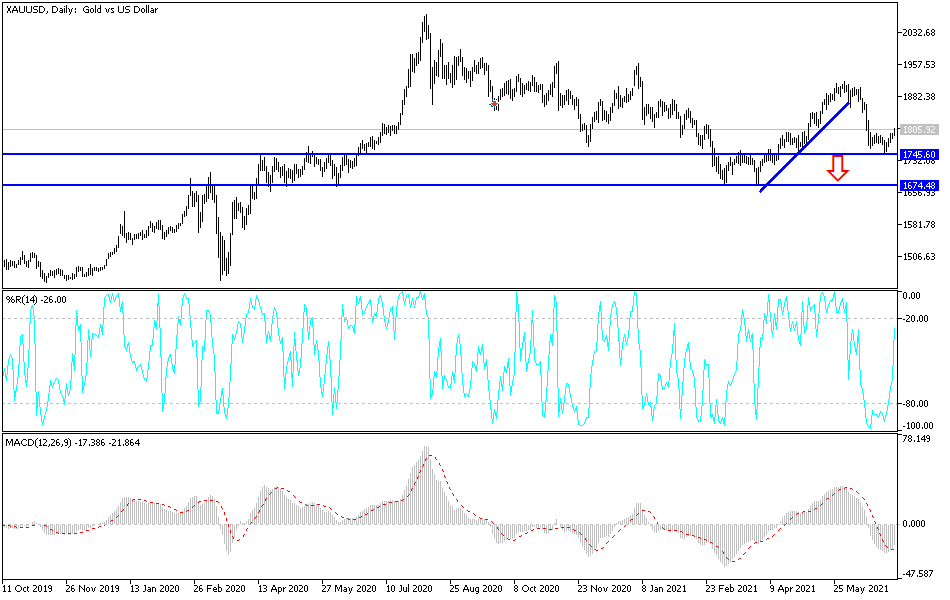

It reached the resistance level of 1806 dollars an ounce at the time of writing the analysis. Breaking the resistance of 1800 dollars is important for gold bulls at the present time because it may stimulate more buying transactions for gold.

In addition to the dollar's weakness, the yellow metal was supported by the decline in US Treasury yields. This is in addition to the renewed global fears of the Corona virus delta variable, which has become the talk of the world. The variable originates in India, which has suffered and is still suffering from the rapid and deadly spread of this variable, which threatens global plans to reopen the economy and thus negatively affects the course of the global economic recovery as a whole.

Currently, gold prices are heading to achieve a weekly gain of 0.7%, but it is still down by nearly 6% since the beginning of the year 2021 to date. Almost the same performance is silver, the sister commodity to gold, as it tries to reach the $ 27 mark. Silver futures rose to $26.57 an ounce. The white metal rose 1.4% last week, returning to positive territory for the year.

The trading session was relatively quiet on Monday due to the 4th of July holiday, with US financial markets closed. There are still some factors that gold investors are watching.

In general, the US dollar index (DXY), which measures the performance of the US currency against a basket of six major competing currencies, fell to 92.21, and the dollar comes from a weekly jump of 0.35%, in addition to its gains in 2021 by 2.5%. A stronger US currency gain is bad for dollar-priced commodities because it makes them more expensive to buy for foreign investors. There is an additional factor affecting the price of gold. The US bond market, which was mostly down, with the 10-year bond yield dropping to 1.431%. One-year bond yields fell to 0.068%, while 30-year yields fell to 2.045%. A weak yield is beneficial to the gold markets because it does not increase the opportunity cost of holding non-yielding bullion.

Meanwhile, within industry news, the world's largest gold-backed trading fund (ETF) SPDR Gold Trust, announced a decrease in its holdings: from 1,043.16 tons to 1,042.58 tons. Also, speculators reduced their net long positions in Comex gold while raising their long positions in silver, according to the US Commodity Futures Trading Commission (CFTC).

Relative to the prices of other metals, copper futures rose to $4.3445 a pound. Platinum futures were traded at $1,100.40 an ounce. Palladium futures jumped to $2,819.00 an ounce.

According to the technical analysis of gold: The breach of the gold price to the psychological peak of 1800 dollars an ounce will motivate the bulls to move the price of gold towards higher peaks and the closest to them are currently 1816, 1830 and 1845, respectively. Access to that depends on the level of the US dollar and the extent to which investors take risks or not, in addition to the increasing global fears of Corona’s variables. At the moment, the closest support levels for gold are 1793, 1780 and 1765 dollars.