The US dollar gave up some of its gains, giving the price of an ounce of gold the opportunity to correct upwards, and the price of gold settles around the level of 1813 dollars an ounce at the time of writing the analysis. Besides the dollar level, the uncertainty about the pace of the global economic recovery due to the spread of the delta variable of the coronavirus has limited the negative side of gold. Yesterday, the DXY dollar index rose to 92.42 before falling back and silver futures settled at $26,239 an ounce, while copper futures ended trading lower at $4.3160 a pound.

Investors are now looking to US inflation data, and Federal Reserve Chairman Jerome Powell's semi-annual testimony to Congress for more clues on the timeline for curtailing asset purchases by the US central bank.

On the COVID-19 front, finance ministers from the Group of 20 countries warned over the weekend that global economic growth is at risk from higher variants of the novel coronavirus and lower vaccine availability in developing countries. Amid global panic over virus variants, rich countries aspire to give a third dose of vaccines to boost immunity. In this regard, senior officials in the World Health Organization say that there is not enough evidence to prove that there is a need for third doses of Corona virus vaccines, and they called on Monday to share the surplus doses with poor countries that have not yet immunized their people instead of using them for reinforcement by rich countries.

At a press conference, the Director-General of the World Health Organization, Tedros Adhanom Ghebreyesus, said the hideous disparity in vaccines in the world was driven by "greed", as he called on drug makers to prioritize supplying poor countries with COVID-19 vaccines rather than pressure on rich countries to use More doses of vaccines. His appeal comes as drug companies are seeking permission for third doses to be used as boosters in some Western countries, including the United States.

After the global coronavirus death rate fell for 10 weeks, Tedros said the number of COVID-19 patients dying daily is starting to rise again and that the highly contagious delta variant is "driving catastrophic waves of cases."

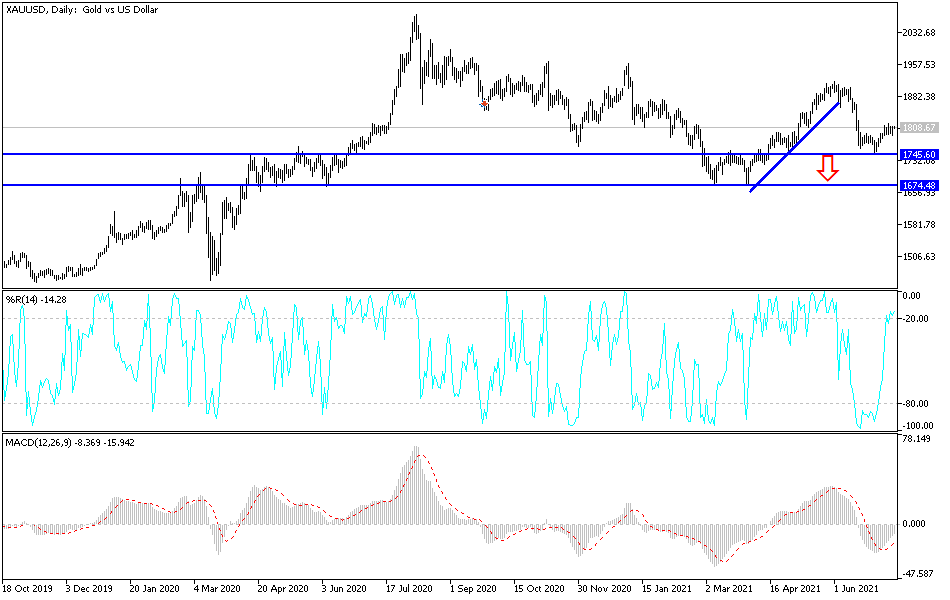

According to the technical analysis of gold: The stability of the gold price above the psychological resistance of 1800 dollars an ounce will be a catalyst for the gold bulls to move towards stronger ascending levels, and the closest ones are currently 1821, 1835 and 1852. After the last bounce, the technical indicators did not reach strong overbought levels, which gives gold the opportunity to rise in case the factors of its gains increase. The rebound gains may stop if the dollar returns to achieve its gains and increases expectations regarding the future of monetary policy tightening by global central banks. Other than that gold will remain supported I still prefer buying gold from every bearish level. The closest support levels for gold are currently 1796, 1785 and 1770, respectively.

The dollar and therefore gold will be affected today by the announcement of US inflation figures and the consumer price index.