For three trading sessions in a row, the price of gold returns to its highest level in a week, reaching the resistance level of 1795 dollars an ounce, after the weakness of the US dollar and the decline in the long-term US bond yields. Concerns about a surge in the delta variant of the coronavirus and travel restrictions in many countries have also contributed to increased demand for the safe-haven yellow metal. Investors reacted to data from the US Department of Labor which showed a larger-than-expected increase in non-farm payrolls in the US in June. With the start of trading this week, the price of an ounce of gold stabilized around the level of 1785 dollars.

The 10-year US Treasury yield fell to 1.43%. The US dollar index fell to 92.25, and in the same performance of gold, silver futures closed at $26.501 an ounce, while copper futures settled at $4.2760 a pound.

The US Department of Labor report showed a continued acceleration in the pace of US job growth in June. The report showed that non-farm payrolls rose by 850,000 in June after rising by an upwardly revised 583,000 in May. Economists had expected US employment to jump by about 700,000 jobs, compared to an addition of 559,000 jobs originally reported for the previous month.

Meanwhile, the Labor Department said the US unemployment rate unexpectedly rose to 5.9% in June from 5.8% in May. The unemployment rate was expected to fall to 5.7%.

A separate report from the Commerce Department showed that the US trade deficit widened roughly in line with estimates in May. With imports increasing more than exports, the department released a report showing the widening of the US trade deficit in May to $71.2 billion from $69.1 billion in April. Economists had expected the trade deficit to widen by $71.4 billion from $68.9 billion originally reported in the previous month.

The widest trade deficit came as the value of imports jumped 1.3 percent to $277.3 billion in May from $273.8 billion in April. The sharp increase in the import of industrial supplies and materials helped offset the marked decline in imports of capital goods such as computers. Meanwhile, the report showed that the value of exports rose 0.6 percent to $206.0 billion in May from $204.7 billion in April. Pharmaceutical exports saw a significant increase, but the jump was partly offset by a decline in exports of passenger cars and civil aircraft.

Commenting on the results, Kathy Bostancik, chief US financial economist at Oxford Economics said: “Strong domestic demand, buoyed by the wider reopening of the economy and significantly improved health conditions, underpinned another strong rise in imports. And demand for exports is less strong, which reflects weak foreign demand.” "The trade deficit is expected to remain wide as the fiscal-supported, consumer-driven recovery in the US precedes the global economic recovery," it added.

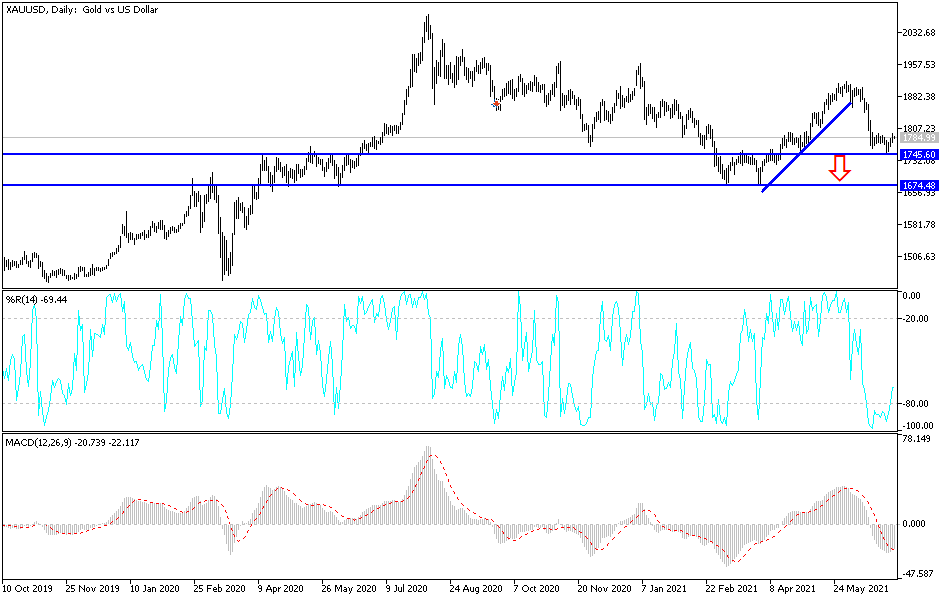

According to the technical analysis of gold: the recent gains did not exit the price of gold from its last descending channel, as shown on the chart of the daily time frame, and this will not happen without the gold price moving towards the resistance levels of 1815 and 1832 dollars again. On the other hand, the closest targets for the bears are currently if the strength of the US dollar continues at 1777, 1762 and 1745 dollars, respectively. All in all, I still prefer buying gold from every bearish level. There are factors that help the yellow metal to achieve strong gains, and the opportunity may be stronger if the gains of the US dollar stop. Corona’s variables threaten the openness of the global economy and threaten to stop global central banks from indicating the imminent tightening of monetary policy.