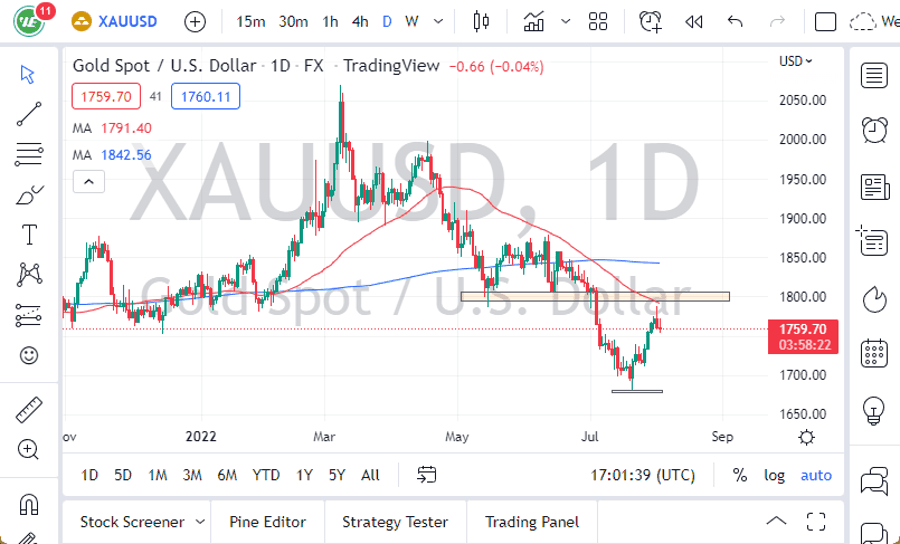

The gold markets fell significantly during the course of the trading session on Thursday to reach towards the same support level that we had seen during multiple sessions before. At this point, the market looks as if it is trying to respect the $1790 level before bouncing and forming a bit of a hammer. The market is also sitting at the 200 day EMA which is flat, and therefore it suggests that we are simply going to go sideways for a while.

To the upside, it is obvious that the $1825 level is massive resistance, and if we can break above that level, it is likely that we could go looking towards the top of the gap that has yet to be filled, meaning that the market could go looking towards the $1860 level. Obviously, there is a lot of negative correlation between the gold market in the US dollar, also something that you should be paying close attention to. With that in mind, take notice of the US Dollar Index, which is one of the main drivers of this market right along with that 10 year yield.

If we were to break down below the support level, then it is likely that we go looking towards the $1750 level, which was an area that had a lot of significant resistance previously, so market memory comes into play, and it certainly makes a nice target. The market will likely continue to see a lot of noisy behavior, but we could get down there that area. A break down below that level will open up a move down to the $1680 level, where we had previously formed a double bottom.

If we do break above the top of the gap above, it is likely that this market goes looking towards the $1910 level, opening up the possibility of a move towards the $2100 level. Better to be cautious with this market, but if you are a short-term trader, you may look at the gray box on the chart as a potential trading range to be involved with. Lastly, it comes down to the time frame that you choose to use.