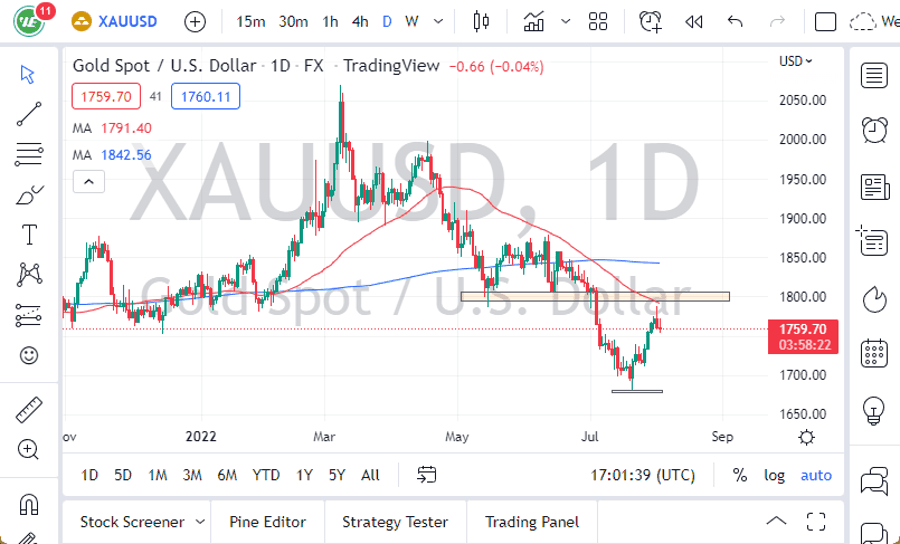

The gold markets fell rather hard during the trading session on Friday as money continues to flow into the bond market in America. As that happens, it demands US dollars, and those US dollars have risen in value. This continues the overall negative correlation that we typically see between gold and the US dollar, and as a result, we ended up crashing into the 200-day EMA.

Just below, the $1800 level is an area that offers support as well, not only due to the psychological importance of it, but the fact that we have seen a bit of structural support there recently. If we break down below that level, then it is likely that we could go looking towards the $1750 level, an area that has been rather significantly supportive recently, and had been significant resistance before. Breaking through that level opens up the possibility of going down towards the double bottom which sits at the $1680 level. I do not know that we will get there easily, but that certainly would be the bearish case scenario. Breaking below that level opens up a massive move lower, perhaps down towards the $1500 level.

On the bullish side, if we can take out all of the selling pressure from the Friday session and recapture those losses, then it is likely that we could go looking towards the $1860 level, which is the top of the gap that you see on the chart. If we break above there, then it is likely that the market will go looking towards the $1910 level, an area where we had seen a bit of resistance previously. Breaking above that level, it is likely that the market could go looking towards the $2100 level over the longer term, but it would almost certainly have to coincide with the US dollar falling in strength, something that does not look very likely to happen based upon the most recent price action. In fact, the US Dollar Index has a major downtrend line sitting just above and is being pressed by the buying pressure that we have seen. At this point, it looks as if it is only a matter of time before we finally break through all of that resistance; but if that trendline holds, then the US dollar starts drifting lower, which would be bullish for gold.