The report provided enough contradictions to calm expectations of US interest rate hikes. Accordingly, the price of the GBP/USD currency pair rebounded to the level of 1.3844, after strong losses that pushed it recently towards the 1.3731 support level, the lowest in more than two and a half months. The pair stabilized at the beginning of this week’s trading around the 1.3835 level. The pair gained some momentum after official results showed an increase in new US job numbers in the non-agricultural sector at the same time, the unemployment rate in the country rose, which made investors confused in dealing with the reaction to the announced numbers .

The market reaction has been largely muted on the longer time frames, but the shorter time frame shows that the dollar has been sold off, allowing GBP/USD to recover. According to the BLS report, 850,000 non-farm jobs were created in June versus the 700,000 jobs the market had expected and up from the 559 thousand created in May. However, this blow was somewhat overshadowed by a rise in the unemployment rate to 5.9%, a disappointment for a market that had been expecting a decline in the unemployment rate to 5.7% from 5.8% in May.

Commenting on the reaction to the pair, Viraj Patel, strategist at Vanda Research said: “The muted reaction in the FX markets suggests that this NFP win has been priced in. I think the high unemployment rate will mask the positive job gains.” "But on a large scale, we may get some profit-taking from long US dollar deals," he added.

The largest contributor to the increase in US jobs came from those sectors that continued to open thanks to the decline in the Corona virus, as the entertainment and hospitality sector added 343,000 jobs while the retail sector added 67 thousand. Simon Harvey, Senior FX Market Analyst at Monex Europe says, “In nominal terms, the upside surprise to the net employment data for June and the higher revision in the employment data for May are positive for the US labor market. Given these developments, one would expect the dollar to rise as the US economy adds jobs at a faster rate. However, the higher net employment data did not translate into a faster recovery in the labor market - which is necessary under the Fed's criteria for policy normalization."

In general, investors will understand the jobs report in the context of what it means for Fed policy; Does it delay the timing of the first rate hike or push it back?... The general rule is when that rate comes in thanks to strong data that appreciates the dollar, and vice versa in weaker data.

On the other hand, it will affect the performance of the GBP/USD pair: British Prime Minister Boris Johnson will provide an update on Monday on plans to ease COVID-19 restrictions in England, amid speculation that he will scrap rules requiring people to wear masks in many public places. Johnson is scheduled to hold a news conference on the government's current expectations for "Freedom Day" - the plan to end the remaining coronavirus restrictions on business and social interactions on July 19. The final decision will be announced on July 12 based on a series of tests, including vaccination rates and the risks posed by new viral variants.

The British government, which has imposed one of the world's longest closures, has lifted the restrictions in a series of steps that began with the reopening of schools in March. The fourth and final phase was postponed last month to make time for more people to be vaccinated amid fears of the rapid spread of the delta variant, which was first detected in India.

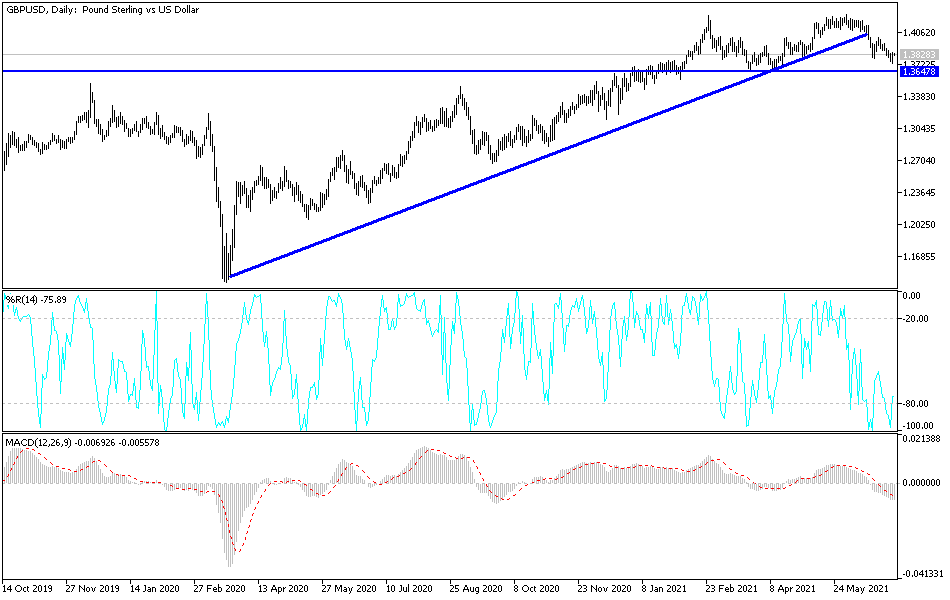

According to the technical analysis of the pair: On the chart of the daily time frame, the price of the GBP/USD currency pair is still in the process of breaking the general trend to the downside. Some technical indicators have not yet reached oversold levels, which may allow some decline. There will be no chance of a correction higher without breaching the 1.4000 psychological resistance again. At the moment, the most appropriate buying levels for the pair are 1.3765, 1.3680 and 1.3600, respectively. The sterling will be affected today by the announcement of the British Services PMI reading.