The day of British freedom from Corona restrictions was the day of sharp losses for the pound sterling against the rest of the other major currencies. The downward pressure for the GBP/USD currency pair continued to the 1.3571 support level, its lowest in more than five months, before settling around the 1.3600 level at the time of writing the analysis.

The pound has been on a steady pullback from the dollar's rally since early June, although sterling didn't help start the week when two members of the Bank of England (BoE) Monetary Policy Committee (BoE) positioned themselves at speaking last week at the other end of the spectrum. Both members Jonathan Haskell and Incoming Katherine Mann have used rhetoric posts to effectively pour cold water on suggestions that the bank should "tighten" its policy settings anytime soon, after two other members of the nine-seat rate-setting committee aired opposing views last week. .

The dollar had previously risen due to the stronger recovery in the United States and its potential implications for Federal Reserve policy (Fed), although the advance against the British pound came amid increased investor focus on the continued spread of the Corona virus and its many variables. The coronavirus is still rampant including in places where the population is being vaccinated, and has been widely cited due to recent losses in stock markets, which have boosted demand for dollars and funding currencies such as the Japanese yen, Swiss franc and euro.

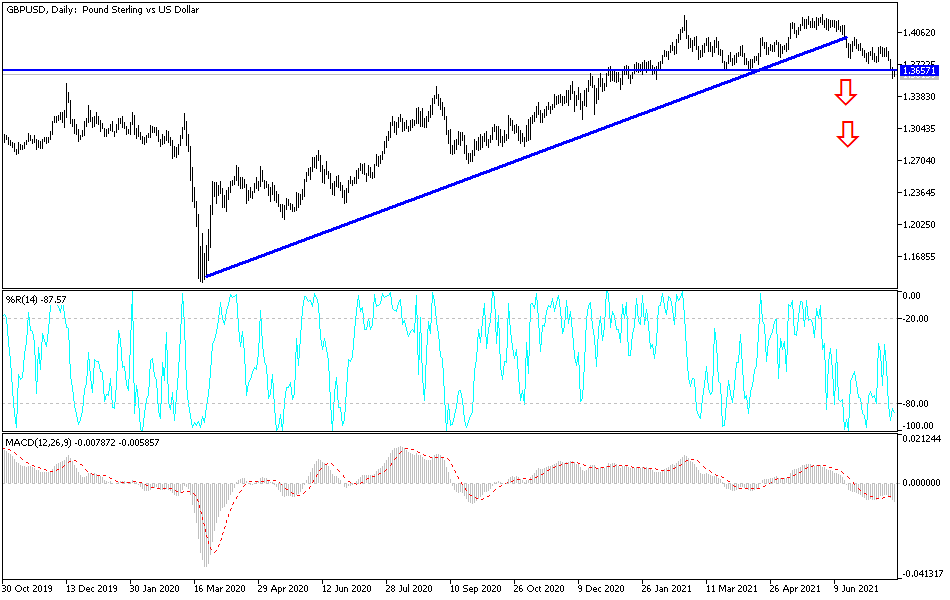

Commenting on the performance of the sterling dollar currency pair: “While we expect new buyers here, we continue to see the US dollar itself on its way to forming an important base,” says David Sneddon, Head of Technical Analysis at Credit Suisse. If confirmed, it will likely see a break below 1.3648 to signal a major top and a change in trend to the downside. Also, says Karen Jones, Head of Technical Analysis for Currency, Commodities and Bonds at Commerzbank: “Failure at 1.3640 would target 1.3504/1.3457, the 55-week moving average, and a 50% retracement of the higher move from September 2020.” She added, “The US dollar index is still buying and the focus is on the most important 93.44 in March 2021 and 93.56 Fibonacci. This protects the 94.80 200 moving average.

The UK was recently put on the US State Department's 'do not travel' list as members of the government including the Prime Minister were quarantined after twice-vaccinated Health Minister Sajid Javid was found to have contracted the virus. Meanwhile, a government consultant said that 60% of those who were recently hospitalized were those who had never received a vaccination. It also means that nearly half of those who need medical treatment have had at least one out of two vaccinations.

According to the technical analysis of the pair: Despite the oversold signs from some technical indicators, the pressure factors on the GBP/USD currency pair push it to stronger bearish breaches, and the closest to them is currently 1.3525 and 1.3440, as is the performance on the daily chart. On the upside, despite moving away from it, the psychological resistance 1.4000 will remain the most important for the bulls to regain control of performance again, otherwise the trend will remain bearish. In light of the current situation and the continuation of pressure factors, the gains of the sterling dollar pair will remain a target for selling again.