This was a rebound from the 1.3742 support level that the pair recorded, between renewed fears of the rapid spread of the Corona Delta variable, and increasing expectations of an imminent date for raising US interest rates.

Recently, the FOMC meeting minutes spurred the safe-haven dollar's rally, as the US monetary policy meeting minutes revealed that more committee members are inclined to scale back stimulus soon.

Last month's Fed announcement actually sparked a similar reaction, although the dollar's gains were reversed when Governor Powell downplayed inflation threats. Disappointing US jobs data also capped the dollar's gains. Overall, the upbeat sentiment in the minutes indicates that the US central bank could get closer to tightening monetary policy by raising interest rates sooner rather than later, which would be bullish for the US currency.

Britain has seen the number of daily COVID-19 infections rise to a nearly six-month high as the coronavirus spreads among younger age groups. Government figures on Friday showed another 35,707 confirmed cases, the highest daily toll since Jan. 22 with more than 40,000 cases reported. The recent rise in cases was due to the more contagious delta variant and occurred mostly among young adults, many of whom had not yet received the first dose of the vaccine.

With all remaining restrictions on social contact lifted in England on July 19, cases are expected to continue to rise. The British government said the daily case rate could reach 100,000 this summer, a new high. There is mounting evidence that the number of people who need to be hospitalized and die from the novel coronavirus is increasing, albeit not at the same rate of infection.

The British economy grew by 24.6% in the year ending in May, an impressive key figure due to the economic meltdown the previous year, but nonetheless less resilient than the 25.9% that the market had expected. Economists say the disappointment could be traced back to the rise in Covid-19 cases in the country. In the month of May, UK growth came in at 0.8%, nearly half of the 1.5% forecast. The three-month average GDP growth in May was 3.6%, lower than the 3.9% the market had been expecting.

All the data delivered by the Office for National Statistics on Friday was disappointing, confirming that the recovery in economic growth in the UK is starting to disappoint against expectations. For the forex markets, this is likely to be important as currencies are traded in a system that increasingly focuses on economic growth differentials and central bank monetary policy. Economists who track weekly data releases have noted a clear slowdown in growth rates in recent weeks due to a rise in Covid-19 cases in the UK.

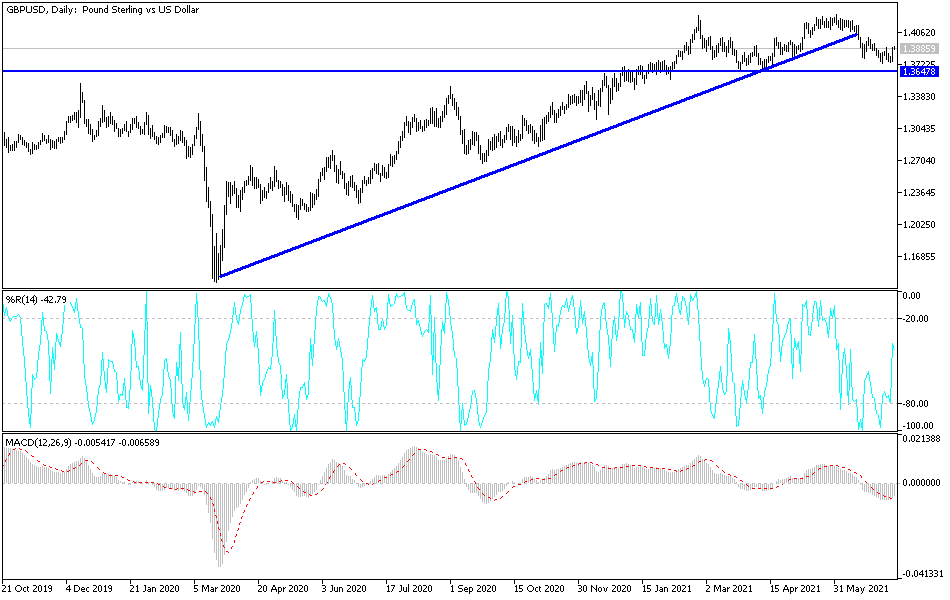

According to the technical analysis of the pair: GBP/USD may be reversing from its long-term bullish trend, as the price forms a double top on the daily time frame. A move below the neckline around 1.3800 could confirm that selling is imminent. The chart pattern extends about 400 pips high, so the resulting dip could be at least the same high, bringing the GBPUSD down to 1.3400 from here.

Currently the 100 SMA remains above the 200 SMA to confirm that the uptrend may resume, but the pair has already fallen below the 100 SMA, a dynamic inflection point as an early indication of downward pressure. A move below the 200 SMA could add confirmation that the bears are in control. However, the stochastic indicates oversold or exhausted levels among the bears. A return to the upside means buyers are back and could push GBP/USD to another high at 1.4200. The RSI is also hovering around an oversold area to indicate that the downtrend is exhausted.