The British government's determination to celebrate Freedom Day, July 19, despite threats of an increase in injuries in the country, causes a cautious stability of the pound sterling against the rest of the other major currencies. The GBP/USD pair will continue to move in narrow ranges until the full UK restrictions imposed by the COVID-19 epidemic are abandoned. Since the start of trading this week, the pair has been stable between the resistance level of 1.3910 and the support level of 1.3800, and it is settling around the level of 1.3860 at the time of writing the analysis, before the announcement of job and wage numbers in Britain.

The British pound moved positively in the forex market after it was reported that UK consumer inflation accelerated more than expected in June, exceeding the Bank of England's inflation target for the second month in a row. Data from the Office for National Statistics showed that inflation in the country rose to 2.5 percent in June from 2.1 percent in May. The rate was expected to rise to 2.2%. The rate was the highest since August 2018.

The annual growth was largely driven by the prices of food, used cars, clothing and footwear. On a monthly basis, consumer prices rose 0.5 percent after rising 0.6 percent in May. The expected rate was 0.2 percent. Core inflation, which does not include energy, food, alcoholic beverages and tobacco, rose to 2.3 percent in June from 2 percent in May.

This optimism is met with disappointment from the increasing British infections with the pandemic again. Daily COVID-19 cases in Britain rose to more than 40,000 for the first time in nearly six months. Government figures showed another 42,302 infections, the highest daily number since January 15 when the country was in strict lockdown in the wake of the deadly second wave of the pandemic.

Cases are expected to rise further, with the government warning that an unprecedented 100,000 daily infections could occur this summer.

The sharp rise in cases in recent weeks from the more contagious delta variant has raised concerns about the upcoming easing of restrictions on Monday in England, which will remove legal restrictions on social contact and the wearing of masks. London Mayor Sadiq Khan wants to wear the required masks on London's transport network.

Other transport authorities across England, healthcare providers, care homes and some retailers are expected to maintain mask-wearing requirements.

Under the precautionary measures. The British government made changes starting at 4am on Monday so that travelers from Croatia, Bulgaria, Hong Kong, and Taiwan will no longer have to self-isolate upon arrival in the UK. However, the updated travel lists will have little impact on many people as they coincide with a previously announced relaxation of quarantine rules. Under the new rules, adults who have been fully vaccinated, as well as British residents under the age of 18, will not have to self-isolate upon return from countries on the Amber List, allowing travel to the United States, the European Union, and many other countries around the world.

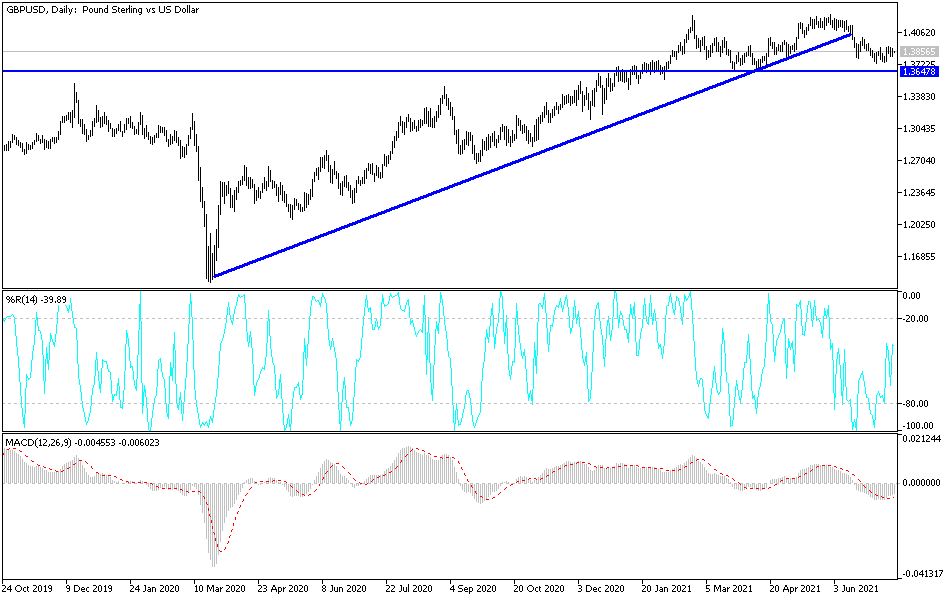

According to the technical analysis of the pair: The GBP/USD approaching the resistance level of 1.3900 still supports the bullish outlook for the pair temporarily, and I still see that this needs more momentum to avoid the bearish move that dominates the performance of the currency pair since the middle of last month . Breaking the resistance 1.4100 will end the current bearish outlook. The bears are determined to break the most important 1.3730 support level on the daily time frame, from which the technical indicators are moving to strong oversold levels.

The sterling will be affected today by the announcement of jobs and wages figures in Britain. From the United States of America, the weekly jobless claims will be announced, the Philadelphia Industrial Index reading, and the second testimony of Federal Reserve Governor Jerome Powell.