The announcement coincided with the country’s officials being injured by the delta variable, led by British Prime Minister Johnson.

Therefore, it was normal for the GBP/USD currency pair to complete its descending path to the support level of 1.3656, the lowest in five months. It settled around the 1.3670 level in the beginning of trading today, Tuesday. He waits whether the collapse will complete, or forex investors think of seizing the opportunity to buy.

Sterling fell below 1.38 in the final hours of trading before the weekend as Thursday's boost from the Bank of England (BoE) comment faded. This opened the question of whether the lows are progressing while some analysts and investors are feeling Concerned about the increase in coronavirus infections worldwide. and potential effects of mutating variants of the epidemic.

Commenting on the performance, Athanasios Vamvakidis, FX Analyst at BofA Global Research said, “Forex FX markets are still volatile, with a flavor of risk aversion, but we are not too concerned at the moment. Our flows do not reflect panic, as hedge funds are cutting some of their long positions in emerging markets, really adding real money to EURUSD longs, and generally light trading.”

The analyst added, “The start of the Fed's policy normalization, with the announcement of a quantitative easing cutback, by the end of the year is almost a final deal in our view; The pace and timing of increases will depend on inflation. Powell's testimony in Congress was pessimistic last week, but that was because he had to defend the Fed's monetary policy that remains very loose."

Vamvakidis and the Bank of America team have stood steadfastly behind bullish dollar expectations throughout 2021. In the weeks after early June, the market has swung in their direction, implying a gradual decline of GBP/USD to 1.35 by the end of September if the recent trend continues.

Recently, the pound against the dollar failed in the latest of several enthusiastic efforts last week to regain the 1.39 level, which may have now taken on the role of resistance level, the danger now is that the pound is struggling to hold on to 1.38 so far. "It's almost completely correlated with the movement of the US dollar," says Stephen Gallo, analyst at BMO Capital Markets.

The analyst added, “The GBPUSD exchange rate is far from building expectations in the financial markets for some form of BoE policy normalization. Assuming late 2022/early 2023 parts of the sterling OIS curve remain roughly the same, we expect GBPUSD to face support below 1.3800 in the near term.”

All in all, the sterling price has been on a downtrend since early June when it pulled lower from three-year highs around 1.4250 and may now be on the way to retest early April lows around 1.37 if the US dollar advance continues this week, which is not expected Important US economic figures.

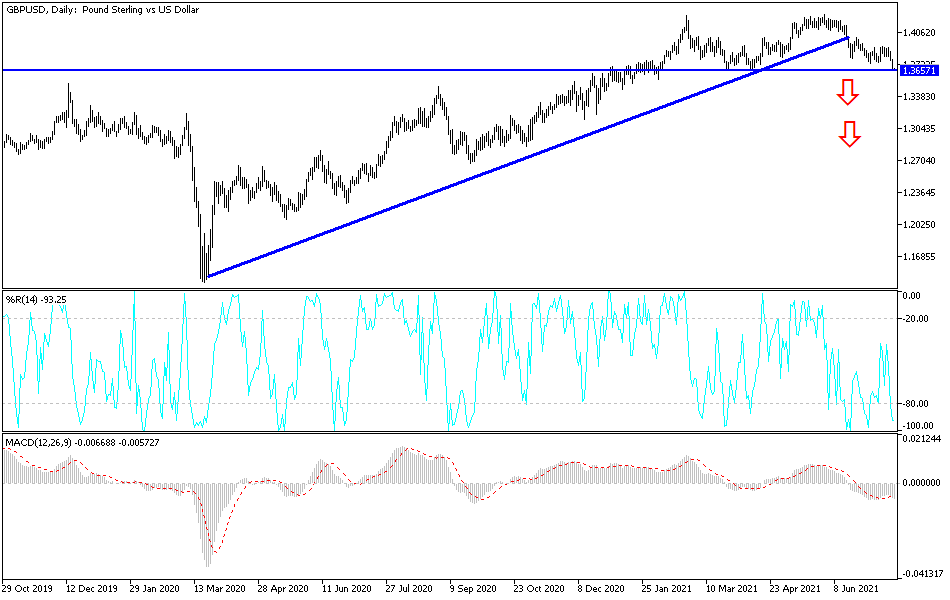

According to the technical analysis of the pair: The recent losses prompted the oversold levels of the technical indicators for the performance of the GBP/USD currency pair, as shown in the daily chart below. The continuation of the dollar's strength may push the pair to the next most important support levels 1.3600 and 1.3510, which I think is the most appropriate to think about buying the currency pair to wait for the expected rebound moment. On the upside, the resistance is still 1.4065 on the same time period, the most important for the bulls to control performance again. The sterling is not awaiting any important British data, and only from the United States of America will be the announcement of building permits and housing starts.