The rebound gains reached the 1.3787 resistance level, and is settling around the 1.3748 level at the beginning of this trading. The case of risk appetite with some weak US data contributed to the gains for the currency pair. Sterling's gains were halted after the improvement in British retail sales numbers were offset by weakness in IHS Markit PMI numbers for June and July.

On the economic side, the UK Manufacturing PMI for the month of July fell to a reading of 60.4 and was expected to come to a reading of 62.5. The Services PMI came in below expectations of 62 with a reading of 57.8 and the Gfk Consumer Confidence Index for July beat expectations of -8 with a reading of -7. On the other hand, UK retail sales for the month of June outperformed expectations.

“The drop in the composite PMI is not as worrisome as it sounds, with the biggest gains already being made after the easing of restrictions,” says Kieran Tomkins, chief economist at Capital Economics. But comments in the economic statement that growth is slowing from self-isolation means that the resurgence of the virus has become an increased downside risk to our forecasts for GDP to return to its February 2020 level in October.”

Overall, lower-than-expected IHS Markit surveys released on Friday for July warned that Britain's economic momentum could slow further in the coming months. This is in part due to large numbers of workers calling for their dismissal through the government's testing and tracing program, which is about the outbreak of the outbreak of the newly infected cases of the Corona virus within one of the most immunization schemes in the world.

From the US, the preliminary Markit manufacturing PMI for July exceeded expectations at 62 with a reading of 63.1, while the services sector PMI missed expectations of 64.8 with a reading of 59.8. In the same week, initial jobless claims came in the US on July 16th, below expectations at 350K, with 419K claims, and continuing claims came in higher than expected, reaching 3.236 million versus expectations of 3.1 million. June building permits also missed expectations while new homes outperformed.

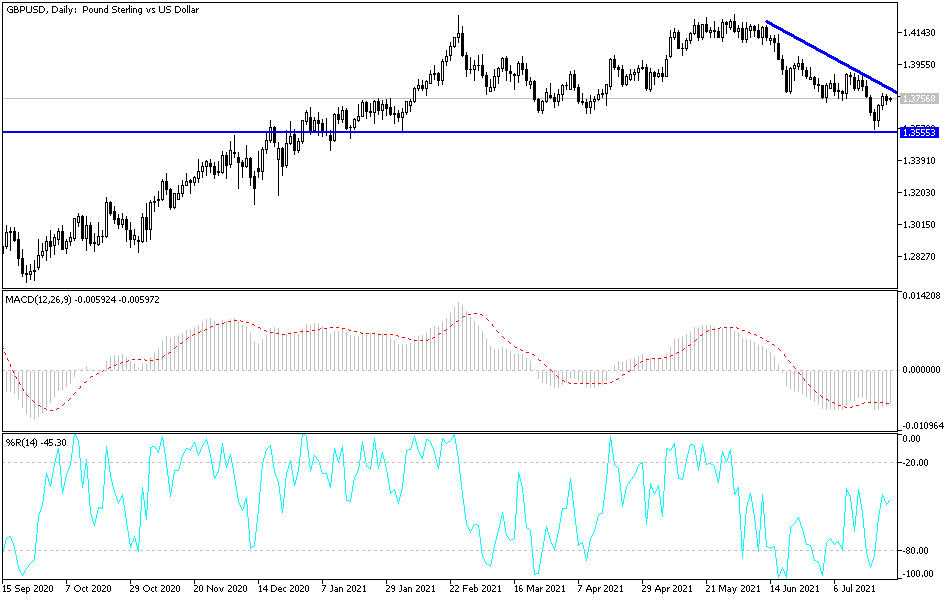

According to the technical analysis of the pair: In the near term and according to the performance of the hourly chart, it appears that the GBP/USD is trading within the formation of a descending channel. The pair retreated last Friday to avoid reaching overbought areas after Thursday's rally. Accordingly, the bulls will look to extend the current uptrend towards 1.3814 or higher to 1.3884. On the other hand, the bears will target profits of the decline around the 1.3669 support or lower at the 1.3596 support.

In the long run and according to the performance on the daily chart, it appears that the GBP/USD currency pair has pulled back recently after a big rally. The pair is now trading above the 23.60% Fibonacci level on its way down. The recent rebound prevented the currency pair from falling into oversold areas on the 14-day RSI. The bears will look to extend the current declines towards 1.3447 or lower to the 38.20% Fibonacci level at 1.3176. On the other hand, the bulls will target profits at 1.3986 or higher at the 0.00% Fibonacci level at the 1.4251 resistance.

Today, the currency pair is not awaiting any important British economic data. From the United States, new home sales will be announced.