The US dollar is enjoying strength factors, amid investors fleeing to it as a safe haven, in addition to increasing expectations that the timing of the Federal Reserve’s monetary policy tightening is imminent. Accordingly, it was normal for the GBP/USD currency pair to decline to the support level of 1.3753 before settling around the 1.3800 level in the beginning of trading today, Thursday.

Recently, US Federal Reserve officials began discussing at their meeting last month the timing and mechanics of reducing their massive monthly purchases of bonds, which are used to keep long-term interest rates in check. The controversy, which was revealed in the minutes of the Federal Reserve's June meeting released yesterday, reflected a broadly positive outlook for the economy among Fed policy makers, as well as concerns that rising inflation could prove more persistent than the US central bank indicated. Economists saw little sign that the Fed was any closer to raising interest rates or lowering bond purchases.

On the other hand, negatively affecting the performance of the sterling dollar. The UK has recorded more than 30,000 coronavirus infections per day for the first time since January, as the British government prepares to lift all remaining lockdown restrictions in England. Government figures showed 32,548 more confirmed cases on Wednesday, the highest level since Jan. 23. For most of the spring, infections were less than 5,000. But the arrival of the more contagious delta type, which was first identified in India, is likely to lead to a spike in cases.

Despite the increase, the British government says it still aims to lift all remaining lockdown restrictions in England on July 19, a move many scientists say is dangerous. Health Minister Sajid Javid said cases may reach their highest daily level this summer at 100,000, a level not reached during previous waves of the virus.

British Prime Minister Boris Johnson's government hopes the rapid spread of vaccines has created a wall of immunity. She says this will reduce the number of hospitalizations and deaths.

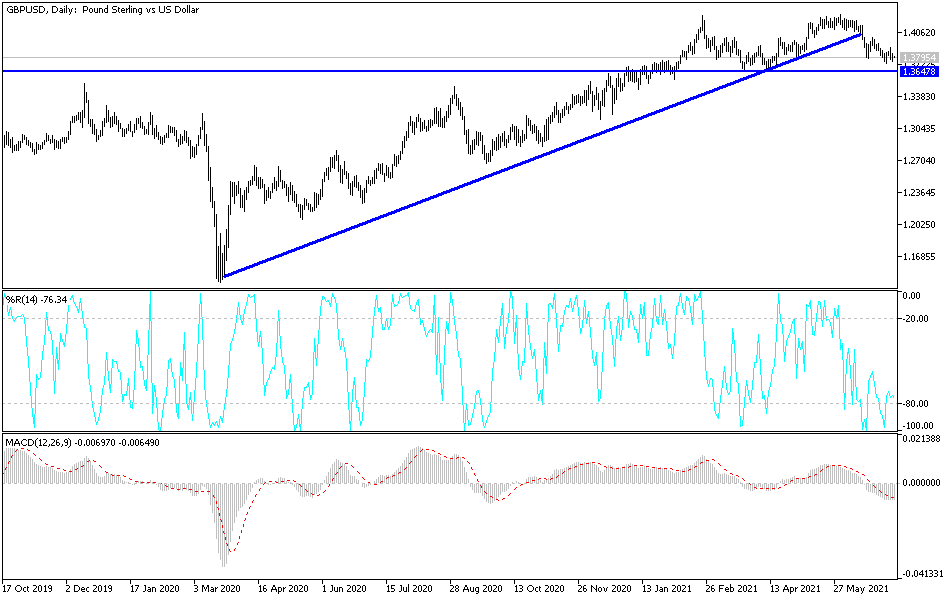

According to the technical analysis of the pair: On the daily time frame, the price of the GBP/USD currency pair is still moving within its descending channel that was formed recently since it breached the 1.4000 level, the most important for bulls. Continuing fears about British infections with the Corona virus and the return of compulsory restrictions may bring the sterling-dollar pair more losses and the closest support levels for the pair are currently 1.3770, 1.3690 and 1.3600. The last level consolidates the technical indicators' movement towards strong oversold levels. On the upside, there will be no chance for a strong correction without breaching the 1.4000 resistance again. The currency pair will be affected today by the US weekly jobless claims announcement.