The gains of the US dollar, which had expectations of near US interest rates, halted. Investors had fled to it recently as a safe haven due to fears of the rapid spread of the Corona Delta variant. The currency pair is stable around the 1.3885 level at the time of writing the analysis, waiting for any news. Sterling reacted positively against the other major currencies after British Prime Minister Boris Johnson confirmed yesterday that all remaining lockdown restrictions in England will be lifted within a week despite the sharp rise in coronavirus cases. He stated that it was "the right moment to move forward" with schools closed for the summer holidays, but urged people to "move forward with caution".

Johnson added that while the pandemic risks remained, legal restrictions would be replaced by a recommendation that people wear masks in crowded places and on public transport. He added that nightclubs and other crowded places should use vaccine passports to enter "out of social responsibility".

This pandemic is not over yet. This disease, the coronavirus, still carries risks for you and your family. "We simply cannot immediately return from Monday 19 July to life as it was before COVID," Johnson said.

At that time, all restrictions on social gatherings will be removed and social distancing measures will be abolished. Nightclubs can reopen for the first time since March last year, and there will be no restrictions on people attending concerts, theaters, weddings or sporting events. As of Monday, 87% of the UK adult population had received their first dose, and 66% had taken their full dose. At the same time, infections increased in recent weeks, reaching more than 30 thousand new cases per day, driven by the infection with the Corona Delta variable.

Health Secretary Sajid Javid told the Commons: "On the basis of the evidence before us, we do not believe infection rates will put unsustainable pressures on the NHS."

The decision means the British economy is on track to regain more lost production, although restrictions on international travel will inevitably make a full recovery unlikely for the foreseeable future. "Further easing in restrictions will somewhat help the UK's economic recovery," says Nikesh Sogani, an economist at Lloyds Bank Commercial Banking. Also, a Barclays weekly forex research note stated, “We do not expect the market to take any particular direction in the near term, and we expect the British Pound to remain range bound this week. The announcement of the reopening has been telegraphed and, therefore, should not have any impact on the market, in our view.”

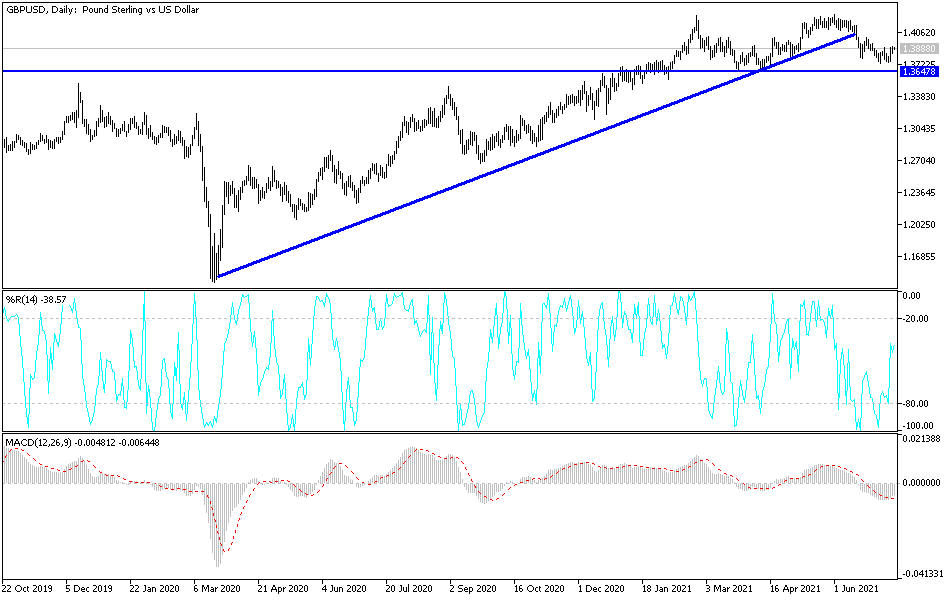

According to the technical analysis of the pair: On the chart of the daily time frame, the price of the GBP/USD currency pair is still in the first stage of the correction upwards. It will need to break through and stabilize above the psychological resistance 1.4000, which is the closest to it at the moment, to have the opportunity to correct upwards stronger. On the other hand, returning to break the 1.3800 support level will increase the bears' control to move towards stronger support levels. The situation is neutral so far, waiting for stimuli in one direction. The currency pair can now be bought at every bearish level.

The British pound will be affected today by the announcement of the Financial Stability Report of the Bank of England. The US dollar will be affected by the announcement of US inflation figures, by reading the consumer price index.