The price of the GBP/USD currency pair did not gain much beyond 1.3898 despite the British government's announcement that it will abandon all coronavirus restrictions. With the return of the US market following the 4th July holiday, the Dollar recovered , and accordingly, the currency pair fell towards the 1.3773 support level before settling at about 1.3800.

The strength of the US dollar came as policy makers at the US Federal Reserve (Fed) presented the date they expected US interest rates to rise from 2024 to 2023 at the policy meeting in June. Meanwhile, pressure is mounting on the Fed to decide how it intends to end its quantitative easing program , a necessary prelude to any rate hike .

The shift in expectations about the future of Fed policy has led to higher yields paid on US government bonds, which in turn increases demand for the dollar. The basis for the Fed's changing stance is the strong US economy, which reported inflation data well above the Fed's 2.0% target.

With the start of trading this week, British Prime Minister Boris Johnson confirmed that Britain plans to repeal laws requiring face masks and social distancing later this month, even as he acknowledged that lifting restrictions will lead to a rise in cases of Corona virus. Johnson said statutory controls will be replaced by "personal responsibility" when the country moves to the final stage of its lockdown lifting roadmap. This is due to happen on July 19, although Johnson has said a final decision will be made on July 12.

The removal of social distancing rules will allow nightclubs to reopen for the first time in 16 months, and people will once again order drinks at bars. Customers will no longer have to check the mobile app to provide their contact details when entering the venue. The government will also stop directing people to work from home if they can, leaving employers free to send employees back to offices.

Britain recorded more than 128,000 deaths from the Corona virus, which is the second highest number of deaths in Europe after Russia, and infections are increasing due to the highly contagious delta variant, which was first discovered in India. The number of confirmed cases jumped from about 2,000 the day before this year to 25,000 a day last week. The death toll is broadly stable, with fewer than 20 deaths a day.

Accordingly, public health officials say the British vaccination program has weakened, if not cut, the link between infections and deaths. So far, 86% of UK adults have received at least one dose of the vaccine and 64% have been fully vaccinated. The government aims to give everyone over the age of 18 both doses by mid-September. Johnson stressed that Britain must "learn to live with this virus" - a major shift in tone from a leader who previously painted COVID-19 as an enemy to be defeated.

Survey data published by IHS Markit showed that the UK construction sector grew by the most since June 1997, buoyed by another sharp rise in new orders. Accordingly, the PMI rose to 66.3 in June from 64.2 in May. A reading above 50 indicates growth. Sharp increases in business activity were seen in all three main areas of the construction sector monitored by the survey.

Construction in the homebuilding subcategory grew at the fastest pace since November 2003. The second best performing region was business, with production rising at the strongest rate since March 1998. Meanwhile, civil engineering activity rose sharply in June, but the pace of growth slowed to its lowest level in three months. There has been a rapid shift in demand for new construction related to the opening up of the British economy. Builders have reported another month of sharply increased hiring numbers, reflecting efforts to boost capacity and meet incoming new orders.

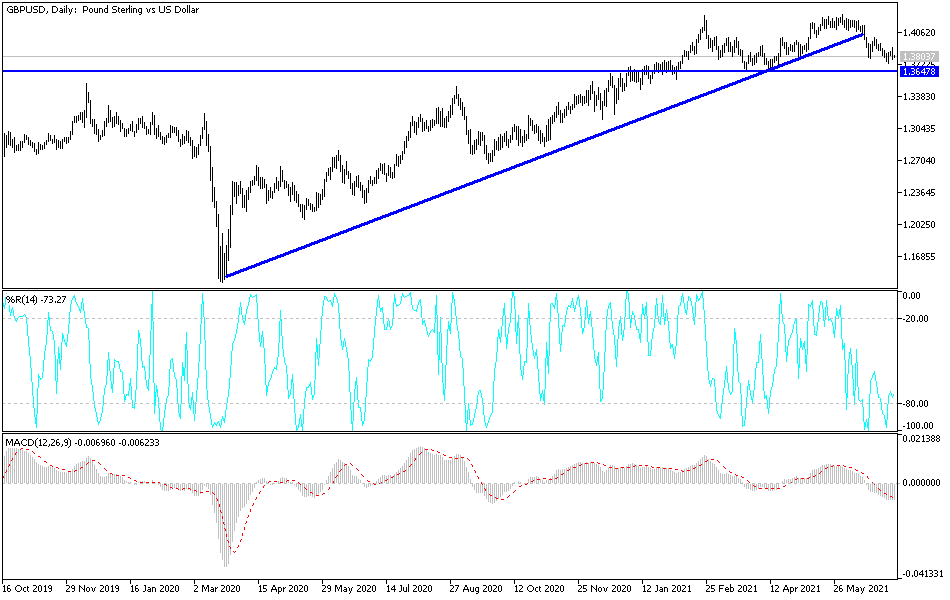

According to the technical analysis of the pair: Do not change the bearish outlook for the GBP/USD currency pair without breaching the 1.4000 psychological resistance again. In the current situation, the bears' control is stronger, and it may be ready to test stronger support levels, the closest to them currently are 1.3775 and 1.3690, respectively. Continuing fears of a rapid spread of Corona’s variables and the confirmation of the imminent date of tightening US monetary policy will remain pressure factors on any gains for the currency pair in the coming period. Today, the focus will be on announcing the contents of the minutes of the last meeting of the US Federal Reserve.