The gains last week did not exceed the resistance level of 1.3910. Pressure returned to the sterling despite the date of Freedom Day today, July 19, in which the British government resolved to completely abandon all pandemic restrictions. Overall, the British Pound failed to record gains against the other major currencies despite signs of a possible turn in direction in the Bank of England in response to rising inflation and building political opposition to QE, although there is ample room to reverse this weak performance.

The last two letters released by the Bank indicate that there is a movement afoot towards raising interest rates and ending quantitative easing in the coming months.

The Pound jumped after speeches by monetary policy members Ramsden and Saunders - a typical reaction that forex analysts expect - but the gains failed to hold. The exchange rate from the pound to the euro ended last week down by a third of a percent while the exchange rate of the pound to the dollar fell by nearly one percent. All in all, the prospect of a UK rate hike in 2022 should be consistent with gains, particularly against the euro weighing on the European Central Bank which appears unwilling to raise rates until 2024.

Investors are not fully buying into the idea that the Bank of England will raise rates before mid-2022: money market pricing shows that they still do not expect a full 25 basis point hike in the bank rate by this point. However, pressure on the Bank of England to end its quantitative easing program - a necessary first step before an interest rate hike - is certainly growing amid concerns that rising inflation simply won't go away.

Not only is shifting economic data that may put pressure on the bank's generous fund-generation program, political pressures appear to be building up as well. Meanwhile, a report by the House of Lords Economic Affairs Committee on Friday criticized the bank for its continued pursuit of quantitative easing.

The committee is currently investigating the BoE's asset purchase program and released its first report on the matter on 16 July. The report is titled “Quantitative Easing: A Dangerous Addiction?” It gives a strong flavor to what lawmakers in the upper house of Parliament think about politics. The Committee wants more information from the Bank about how they intend to proceed if inflation proves to be more stable than currently expected.

Commenting on this, a daily briefing note from Hamilton Court FX says: "Their argument makes sense, with the economy on an upward trajectory, why the bank feels the need to maintain such high levels of asset purchases." Lord Forsyth, chair of the committee, said: “The Bank of England has become addicted to quantitative easing. It seems to be the solution to all the economic problems in the country.” He said the scale and persistence of quantitative easing - which now equates to 40% of GDP - requires significant scrutiny and accountability.

In the UK, the unemployment rate for the three months to May 31 beat expectations by 4.7% with 4.8%. On the other hand, average wages including bonuses for the period exceeded the expected change (on an annual basis) by 7.2% with a record of 7.3%. The figure was in line with expectations excluding bonuses at 6.6%. Prior to that, the UK PPI for June was released, forecast at 3.2%, with 2.7% (y/y). The CPI outperformed the expected change of 2.2% by 2.5%.

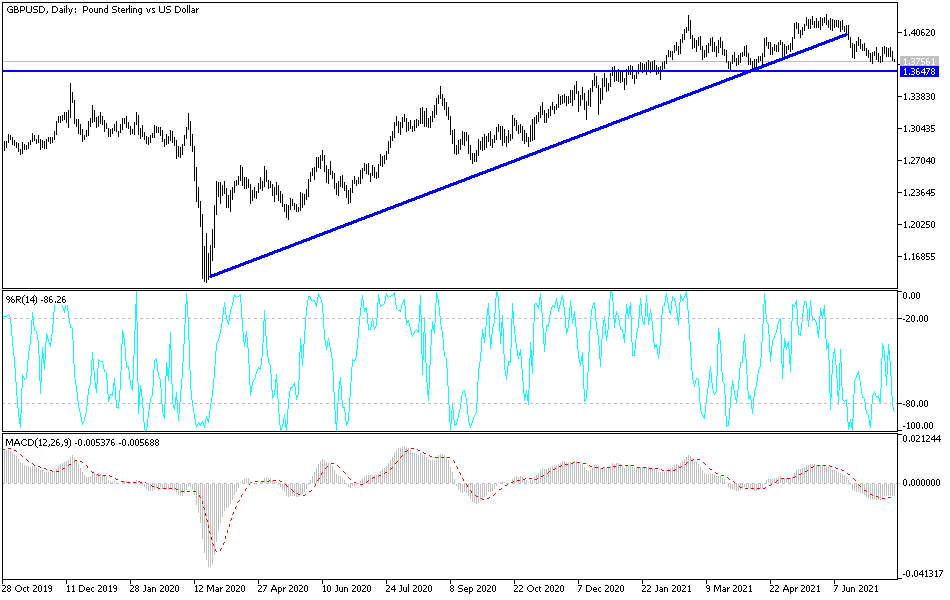

According to the technical analysis of the currency pair: In the near term and according to the performance on the hourly chart, it appears that the GBP/USD currency pair has recently pulled out of the descending channel formation. This indicates a significant increase in the bearish momentum in the short term. Accordingly, the bulls will target potential rebound profits at around 1.3778 or higher at 1.3810. On the other hand, the bears will look to extend the current decline towards the 1.3731 support or lower to the 1.3701 support.

In the long term and according to the performance on the daily time frame, it seems that the GBP/USD currency pair is closer to completing the XABCD double top reversal pattern. The currency pair has already fallen near the oversold areas of the 14-day RSI, but there is still room to run. Therefore, the bears will target an extended decline around 1.3631 or lower at 1.3510. On the other hand, the bulls will look to pounce on long-term profits around 1.3881 or higher at 1.4000 psychological resistance.