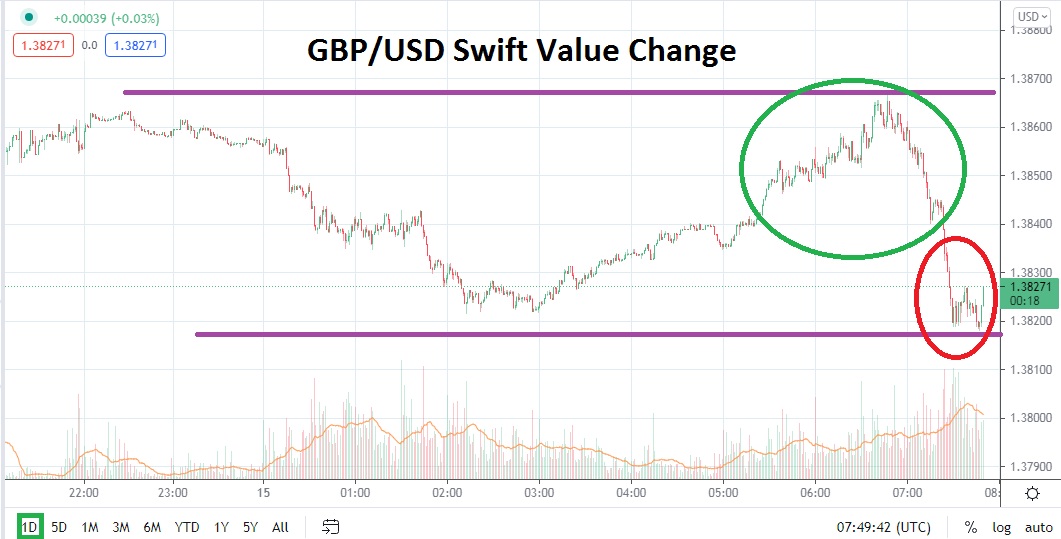

Conditions within the GBP/USD have been choppy during July and that has been demonstrated rather well in early trading this morning. The Forex pair is moving around the 1.38300 vicinity now, but did see a high of 1.38660 less than two hours ago. While this morning’s highs did not match yesterday’s highs, what is intriguing is that short-term technical charts show an incremental decrease in resistance levels.

On the 2nd of July, the GBP/USD was trading near a low of 1.37290, and on the 12th of the month, a high of nearly 1.39100 was seen. The current price ratio of the GBP/USD in the middle of this range may prove to be a dilemma for traders and, if they do not have a clear perspective, patience is advised. From a mid-term perspective the GBP/USD is trading within the lower realms of its price range. It needs to be highlighted that before the U.S Federal Reserve whispers on the 16th of June, about a potential increase in interest rates being eyed a couple of years down the road the Forex pair was near the 1.41300 juncture.

The current price range of the GBP/USD is a good opportunity for technical traders who believe the Forex pair may have been oversold and that upside potential exists. The question is when a move higher will ensue. After displaying a run higher today, the juncture of 1.38700 proved to be difficult resistance, and yesterday’s high of nearly 1.38900 was accomplished very early on Tuesday. This underscores that traders should not be overly aggressive if they want to be buyers and potentially wait to go long the GBP/USD on additional selling if the 1.38250 to 1.38200 support junctures prove to be adequate.

Bearish speculators who believe the GBP/USD has additional momentum to track downwards cannot be faulted either, and may actually want to be seller if they believe current resistance levels look durable. The GBP/USD was trading near 1.37900 just two days ago. The GBP/USD looks destined in the short term to remain choppy, and traders should use limit orders with carefully selected risk-taking tactics to catch momentum shifts which may prove rather quick.

GBP/USD Short-Term Outlook:

Current Resistance: 1.38370

Current Support: 1.38210

High Target: 1.38750

Low Target: 1.37930