Bullish View

Buy the GBP/USD and add a take-profit at 1.3835.

Add a stop-loss at 1.3600.

Timeline: 1-2 days.

Bearish View

Set a sell-stop at 1.3670 and a take-profit at 1.3600.

Add a stop-loss at 1.3750.

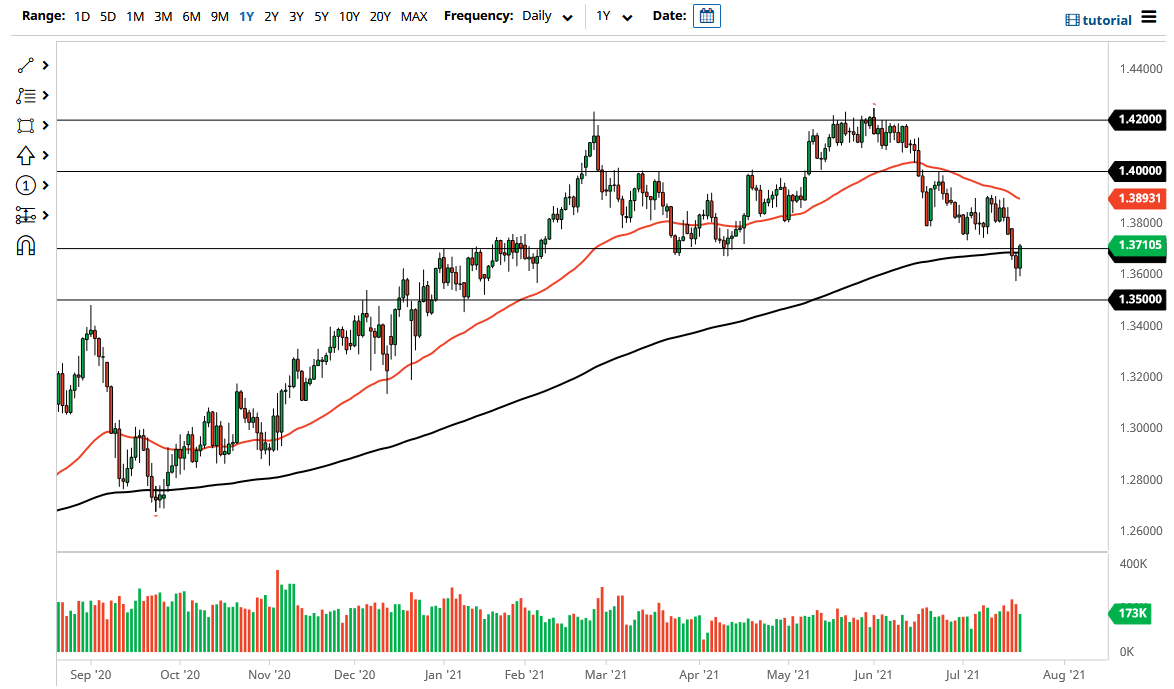

The GBP/USD pair rose in the overnight session as investors continued to focus on the UK reopening and the Delta variant situation. It is trading at 1.3700, which was slightly above this week’s low at 1.3572.

UK Public Debt Expands

The UK became the first major country to remove most COVID restrictions this week even after the prime minister isolated. Today, all businesses, including high-risk ones like hotels and clubs, have been allowed to reopen. Similarly, the government has removed the mask mandates in England.

Therefore, while business activity is expected to increase, there are concerns that the number of new infections will rise and force the government to reinstate restrictions.

The GBP/USD is also reacting to the latest figures that showed that the cost of servicing the UK debt were rising. The Office of National Statistics (ONS) data showed that public sector borrowing rose from 19.87 billion pounds in May to 22 billion in June.

The public sector net cash requirement declined from 21.7 billion pounds to 11.25 billion pounds. All this pushed the total UK debt to more than 2.2 trillion pounds and its proportion to GDP to 99.7%. This is the highest it has been since 1961.

At the same time, the cost of servicing the debt rose to 8.7 billion pounds. The higher costs of servicing the debt is mostly because most of the country debt is linked to the Retail Price Index, which rose by 3.9% in June.

The GBP/USD pair also rose as the overall fear of the Delta variant faded. This is evidenced by the fact that the US dollar has eased a bit after rising substantially on Monday. Similarly, global stocks have erased most of their losses made on Monday.

GBP/USD Technical Analysis

The GBP/USD pair has rebounded from this week’s low of 1.3572 to the current 1.3700. On the four-hour chart, the pair is slightly below the 50-day moving average. It is also slightly lower than the important resistance at 1.3747, which was the lowest level on July 2 and 8. The Relative Strength Index (RSI), on the other hand, has moved from this week’s low of 18 to 50. Therefore, the pair will likely keep rising as bulls target the next key resistance at 1.3830, which is along the 38.2% retracement level.